Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on July 21, 2024

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so you can focus on building a successful business.

One of the top options is Paychex Flex. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the payroll service that will keep your business on the road to success.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Paychex is one of the country’s top providers of payroll solutions – issuing pay to one out of 12 U.S. private sector employees, according to its website.

Paychex Flex is a suite of three payroll processing plans that aim to satisfy a wide variety of business types and needs. Key benefits include running payroll via an online platform or free mobile app, 24/7 customer support, full calculation and payment of payroll taxes, and more than 200 compliance experts ensuring your payroll processing is always fully up to date.

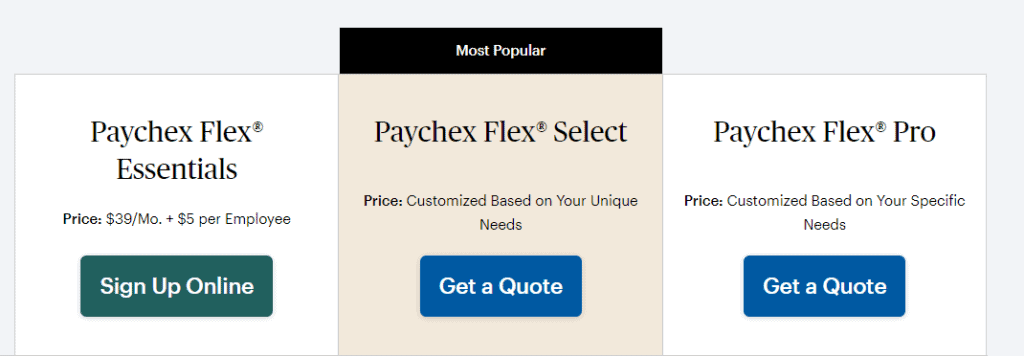

| Paychex Flex Essentials | Paychex Flex Select | Paychex Flex Pro | |

|---|---|---|---|

| Price | $39/Month + $5/ Employee | Customized Based on Your Needs | Customized Based on Your Needs |

| Direct Deposit & On-Site Check Printing | x | x | x |

| Mobile App for Employees and Employers | x | x | x |

| Standard Analytics and Reporting | x | x | x |

| General Ledger Report | x | x | x |

| Guided Setup | x | ||

| Dedicated Payroll Specialist | x | ||

| Additional Employee Pay Options | x | x | |

| Garnishment Payment Services | x | x | |

| Accounting Software Integration | x | ||

| Taxpay® Payroll Tax Administration* | x | x | x |

| W-2s and 1099s ** | x | x | x |

| New-Hire Reporting | x | x | x |

| Labor Compliance Poster Kit | x | x | x |

| Workers’ Compensation Insurance ** | x | x | x |

| State Unemployment Insurance Services | x | ||

| HR Library and Business Forms | x | x | x |

| Paychex Learning Management System | x | x | |

| Paychex Flex Onboarding Essentials | x | ||

| Paychex Employee Screening Essentials | x | ||

| Employee Handbook Builder | x | ||

| Paycard | x | x | x |

| Financial Wellness Program | x | x | x |

| Tax Credit Services | x | x | x |

| Employee Assistance Program (EAP) | x |

NOTES:

* Additional fees may apply

** Available at an additional cost

Paychex Flex offers a number of different service levels. We explored all of the options, as detailed below.

