Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on July 21, 2024

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is HomeWork Solutions. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine if this is the right payroll service for your business.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

HomeWork Solutions is one of the more unique payroll service providers, specializing in helping household employers pay their nannies, in-home caregivers and other domestic workers and comply with tax laws. HomeWork Solutions offers full payroll and payroll tax filing services and guarantees the accuracy of its work.

Household payroll has many nuanced laws, regulations and exemptions that differ from regular business payroll. HomeWork is nationally recognized as an expert in household employment taxes and regularly consulted by top media outlets like The New York Times and Wall Street Journal.

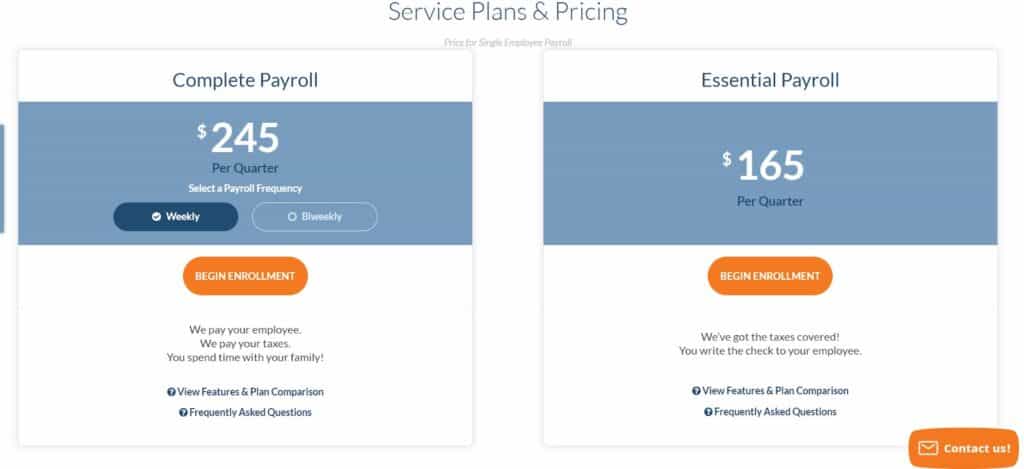

HomeWork Solutions offers two different service plans. We explored all of the options, as detailed below.

| Essential Payroll | Complete Payroll | |

|---|---|---|

| Cost | $165 per quarter* | Biweekly Payroll – $220 per quarter*Weekly Payroll – $245 per quarter* |

| Unlimited, concierge-quality support | x | x |

| Proactive Support (i.e. being alerted of changes) | x | x |

| Withholding calculations | x | x |

| Payroll tax return preparation | x | x |

| Generation of Form 1040 Schedule H & W-2 | x | x |

| Tax payment services & report filing | x | x |

| Employee payment | x | |

| Maintain payroll records | x | |

| Direct Deposit | x | |

| Text alerts & access to pay stubs | x | |

| Dedicated payroll representative | x |

*NOTE: This plan also requires a $110 one-time setup fee and a $110 year-end fee. Prices are also for a single employee. With Complete Payroll there is an additional fee per employee of $65 each quarter if you pay more than one nanny or household worker. For example, if you pay three employees, this will cost an additional $130 that quarter (the first employee is included in the base price).

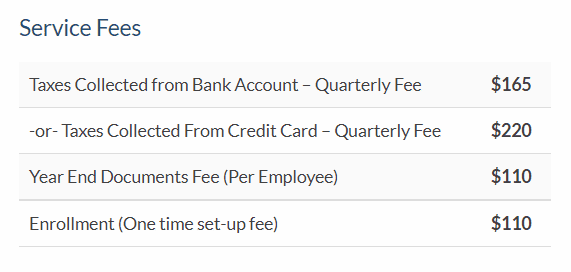

The $165 per quarter Essential Payroll plan includes payroll withholding calculations, payroll tax payment and return preparation, and generation of payroll tax forms. It also includes unlimited customer support.

The Essential Payroll plan includes concierge-quality customer service. Their proactive support team will reach out to inform you of any major payroll changes and updates, such as increases or decreases in state payroll tax rates.

HomeWork Solutions will prepare payroll tax returns and generate tax forms, like Form 1040 Schedule H and W-2s. HomeWork Solutions will also make tax payments and file reports on a customer’s behalf.

However, in the Essential plan, the employer is responsible for paying their employees. If you would like to have HomeWork Solutions handle your employee payments, you’ll have to upgrade to the Complete plan.

