Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 10, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

One of the top options is OnPay. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the payroll service that will keep your business on the road to success.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

OnPay handles the entire payroll process for you, making it nearly seamless and automated while offering additional services that simplify life for a business owner. OnPay takes care of all the red tape so you can focus on building a successful business.

Unlike other payroll services, OnPay only offers one pricing plan that includes all of their services. We explored what they offer, as detailed below.

| Price | $40/month + $6 per employee/month |

|---|---|

| Unlimited monthly pay runs | X |

| All tax filings and payments | X |

| Both W-2 and 1099 workers | X |

| Pay by direct deposit, debit card, or check | X |

| Multiple pay rates and schedules | X |

| Garnishments | X |

| Unemployment insurance withholdings | X |

| Custom reporting | X |

| Accounting and time tracking integrations | X |

| Mobile optimization | X |

| Multi-state payroll | X |

| Employee self-service onboarding and account management | X |

| Weekday customer support | X |

| COVID-19 compliance | X |

| In-app offer letters | X |

| HR task tracking | X |

| Document templates | X |

| Compliance audits | X |

| HR resource library | X |

| Full PTO management | X |

| Organization charts and company directory | X |

| Health and dental benefits | X |

| Integrated 401K plans | X |

| Life, disability, vision insurance add-ons | X |

| Workers comp administration | X |

| Printable W-2s and 1099s | X |

The $40/month plus $6 per month per employee OnPay plan offers full service payroll plus benefits administration, making it an outstanding value.

The OnPay plan includes full-service multi-state payroll, including W-2s and 1099s, self-service employee onboarding, custom reporting, and tax filings and payments.

The plan also offers health and dental administration, as well as add-on life, disability, and vision insurance administration. It even offers 401K and worker’s compensation administration.

The plan provides a lot of bang for your buck, with so many services offered for only $40 a month plus the per-employee fee.

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

You also have the option of paying employees via direct deposit, debit card, or paper check, with custom payroll reports.

The payroll process is complex, so using OnPay can save you considerable time and ensure you remain in compliance with payroll laws at all levels.

OnPay provides hiring documents for new employees that can be electronically signed and stored. They also offer letters and document templates. Hiring employees comes with a lot of paperwork and having a service like OnPay can make it much easier for you.

This hiring and onboarding service, included in the plan, is a great value.

The Onpay plan includes health and dental insurance administration, and you can add on life, disability, and vision insurance.

Employees also have access to their health insurance accounts. Most importantly, OnPay handles compliance matters related to health insurance, which can give you peace of mind.

OnPay can administer your 401K plans as well.

This service provides great value, enabling you to provide quality benefits to your employees and stay in compliance with all laws.