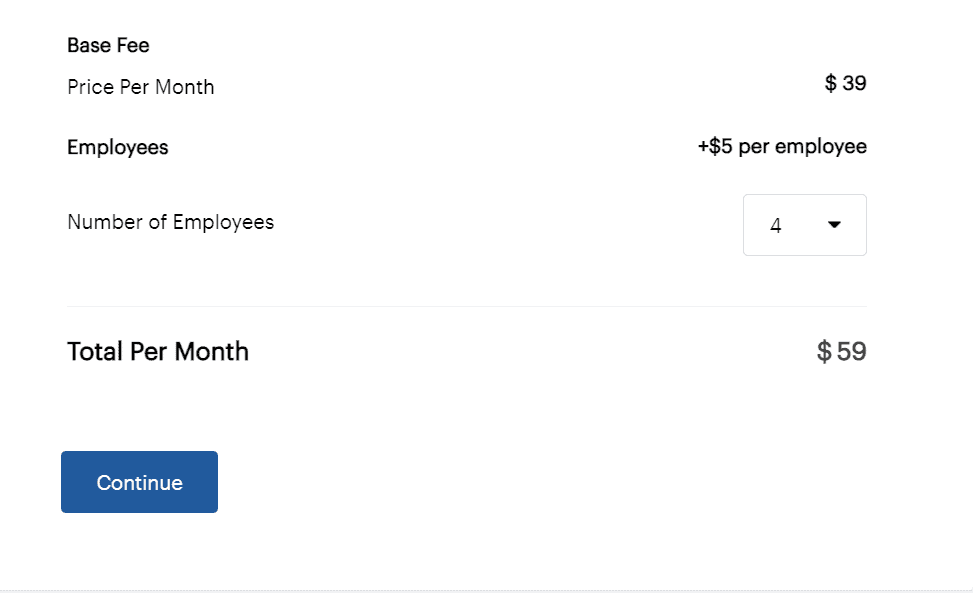

The Paychex Flex Essentials plan costs $39 per month plus $5 monthly for each employee. This affordable yet comprehensive package includes online payroll and tax filing and access to a mobile app and is best for businesses with 1-9 employees.

The Paychex Flex Essentials plan is the lowest-tier plan out of three service offerings. It’s tailored to smaller businesses with one to nine employees. Unlike providers who charge for each payroll run, Paychex subscribers can make an unlimited number of payroll runs.

This plan includes payroll tax calculations and filings with relevant federal, state, and local bodies. With the standard analytics and reporting benefit, you can review payroll reports and make changes as needed prior to submitting payroll.

Paychex Flex Essentials contains a robust suite of offerings that center around the employee experience. With an included HR library and business forms repository, your HR team will have access to key onboarding forms and documents.

There’s also a free mobile app that enables employers and employees to access payroll related info anywhere, anytime.

The Paychex Flex Select plan includes everything in the Essentials plan plus tax credit service, additional employee pay options, and online employee training and development. The cost of this plan depends on the nature and size of your business and can only be obtained by requesting a quote.

The Paychex Flex Select plan is the second-tier payroll package from Paychex and includes everything in the Essentials plan plus a number of features, such as more pay options for your employees. In addition to direct deposit and paper checks, Flex Select offers check signing and a check logo service to subscribers.

Another key feature is access to the Paychex Learning Management System. If you’re interested in making e-learning a priority, this feature offers courses to help your employees stay engaged and focused. Offering e-learning tends to help improve employee retention.

The Paychex Flex Pro plan is the top-tier plan and includes everything from the Essentials and Select packages plus added features, including a dedicated payroll specialist, guided setup, and accounting software integration. The cost of this plan depends on the nature and size of your business and can only be obtained by requesting a quote.

The top-tier Paychex Flex Pro plan includes all the benefits in the Essentials and Select plans plus additional benefits, such as access to a dedicated payroll specialist. Business owners and payroll processors are assigned a single point of contact for both payroll and tax related matters.

The Paychex Flex Pro plan includes guided setup so you can start off on the right foot. Guided setup provides expert step-by-step support setting up payroll processing. You’ll also be able to integrate Paychex with your existing accounting software, including QuickBooks Online, Sage Intacct, and Xero.

Additional benefits of the Pro plan include state unemployment insurance services to help file and pay your SUTA taxes. You’ll also gain access to a robust platform of HR services, such as onboarding support, employee screening, and an employee handbook builder.

Note that in the plan breakdown, each plan lists W-2 and 1099 processing as a benefit, but the fine print at the bottom of the website makes clear that there is an extra cost associated with this feature. This is a bit misleading as the access to the feature is what’s included in each plan, not the actual service.

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

You also have the option of paying employees by direct deposit or paper check, and they provide payroll reports. The payroll process is complex, so using Paychex Flex can save you considerable time and ensure you remain in compliance with payroll laws at all levels.

The Paychex Flex plans also provide support with payroll taxes and reporting. The higher-tier plans provide more hands-on support and assist you with setting up your account so you can rest easy knowing your payroll processing is accurate.

