How to Fill Out Form W-2

Written by: Carolyn Young

Carolyn Young is a writer with over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on November 27, 2025

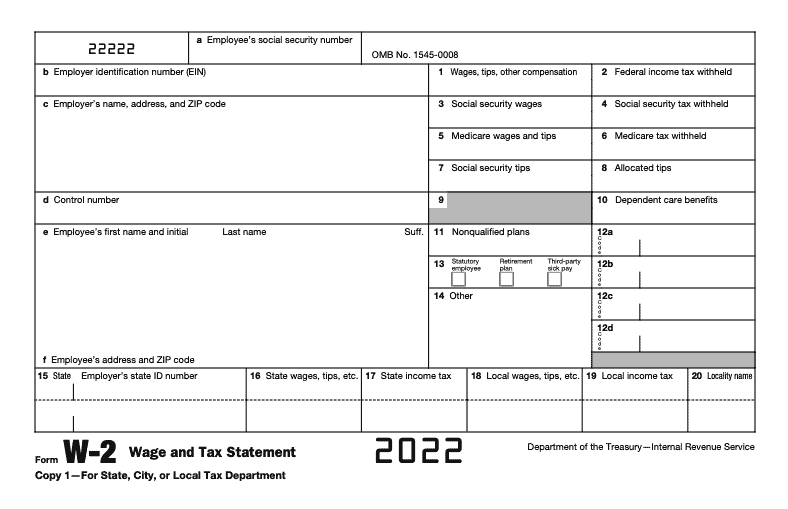

If you’re starting a business and hiring employees, you’ll have to deal with the payroll process, part of which is filling out and issuing W-2 forms. Payroll processing can be quite complex, so it’s important that you fully understand each part, including how to fill out a Form W-2.

This guide walks you through filling out the form, line by line.

Box A – Employee’s Social Security Number

A Social Security number is a 9-digit number you’ll have in your records in form W-4, which your employee should have filled out when they started working for you.

If the employee has applied for a Social Security number but has not yet received it, write “Applied for” in this box. When they do receive it, you’ll need to issue them an updated W-2.

Box B – Employer Identification Number (EIN)

If you don’t yet have an EIN, you’ll need to get one. You cannot use your Social Security number. You can apply online and write “Applied for” in Box B.

Box C – Employer’s Name, Address, and Phone Number

Fill in your company’s legal name and full address.

Box D – Control Number

Control numbers are something employers use internally for recordkeeping purposes. If you don’t use control numbers, just leave this box blank.

Box E – Employee’s Name

Write the employee’s first name, middle initial, and last name.

Box F – Employee’s Address

You should have this information in your records.

Box 1 – Wages, Tips, and Other Compensation

Dig into your payroll records and add up everything your company paid this employee during the relevant year. This number should exclude pre-tax contributions to retirement savings accounts, health insurance premiums, and commuter benefits.

Box 2 – Federal Income Tax Withheld

Again, consult your payroll records to find the amount of federal taxes you withheld for that employee that year.

Box 3 – Social Security Wages

You’ll need to determine if any of the employee’s wages are not subject to Social Security tax, subtract that total from the amount in Box 1 and enter the result here.

Things like 401K contributions are excluded from Box 1 for federal income tax, but are still subject to Social Security tax – in such cases, Box 3 will be higher than Box 1. In other cases, all of an employee’s compensation will be subject to Social Security tax and thus Box 1 and Box 3 will be the same.

Read the instructions for this box on the IRS website.

Box 4 – Social Security Tax Withheld

Check your records for the total Social Security tax withheld from the employee during the year.

Box 5 – Medicare Wages and Tips

This number will be the amount of wages and tips subject to Medicare tax. This will be the same as Box 3.

Box 6 – Medicare Tax Withheld

Check your records for the total Medicare tax withheld from the employee during the year.

Box 7 – Social Security Tips

If the employee earned tips during the year, record that number here.

Box 8 – Allocated Tips

If you collect tips and allocate them to employees, enter the allocated amount here.

Box 9 – Blank

Leave this blank, as this box is no longer in use.

Box 10 – Dependent Care Benefits

If you provided an employee with dependent care benefits through a dependent care assistance program, enter the amount you paid for the program.

If the amount is less than $5,000, these dependent care benefits are not taxable. If it’s more than $5,000, the amount needs to be added to the total in boxes 1, 3, and 5.

Box 11 – Nonqualified Plans

If you made distributions from a nonqualified distribution plan to the employee, report those here. These distributions should also be included in the Box 1 total.

Box 12 – Codes

If any codes apply, enter them here. You can find the codes on the W-2 instruction form. There are quite a few.

Box 13 – Checkboxes

Simply check the boxes that apply.

- Statutory employee

- Retirement plan

- Third-party sick pay

Box 14 – Other

If the employee had things like health insurance premiums or state disability insurance taxes withheld, enter the amount here.

Box 15 – Employer’s State ID Number

Enter your state’s abbreviation and your state tax ID number, if applicable. If your state has no income tax, leave this blank.

Box 16 – State Wages and Tips

Enter the amount of wages paid that are subject to state income tax. If your state allows an exemption for retirement contributions, this number will be the same as Box 1. If not, it will be the same as Boxes 3 and 5. Again, if your state has no income tax, leave this blank.

Box 17 – State Income Tax

This is how much you withheld from the employee for state taxes. Again, if your state has no income tax, leave this blank.

Box 18 – Local Wages and Tips

If your locality has income tax, enter the wage and tips total here.

Box 19 – Local Income Tax

This is how much you withheld from the employee for local taxes, if applicable.

Box 20 – Locality Name

Name your city or town.

Using a Payroll Service

Processing payroll and filling out tax forms like W-2s is often more complicated than you might think, so it’s a good idea to consider using a payroll service. It’s likely to be less expensive than creating a new staff position for managing payroll.

Payroll and payroll taxes come with countless laws, rules and restrictions, and a payroll service can ensure your business remains in compliance at the federal, state and local levels.

You’ll just need to send over your digital timesheets and relevant employee and business information, and the payroll provider will do the rest. The service even takes care of payments and taxes, freeing you up to focus on running, and growing, your business.

We highly recommend hiring a payroll service — as a busy entrepreneur, you won’t regret it!