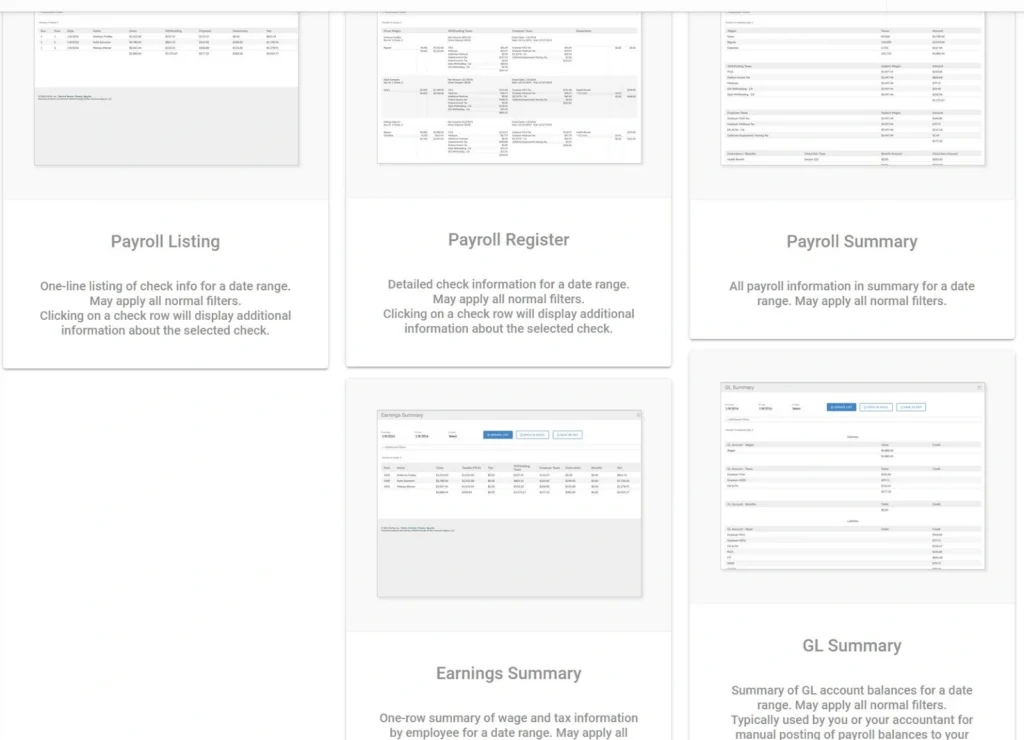

The reporting is standard, with few bells and whistles. Typical items like a Register and General Ledger Summary serve their purpose just fine. There is no custom report creator or statistical analysis, which means all custom information needs to be requested.

The information is reliable and includes all key elements, but offers nothing beyond the basics.