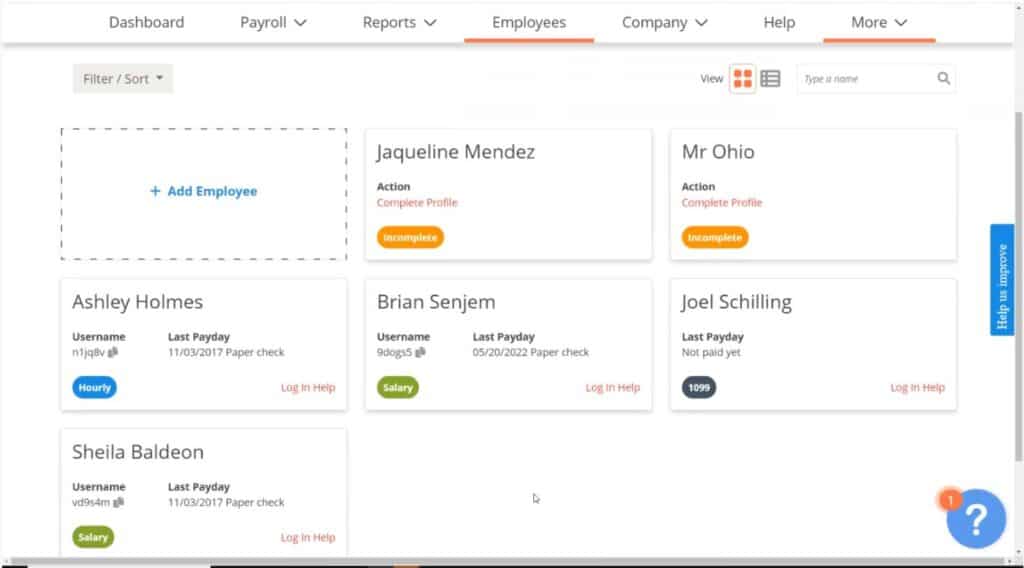

Each of the Paychex Flex payroll plans comes with a robust offering of employee resources. The Essentials plan includes a self-service HR library and business forms repository. In the middle-tier Select plan, you’ll receive access to Paychex’ e-learning platform.

With the Pro plan you’ll have access to the Paychex Flex Onboarding Essentials, which enables employees to complete their new-hire documentation, including direct deposit and tax forms, through a paperless, mobile-friendly experience. You’ll also have access to Paychex’ Employee Screening Essentials, for efficient background check processing, and the Employee Handbook Builder.

None of the Paychex payroll plans include benefits administration. However, you can purchase these services a la carte.

According to the Paychex website, they can administer the following benefits:

To find out more and to receive a quote, visit the Employee Benefits section of the website.

Paychex’s reporting function is strong, but lacks customisation. Some details are available, such as 401K totals and after-tax wages. But it’s difficult to understand how to track non-standard elements like bonuses and reimbursements.