Keep in mind that the $165 quarterly fee does not include the $110 set up fee or $110 year-end fee. You will also pay an additional fee if you choose to have your payroll taxes deducted from a credit card instead of a bank account.

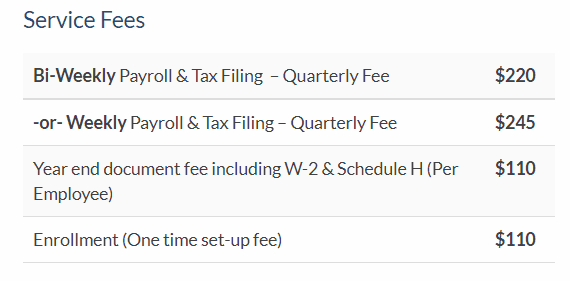

The Complete Payroll plan is $220 per quarter for those on a biweekly payroll schedule and $245 per quarter for those who run payroll weekly. The plan includes everything from the Essential Payroll plan, plus employee payment, record keeping, and a dedicated payroll specialist.

The Complete Payroll plan from HomeWork Solutions includes all of the features and benefits from the Essential Payroll plan, plus employee payment services. There are also two different pricing structures, depending on how often you pay your staff (biweekly or weekly).

If you choose the Complete plan, HomeWork Solutions will maintain your payroll records. You’re also able to pay your employees through direct deposit and you’ll receive text alerts and access to pay stubs. The Complete Payroll plan also comes with a dedicated payroll representative to assist you with any issues.

As with the Essential Payroll plan, Complete plan pricing does not include the set-up fee or year-end fee. However, unlike the Essential plan, there are no pricing differences for tax collection preferences.

HomeWork Solutions takes care of all quarterly and annual employment tax forms, filings and remittances. They also guarantee the accuracy of their work. Through the HomeWork Solutions online tools, customers can calculate and store periodic payroll information, including tax deductions.

Each quarter, HomeWork solutions receives your files and makes all of the necessary tax calculations for you. They will alert you of any tax updates and changes and coordinate tax-related correspondence with the government.

Customers also have the option to pay their employees via the Essentials plan, or have HomeWork Solutions handle employee payment through the pricier Complete plan.

HomeWork Solutions partners with NannyVerify.com for customers who wish to perform nanny or caregiver background checks. There are several different types of background checks available as well as add-on services.

A basic background check, including a single-county criminal record check, starts at $34.95.

The Homework website is user-friendly. The plans are easy to find, with good detail on features and pricing. You can even get more information on each individual service. It’s laid out well and easy to understand.

The site also has a robust help center where you can get information on a variety of topics.

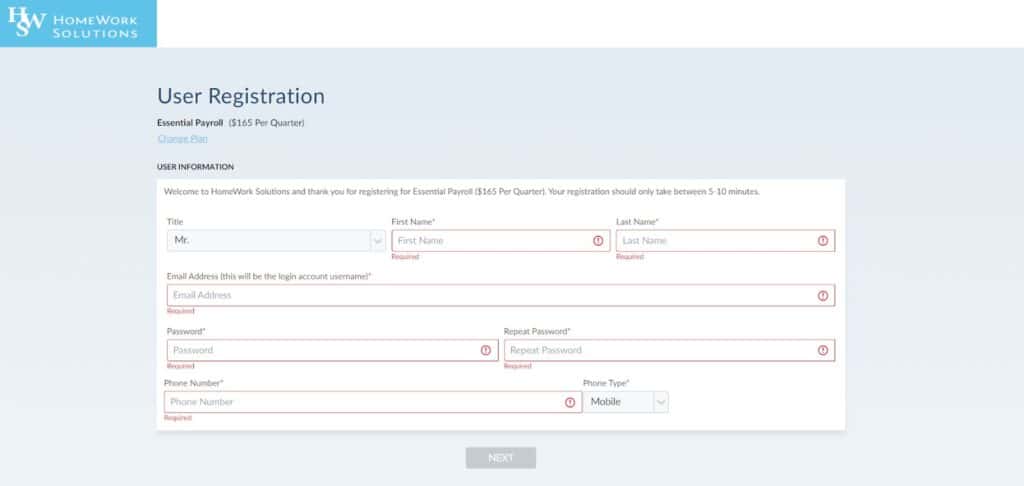

To sign up for one of the HomeWork Solutions plans, click on the Begin Enrollment button underneath the plan of your choice.

You will then be taken to the User Registration page where you are prompted to fill in your contact information. Click on the Next button when you’re finished.