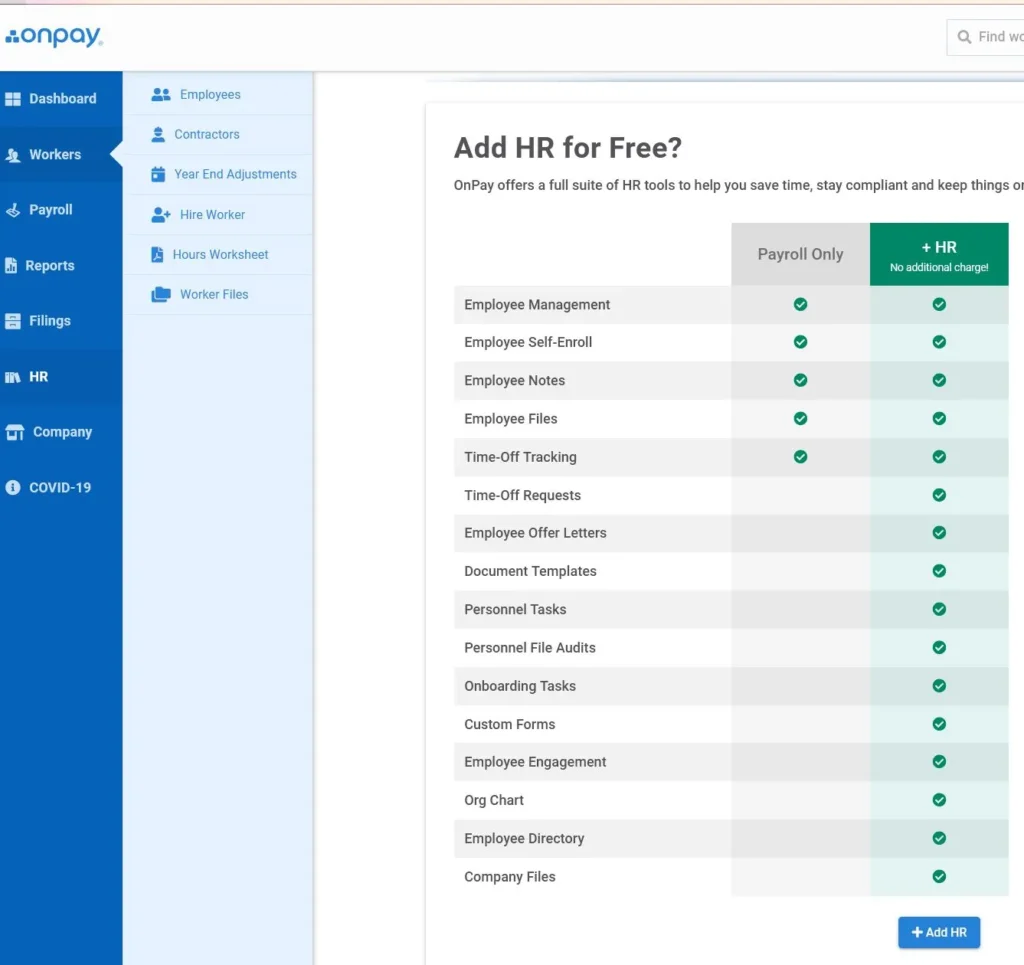

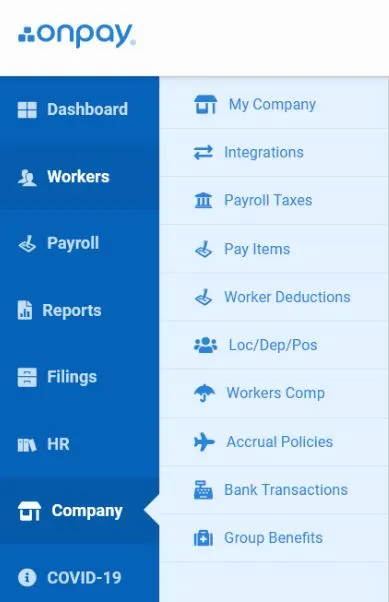

The interface is a bit clunky and feels like a bare-minimum effort. For example, the HR page is available for free, but I still had to choose to add it.

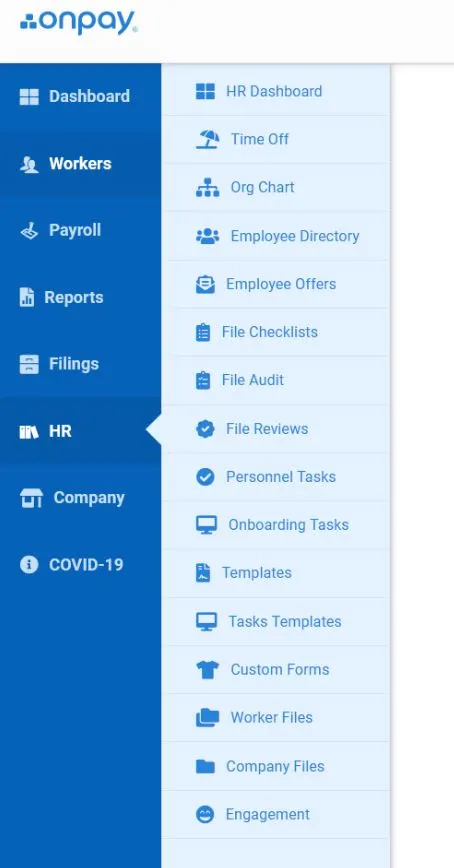

The main Reports page only includes a portion of the available reports and cannot be changed. Users can only access the full list via the menu along the left margin.