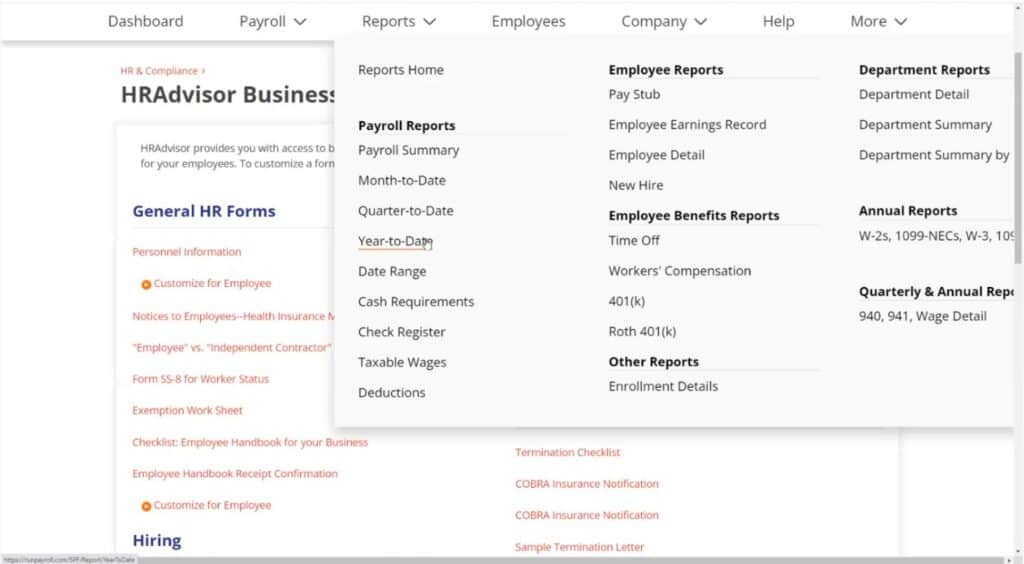

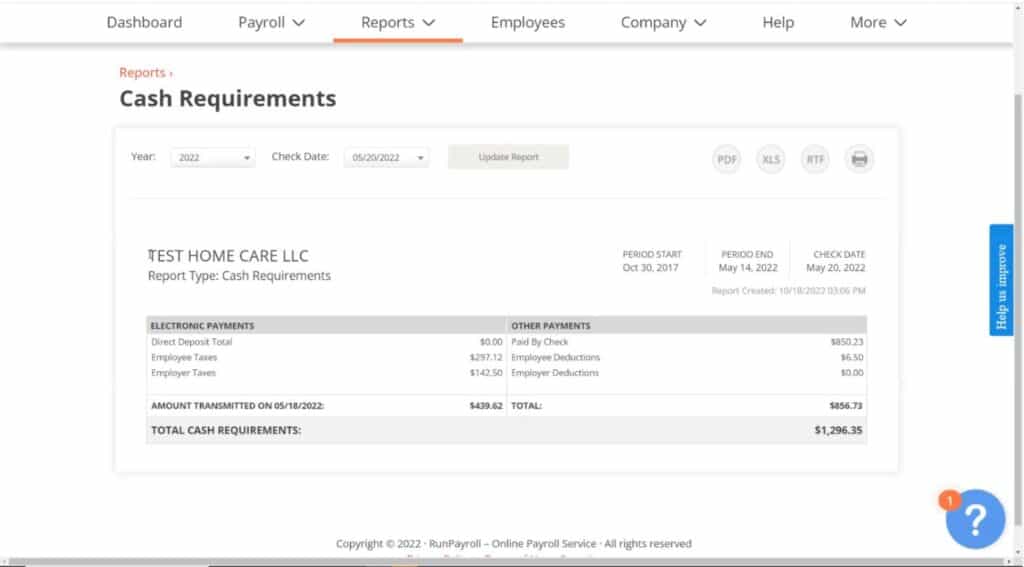

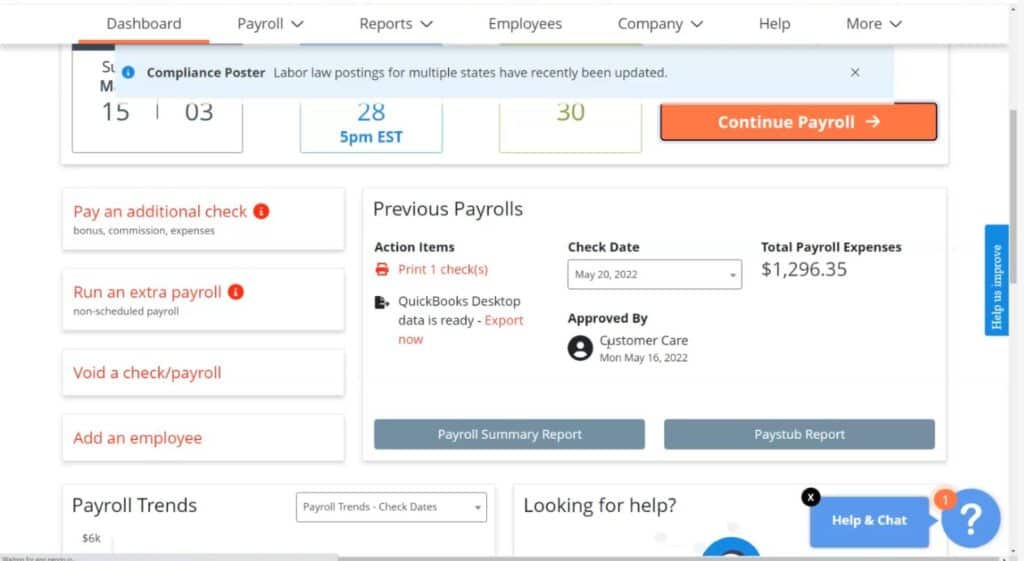

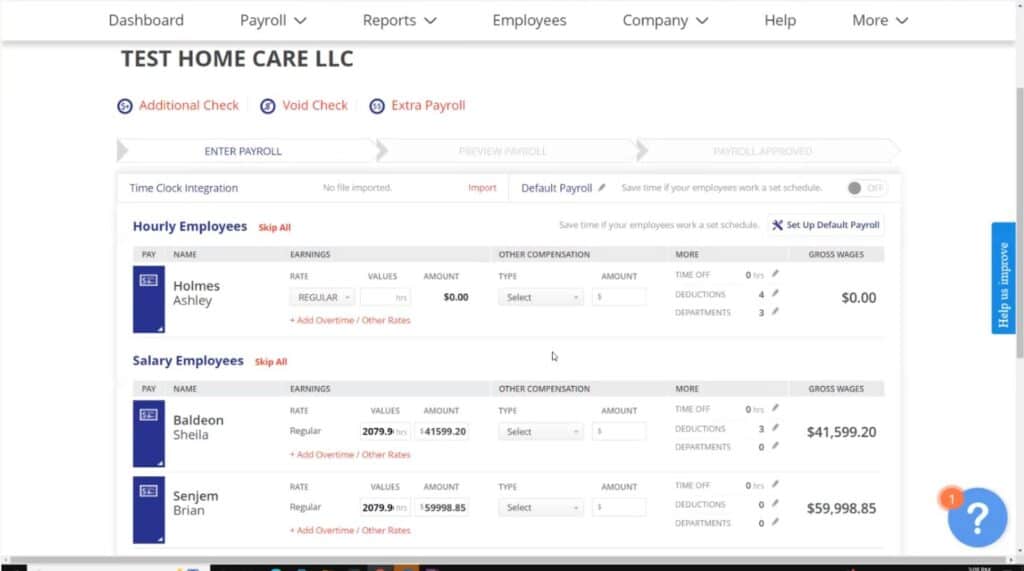

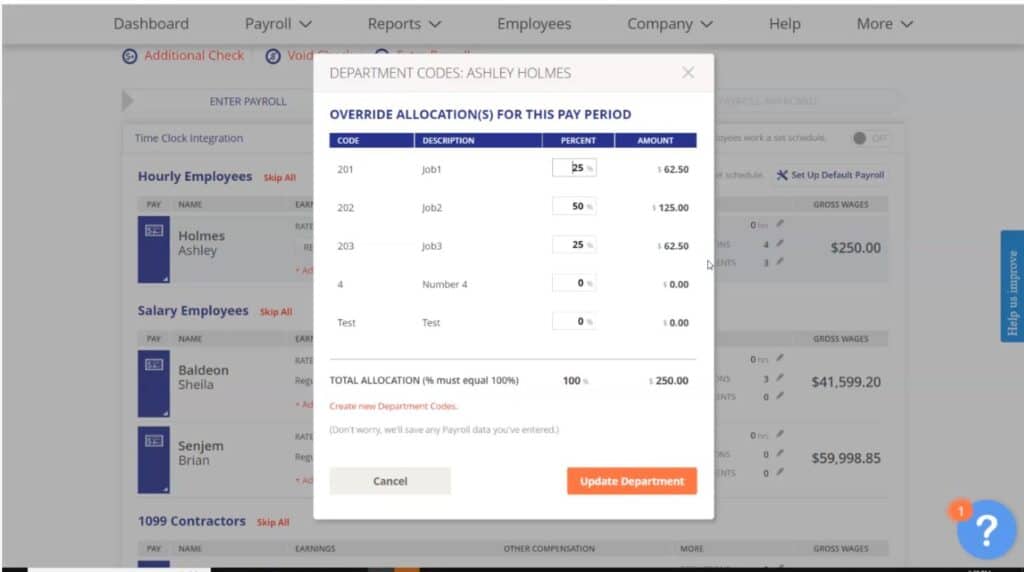

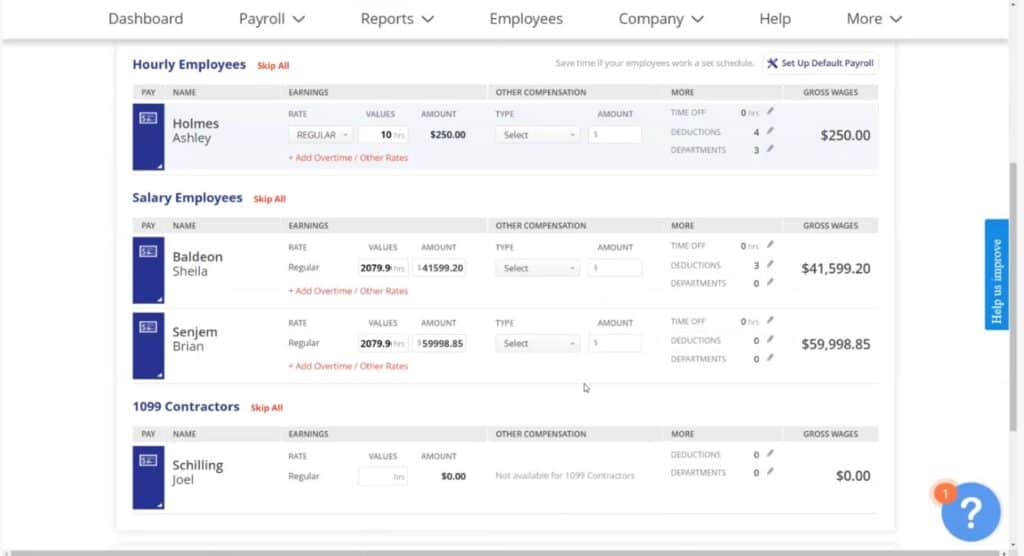

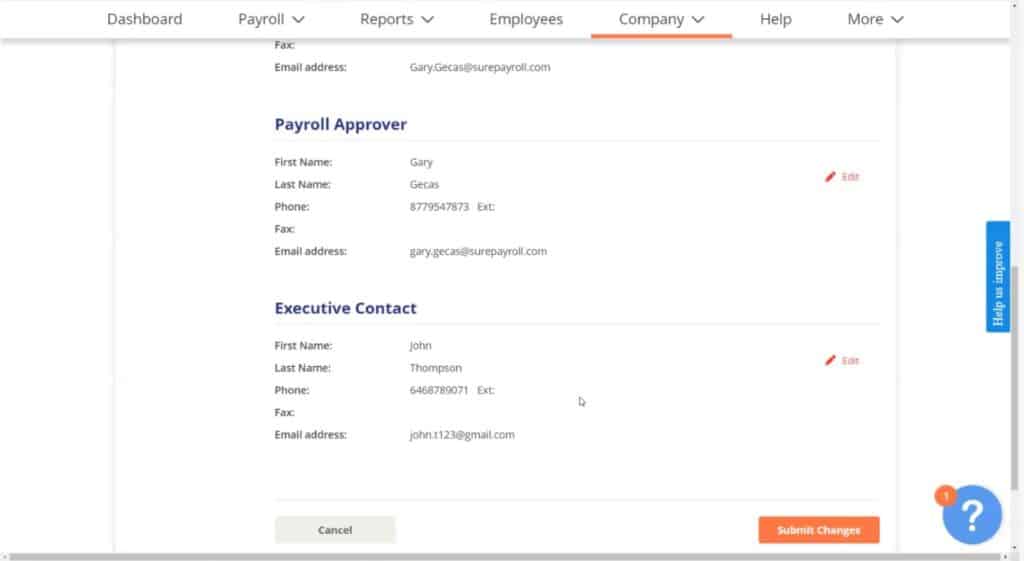

The interface is appealing, but getting into the heart of the system is far more difficult than it should be. Once I was finally able to access the main menus, the information provided was exceptionally detailed and useful. From cash requirements to notices and individual employee edits, any numbers relevant to payroll are available in a one-click menu.

The submission process was straightforward, while also offering the ability to make adjustments at each step. The only issue is the lack of permissions. Paychex clients are only allowed two accounts, each of which must be administrator-level, with access to all.

This means there’s no way to separate the accounting and HR functions. So if you have a dedicated HR staffer, they will also have full access to all the payroll functions.

If your company has a diverse and changing payroll, Paychex is a solid option. But you will likely need a responsible, tech savvy team to operate it, as access cannot be limited – all those who login will have the full range of payroll actions at their fingertips.

If you can get past the initial access and setup hurdles, the options to adjust payroll detail are excellent for companies that have a frequently changing payroll.

The site is user-friendly. The plans are easy to find, with good detail on included features. You can even get more information on each individual service. It’s laid out well and easy to understand. Pricing is a bit trickier to navigate, as you must submit a quote to obtain the cost of both the Select and Pro plans.