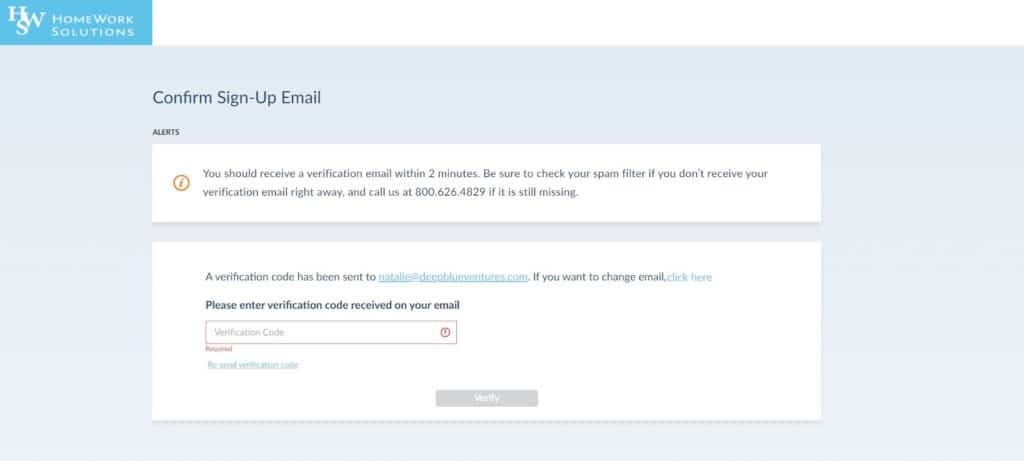

Next, you’ll be sent a verification code to the email address you’re using to sign up. Retrieve the code, enter it, and click the Verify button.

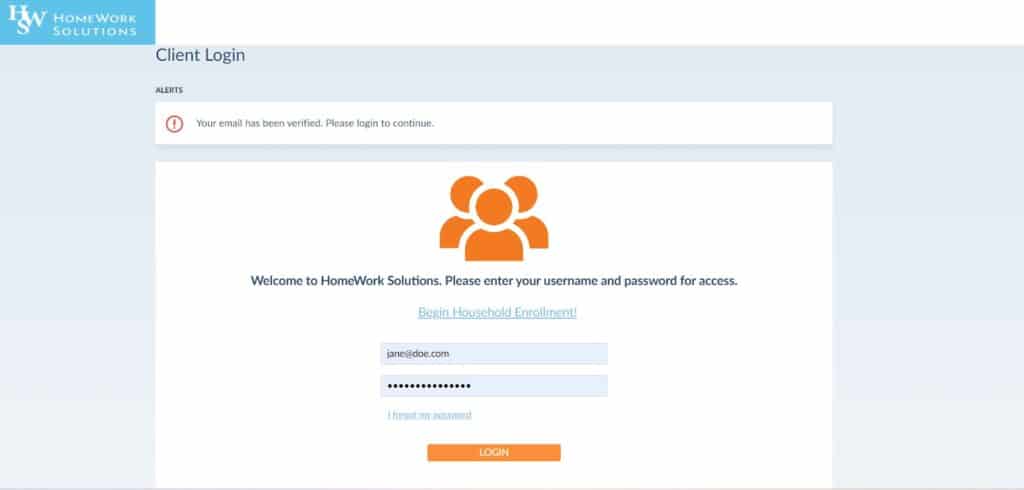

Once verification is complete, you can log into your HomeWork Solutions account.

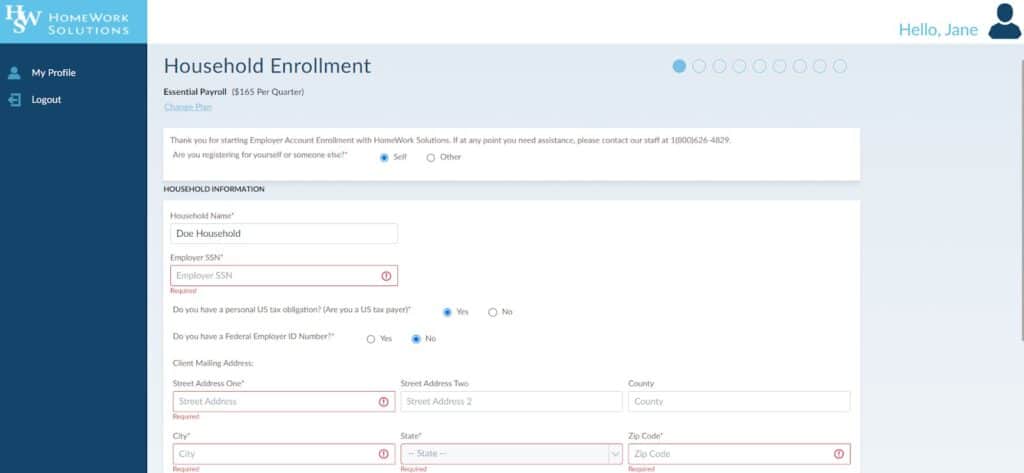

Once inside the online portal, you’ll move through several prompts to complete the registration process and enter payment information.