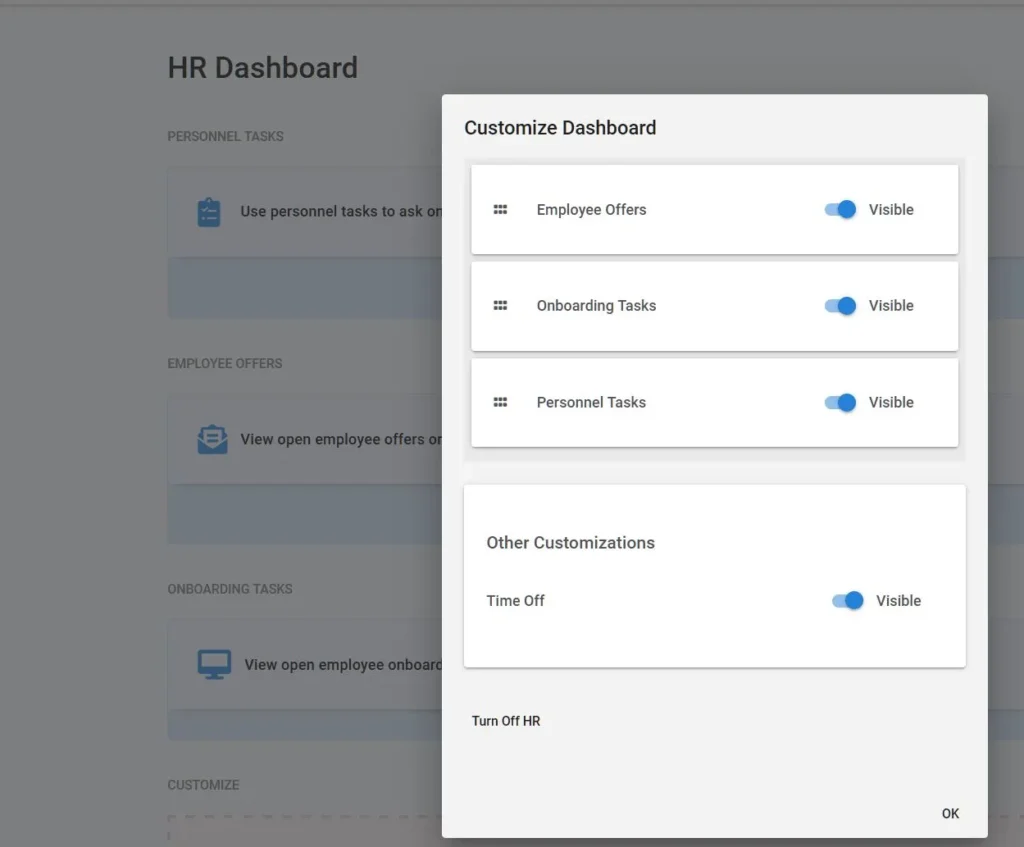

These pages offer minimal detail. The HR main page, for instance, is effectively a calendar. And again, the side menu has all the important information, which even there is disorganized.

“Worker’s Comp’ is listed under “Company” instead of “HR”, and it’s not clear if or how a user is able to move it.

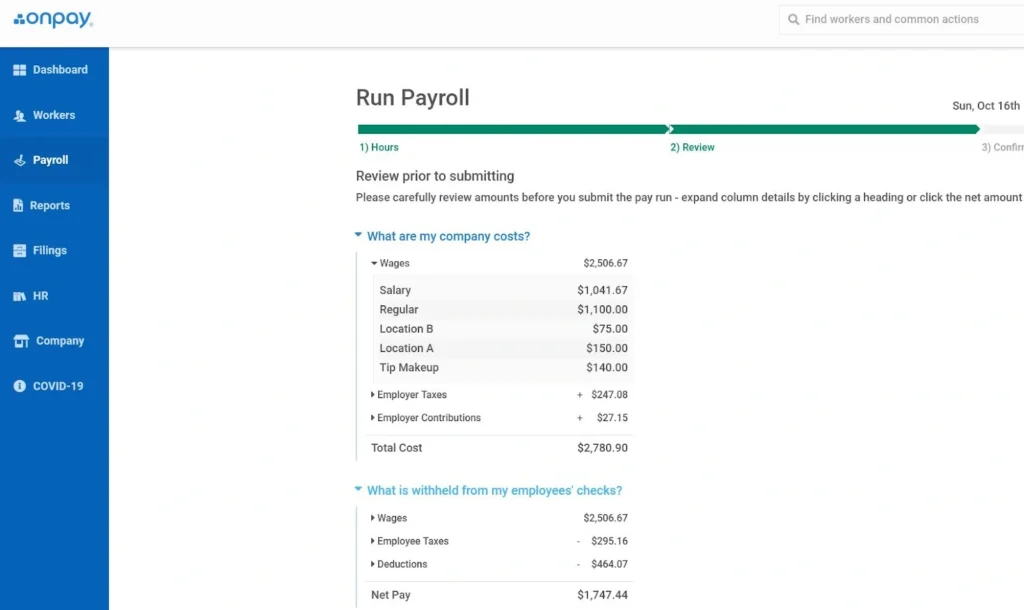

Like the rest of this software, the Payroll Submission aspect is minimal and incomplete. The broad categories of payroll are provided, but with no ability to examine in detail. In addition, the user is unable to easily export this information to create a comparison, and no audit report is provided after submission.

