Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on July 21, 2024

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

A payroll provider will handle the entire payroll process for you, making it nearly seamless and automated and freeing you up to focus on running your business. One of the top options is Patriot. But is it the best service? And is it the right choice for you?

This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you choose the payroll service that will keep your business on course for success.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Patriot is one of the more affordable payroll service options in the market. Their payroll plans offer flexible payroll services that can be customized for your business. If you opt for their Full Service plan, they will also handle your tax filings.

Patriot offers a number of different service levels. We explored all of the options, as detailed below.

| Basic Payroll | Full-Service Payroll | |

|---|---|---|

| Price | $17 per month plus $4 per employee per month | $37 per month plus $4 per employee per month |

| Expert support | X | X |

| Payroll setup | X | X |

| 2-day direct deposit | X | X |

| Worker's comp integration | X | X |

| Unlimited payrolls | X | X |

| All pay frequencies | X | X |

| Multiple locations | X | X |

| Customizable hours, money, deductions | X | X |

| Mobile friendly | X | X |

| Accounting software integration | X | X |

| Electronic or printable W-2s | X | X |

| Time off accruals | X | X |

| Multiple pay rates | X | X |

| Repeating additional money types | X | X |

| Pay contractors | X | X |

| Departments | X | X |

| Time and attendance integrations | X | X |

| HR integration | X | X |

| 1099 e-filing | X | X |

| Net to gross payroll tool | X | X |

| Federal, state and local tax filings | X | |

| Year end payroll tax filings | X | |

| Tax filing accuracy guaranteed | X |

The $17/month plus $4 per employee per month Basic Payroll service is a robust payroll service, but does not include payroll tax filings.

The Basic Payroll plan includes unlimited payrolls, accounting, time and attendance, and HR integrations, as well as W-2s and 1099s.

If you’re just looking to outsource payroll and handle your tax filings yourself, the plan is a great value compared to competitors. You’ll still be able to generate reports that will give you all the information you need for your tax filings.

The $37/month plus $4 per month per employee Full Service plan has the additional benefits of federal, state, and local tax filings.

Full Service offers full payroll services and handles all your payroll tax filings. It also includes year-end payroll tax filings and a tax filing accuracy guarantee.

This plan is well priced compared to the competition, but most payroll services include HR tools and support, which Patriot does not.

Note that both plans come with a 30-day free trial.

The payroll service offers a complete suite of services to take many tasks off your plate, including calculating and withholding federal, state, and local payroll taxes, and doing your W-2s and 1099s.

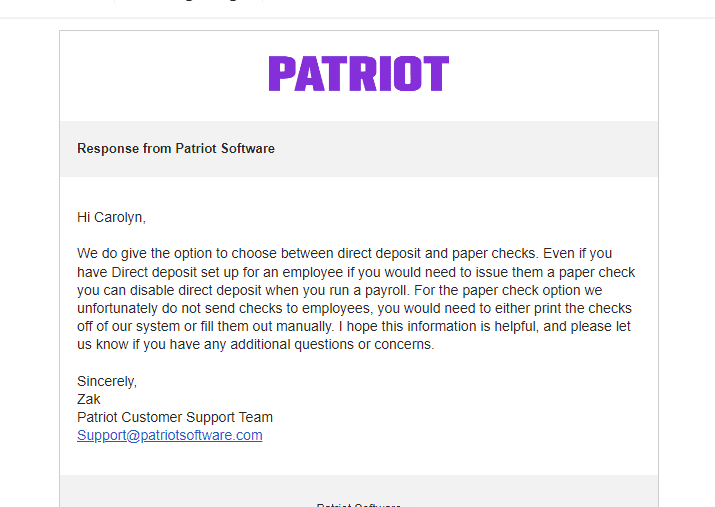

You also have the option of paying employees by direct deposit or paper check. With the Full Service plan you also get payroll tax filing services at the federal, state, and local levels.

The payroll process is complex, so using Patriot can save you considerable time and ensure that you are in compliance with payroll laws at all levels.

For accounting purposes, Patriot is a reliable service focused on independent contractors.