Unlike some other payroll service providers, HomeWork Solutions does not have a mobile app. But customers can manage their account through the web portal.

HomeWork Solutions customers can cancel their service plan by contacting customer service. Here is what is listed on their website:

HomeWork Solutions is committed to meeting your needs and ensuring your complete satisfaction. Should you need to cancel for any reason, the unused portion of your prepaid annual service fee will be cheerfully refunded. Regretfully, the one time account registration fee (account establishment) is non-refundable.

The HomeWork solutions website is quite user-friendly, and information is easy to find. If you have all your information handy, you can complete the signup process in less than 30 minutes.

The site is not very “salesy” and simply seems to guide you toward the right plan for your own personal payroll needs. It also offers an excellent customer experience.

We tested all three forms of HomeWork Solutions customer support, as detailed below.

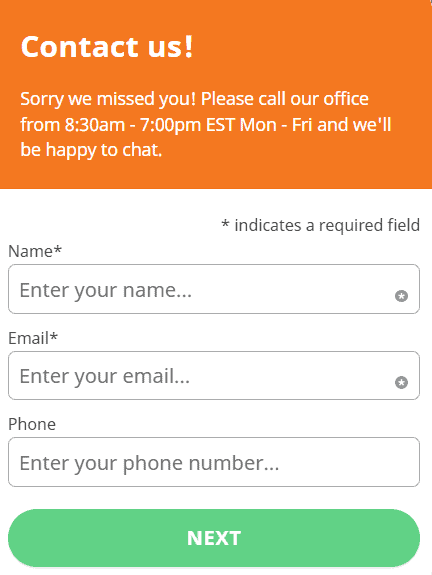

The HomeWork Solutions chat support feature is essentially just a contact form. There is no live chat support, but you can call customer support within the timeframe below:

We called HomeWork Solutions’ customer support and reached a live representative in less than one minute. We asked them about their tax support guarantee and how it worked. The representative was very cordial and polite, and gave us some details.

Essentially, although HomeWork Solutions guarantees accuracy, it is ultimately up to the customer to provide them with accurate data in the first place. If the data provided is incorrect, the company cannot be held responsible for any payroll errors that result.

They also mentioned that they are not tax advisors. You can read more about this in HomeWork Solutions’ terms of service.

In the Contact Us section of the website, we completed the form and asked how long it would take to get our account set up after purchasing services and paying the set up fee. A friendly representative got back to us the next day and told us that the turnaround time for account set up depends on the customer, but typically takes 5-7 business days.

Overall, HomeWork Solutions’ services offer advantages and drawbacks, as detailed below.

HomeWork Solutions was founded in 1993 and is currently headquartered in Sterling, Virginia. The firm is a trusted leader in concierge-level household payroll and employment tax compliance services for over 50,000 families across the country.

HomeWork claims that its FPC-certified payroll experts have processed more than half a million tax returns for household employers.

Leadership Team:

Jay Schulze – President

Kathleen Webb – Founder, Director of Compliance

Jessica Glover – Director of Payroll Operations

Andrew Chau – Director of Tax and Finance

ADP services are priced by quote only and include a more robust suite of payroll, HR, and benefits features than the HomeWork Solutions plans. ADP also has an A+ rating with the BBB, though its customer review score is low.

The base plan from Paychex is less costly than HomeWork’s plans and comes with a more robust employee benefits service. Paychex has 24/7 customer service, while HomeWork only has customer support during business hours. Paychex has an A+ rating with the BBB, though its customer review score is low.

Gusto has three plans, and their base plan is cheaper than HomeWork Solutions’ plans. The high-level Gusto plans include more features, though Gust has an F rating with the BBB.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of HomeWork Solutions payroll services.

Overall, we were pleased with our HomeWork Solutions experience. The site is easy to use, information is readily available, and sign up is fast. Our interactions with their customer service team were pleasant and informative with prompt responses.

HomeWork Solutions’ services are a very good value for household employers looking for basic payroll support. Based on our thorough research, we confidently recommend HomeWork Solutions to anyone with household employees.