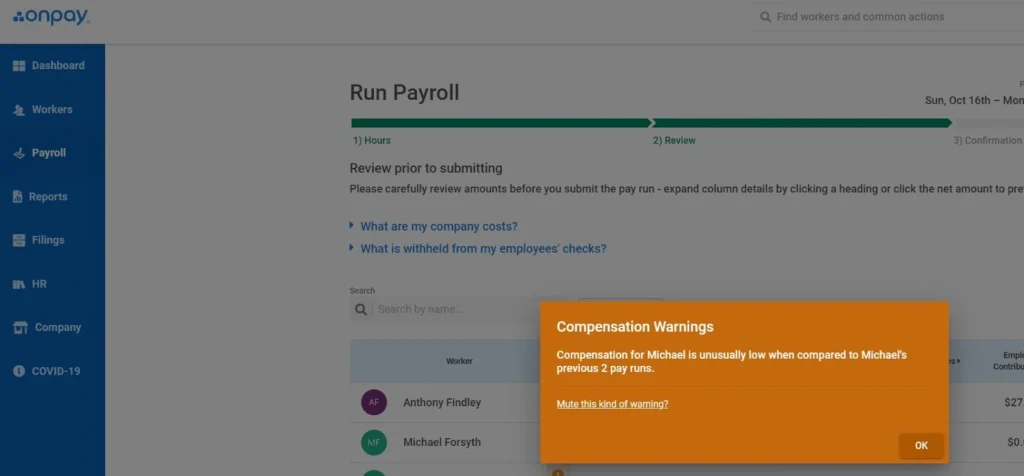

One feature I do appreciate is this preemptive warning about unusual activity.

Users are also informed of issues such as a negative dollar amount or a missing tax line. I actually wish other payroll softwares would incorporate this kind of analysis and warning system, as it’s very useful.

OnPay’s primary selling points are cost and simplicity. If your small business pays only in salary, or your payroll does not change week to week, then this is a reasonable option.

The accounting and HR functions get the job done, but the lack of menu customization makes navigating more challenging than it needs to be. The lack of payroll detail – both pre- and post-process – means that if your payroll ever does change, figuring out what you need to do could be difficult.

The site is very user-friendly. The plan features and pricing are easy to find, and a robust help center provides articles on how different payroll functions work. You can even find tax information for all 50 states.

The site is promotional, as expected, with icons showing ratings and recognition from sites like PC Magazine and Capterra, but there are no annoying popups or sales offers.

You’re immediately able to begin a one-month free trial.

When you click to start the free trial, you’re asked for your name, company name, email, and phone number. Then you get a notification to check your email for verification. Once you verify your email, you’re prompted to put in your mobile number for another level of verification, and then you get a code by text.

Next, you set your password and are prompted to complete the setup. To do so, enter the following information:

The sections are simple to understand and navigate, and you should complete the signup process in 10-15 minutes.

We did not complete the process, but shortly after doing a basic account setup, we received a text from Katie at OnPay asking to schedule a call to help us complete our setup.

OnPay has a mobile app for employees of companies that use OnPay for payroll. You can track your hours, paychecks, and PTO. This is pretty standard across the industry.

The OnPay cancellation policy is as follows:

“Service will continue until such time as Client or Service Bureau gives thirty (30) days’ prior written notice, unless termination is for cause.”

We did not see any negative reviews of OnPay involving cancellation.

The site is quite user-friendly overall, and information is easy to find. If you have all your information handy, you can complete the signup process quickly. The site is not too “salesy”, but simply guides you through the process. It offers an excellent customer experience.