In this section, HumanResource’s in-house expert Daniel Eisner examines the main elements of Paychex’s accounting services and delivers his verdict.

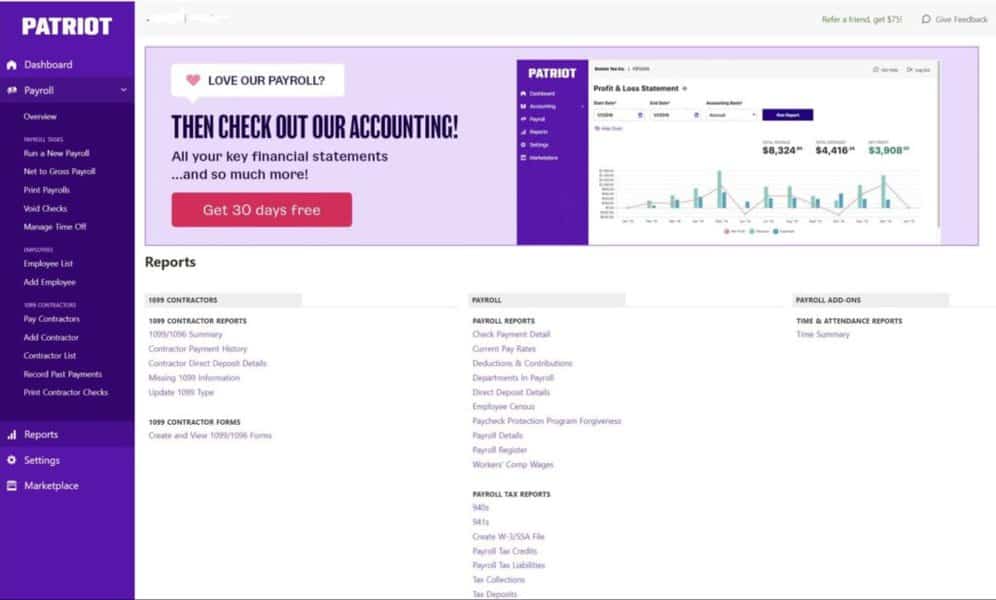

Patriot’s reporting contains all the standard information, plus a few elements that are often seen as part of HR, like departments and an employee census. Patriot offers a special focus on contractor information and provides all tax documents on the main reporting page.

The fact that time and attendance is a separate add-on seems odd, given the focus on 1099s and related tax information.

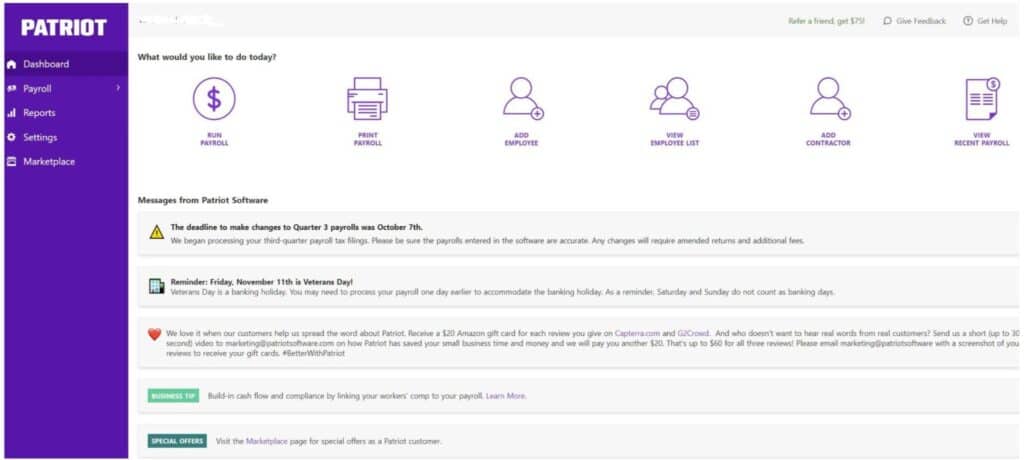

Patriot takes a minimalist approach to web design. The front page contains important dates, while the sidebar has links to all other pages. The main overview page also has a date list and an option to pay contractors separately from the regular payroll.

