What Is a Payroll Register?

Written by: Carolyn Young

Carolyn Young is a writer with over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on November 27, 2025

If you’re starting a business and hiring employees, you’re probably also beginning to navigate the complex world of payroll. Maybe you’ve heard the term payroll register and wondered what it is.

Well, it’s a key part of the payroll process that involves recording your employees’ payment details for each payroll period. Fortunately, this guide will explain all you need to know to manage your payroll register and keep your business humming.

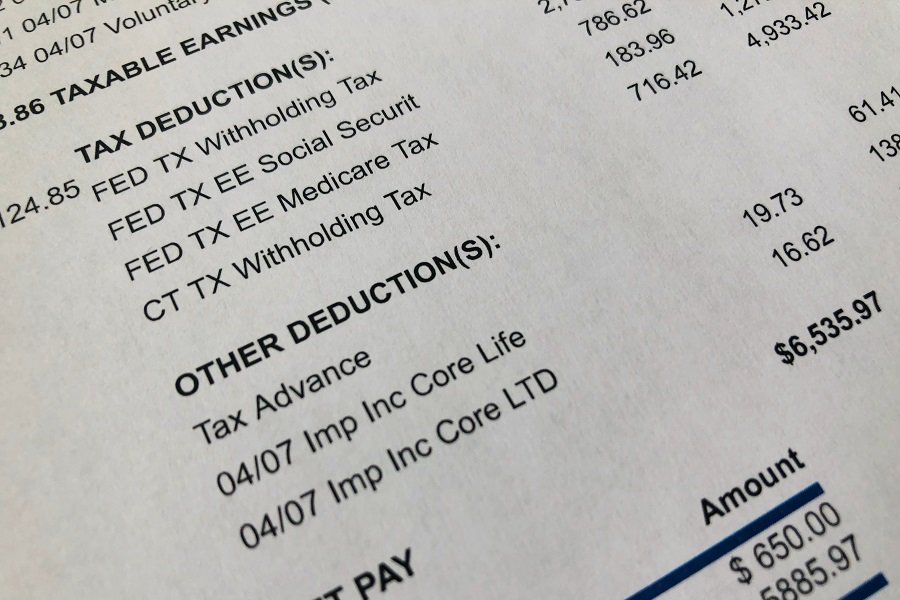

What’s Included in the Payroll Register?

The payroll register includes the following for each employee:

- Gross pay for the period

- Net pay for the period

- Payroll taxes

- Deductions for health insurance, 401K, etc.

At the bottom of the register, you should have a total for each of these for all employees.

Registers might also include:

- Employer portion of Social Security and Medicare taxes

- Federal unemployment tax (FUTA)

- State unemployment tax (SUTA)

Using the Payroll Register

You’ll need the information from the payroll register to know how much to deposit in payroll taxes and to set aside for other payments like Social Security and Medicare. You can also use the register to plan your payroll expenses each month so that you know what your cash flow will be. It should be an invaluable accounting tool you refer to on a regular basis.

Under the Fair Labor Standards Act (FLSA) you must maintain these registers and keep them in your records for at least three years. This is the legal requirement, but it’s recommended that you keep them indefinitely.

Your payroll records, which include registers, must contain the following by law:

- Employee info (name, address, employment documents)

- Taxes (federal, state, local)

- Copies of all paychecks and stubs

- Hours worked

- Wage basis (Hourly rates, for example)

- Pay frequency

- Date of payment

Payroll Register vs. Paycheck History

While a payroll register shows the total current payroll of all employees, a paycheck history shows every payment your business has made to a specific employee. You’ll give the latter to the employee as part of their pay stub and keep a copy for your records. Both the payroll register and the paycheck history are important, so take care to prepare them correctly.

Using a Payroll Service

Processing payroll is more complicated than you might think, so it’s a good idea to consider using a payroll service. It’s likely to be less expensive than creating a new staff position for managing payroll.

Payroll and payroll taxes come with countless laws, rules and restrictions, and a payroll service can ensure your business remains in compliance at the federal, state and local levels.

You’ll just need to send over your digital timesheets and relevant employee and business information, and the payroll provider will do the rest. The service even takes care of payments and taxes, freeing you up to focus on running, and growing, your business.

We highly recommend hiring a payroll service — as a busy entrepreneur, you won’t regret it!