We tested all three forms of OnPay customer support.

The OnPay chat support is simply a chatbot that offers few answers. If you have a question, you’re advised to schedule a call with a customer service representative. This is problematic, as simple questions should be answered without having to speak to someone on the phone.

Chat Support Rating:

Response time:

Immediate

We called customer support to ask about the additional cost of life and vision insurance administration. After waiting three minutes, we got an answer. The answer was that yes, there is an additional cost, but it depends on the plan you choose. Once you sign up for the service, you meet with the benefits team to discuss your options.

The service representative was very nice and made no sales pitches. It would have been nice, however, to get a more straightforward answer.

Phone Support Rating:

Response time:

Immediate

We sent the following email to customer support:

“I’m considering signing up and am still shopping around. I have a question – I see that life and disability insurance are an add- on. Do those come with an additional monthly cost?”

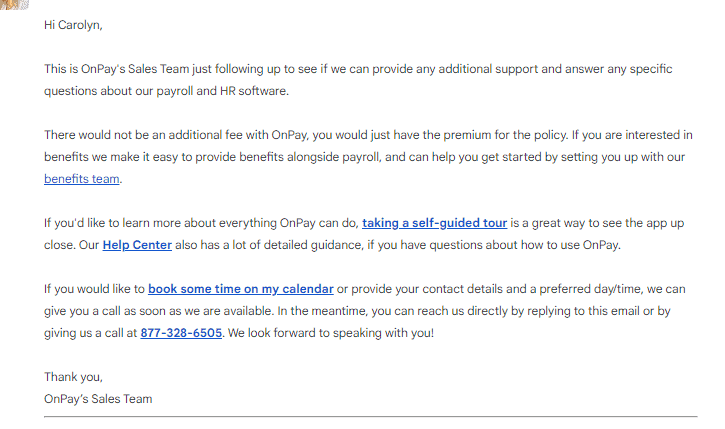

We got an immediate auto reply. We received an email response in three hours, giving a different answer than we got on the phone – that the only additional cost is the premiums.

The response was from someone on the sales team, who is probably more knowledgeable about pricing and features. The email also contained an effort to get us to schedule a call, on which we would no doubt get a sales pitch.

Email Support Rating:

Response time:

Immediate

Overall, OnPay’s services offer advantages and drawbacks, as detailed below.

OnPay was founded as a traditional payroll company in 2007 and evolved into the online payroll service it is today. According to the BBB, it’s currently managed by Mark McKee, President and COO.

Paychex is more expensive than OnPay, though it does have a more robust employee benefits service. Still, the OnPay plan offers more than the Paychex base plan. Paychex has 24/7 customer service, while OnPay only has customer support during business hours.

Paychex has an A+ rating with the BBB, although their customer review score is low.

ADP services are priced by quote only and are more expensive than the OnPay plan. They do, however, offer more health insurance options than OnPay. ADP has an A+ rating with the BBB, although their customer review score is low.

Gusto has three plans, and their base plan is the same price as the OnPay plan. The higher level Gusto plans offer a bit more than OnPay, but at a higher price. Gusto, however, has an F rating with the BBB.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of OnPay payroll services.

Overall, we were pleased with our OnPay experience. The site is easy to use, information is readily available, and sign up is fast.

Their customer service is a little lacking, as they don’t have live chat support, and their email response took some time. The customer service phone representative, however, was prompt and polite.

OnPay services are an outstanding value compared to most competitors, so they are tough to beat. They also have many positive reviews. Based on our research, we confidently recommend OnPay to business owners.

OnPay handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. OnPay takes care of all the red tape so you can focus on building a successful business.

OnPay provides hiring documents for all employees that can be electronically signed and stored. They also provide offer letter templates and other document templates.

The OnPay plan includes health insurance administration, which includes medical and dental insurance. Employees can enroll online. OnPay can also administer 401K plans for your employees.

Yes, you can add vision insurance to their plan for an additional fee. The fee will depend on the package you choose.

OnPay customer service is provided during normal weekday business hours. They do not, however, have live chat support.