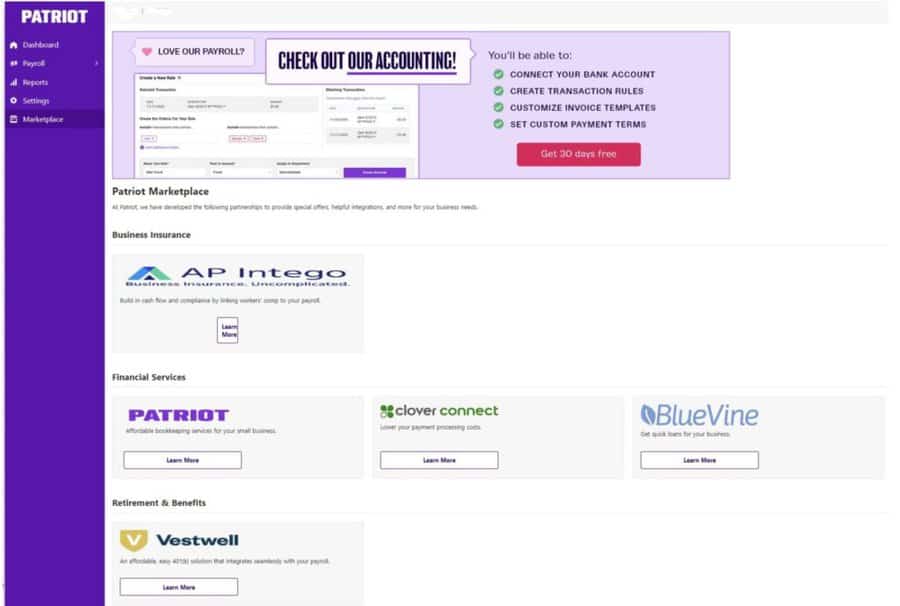

Upselling and ads are prevalent on nearly every page, making the visitor feel pressured. Additionally, including the marketplace with the main menu bars is a questionable choice. Several times I accidentally clicked into the marketplace instead of settings.

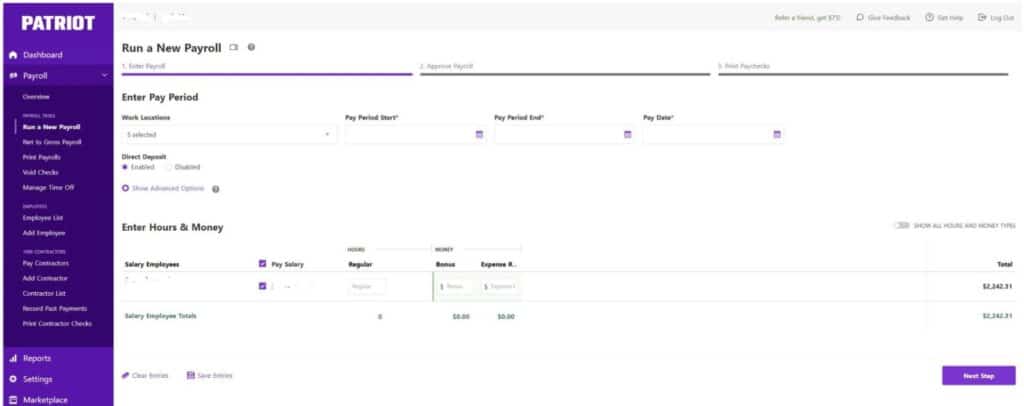

The submission process was straightforward and offered the ability to adjust hours and reimbursements, but not total pay. If I needed to change the payment type or amount, I had to go back to the time sheet.

But there is also an option to break out the details of all pay types. It’s also available as a toggle, which I particularly like. Being able to change from a detailed view to a compact view while staying on the same page was also useful.

Patriot is reliable and offers decent features, but nothing that stands out as exceptional. The focus on separate 1099 payroll information is helpful if that’s your primary employment type.

There are no HR functions to speak of, but at the same time I found no flaws in the reporting or submission process. Overall, Patriot is a solid option if you’re looking for a simple and affordable provider.

When you go to the site, you can easily find the plan pricing and details – it’s all in a chart that’s laid out quite well.

The site is user-friendly and the free trial offer is prominently displayed.

You can start your free trial by entering your name and email address. It does not ask for your phone number, streamlining the process.

Once you enter that information, you’ll get an email to confirm your email address. Then you’ll create a username and password and choose the plan that you want.

Once you make your selection, you’re offered two add-on services:

The whole process was quite simple and streamlined.

Next you’ll enter your business name, address, phone number, and number of employees.

Then you’ll go through their startup wizard – a series of questions about your payroll needs, EIN number and more. That’s where we stopped, as we do not have an EIN.

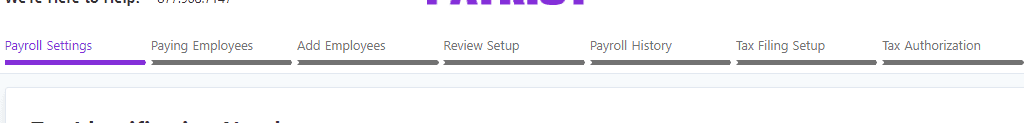

The next steps are to set up payroll, add employees, and enter tax filing information.

Patriot does not have a mobile app, but its website is optimized for mobile.

To cancel your payroll service, you’ll need to do the following:

“If you are a Full-Service Payroll customer, we will need to get more details about exactly when you want to stop the tax filing service.

After you cancel your software, you’ll be invoiced for the days that the software was active on the first of the next month.”

The site is quite user-friendly overall and information is easy to find. If you have all your information handy, you can complete signup in less than 30 minutes. It offers an excellent customer experience.

We tested all three forms of Patriot customer support, as detailed below.

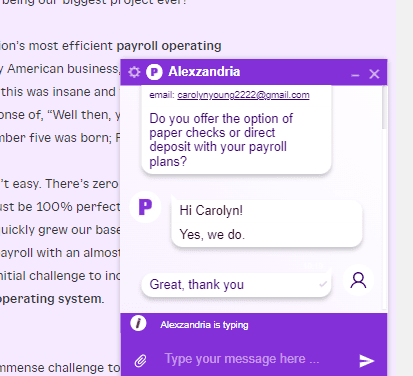

We asked chat support if both direct deposit and paper checks are available and received an immediate response.

Support Rating:

Response time:

Very quick

We called customer support to ask if Patriot offers same-day direct deposit. Our call was answered within a few seconds, and the answer was that they only offer two-day direct deposit. The support representative was friendly and helpful.

Support Rating:

Response time:

Very quick

We asked email support if both direct deposit and paper checks are available. We sent our message on a Sunday and received a response on Monday at about 10:30 a.m.

Support Rating:

Response time:

Immediate

Overall, Patriot’s services offer advantages and drawbacks, as detailed below.

Patriot was founded in 2002 by Mike Kappell in the basement of a factory. Its mission, according to its website, is: “to make accounting and payroll fast, simple, and affordable for millions of American businesses and their accountants.”

OnPay has one plan that’s more expensive than Patriot’s plans, but it offers hiring tools and health insurance and 401K administration.

Gusto offers three plans, all of which are more expensive than Patriot’s, but include health insurance administration, financial benefits administration, and hiring and onboarding tools. However, Gusto has an F rating from the BBB.

QuickBooks also offers three plans, all of which, again, are more expensive than Patriot. However, the QuickBooks plans offer more services than Patriot.

As a leading entrepreneurial advisory site, we take our responsibilities seriously. We understand that countless entrepreneurs, and potential entrepreneurs, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of Patriot payroll services.

We were pleased with our overall experience with Patriot. The site is easy to use, information is readily available, and customer service was excellent. In addition, most customer reviews are positive.

Patriot’s plans are priced well compared to the competition. The only issue is that neither includes HR services or benefits administration.

But if you’re looking for a robust and affordable payroll-only service, we highly recommend Patriot.