The site also has a robust help center where you can get information on a variety of topics.

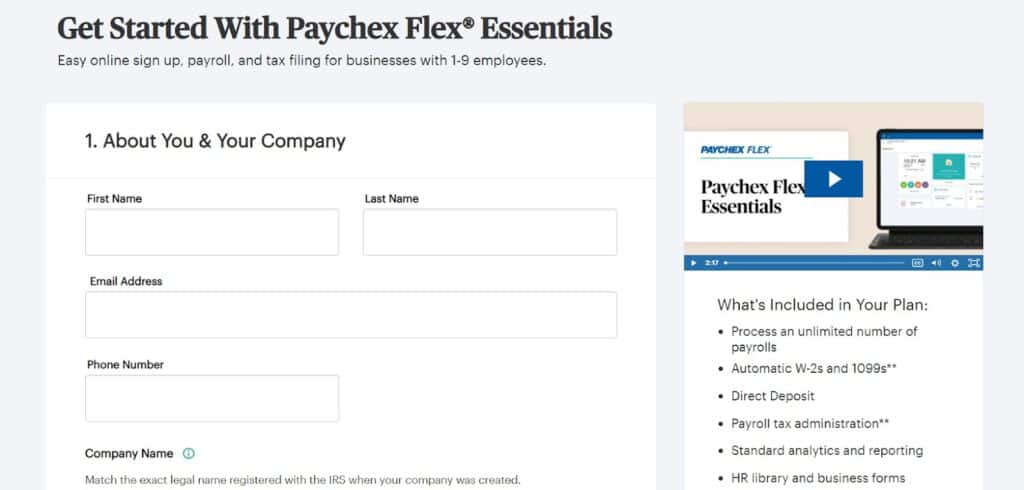

While you’re unable to sign up for the Select and Pro plans without contacting a representative and obtaining a quote, you can go ahead and register for the base Essentials plan.

To start the signup process for the Flex Essentials plan, click Sign Up Online. The next screen will prompt you to enter your contact information. There’s also an informative video about the plan on the right side of the page, along with a summary of the plan’s benefits.

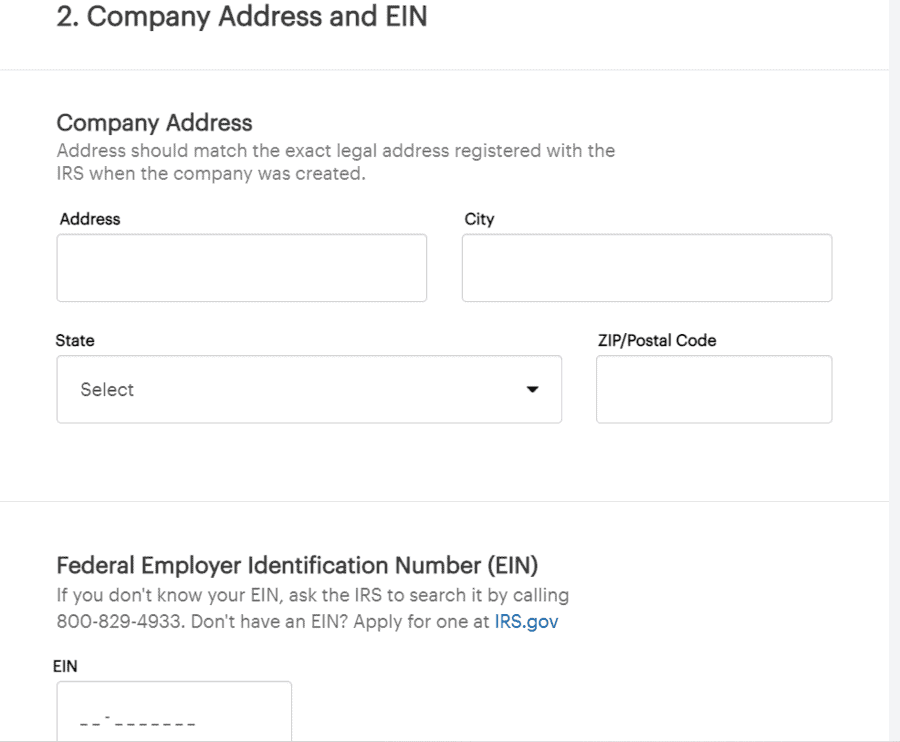

Next, enter your company information and EIN.

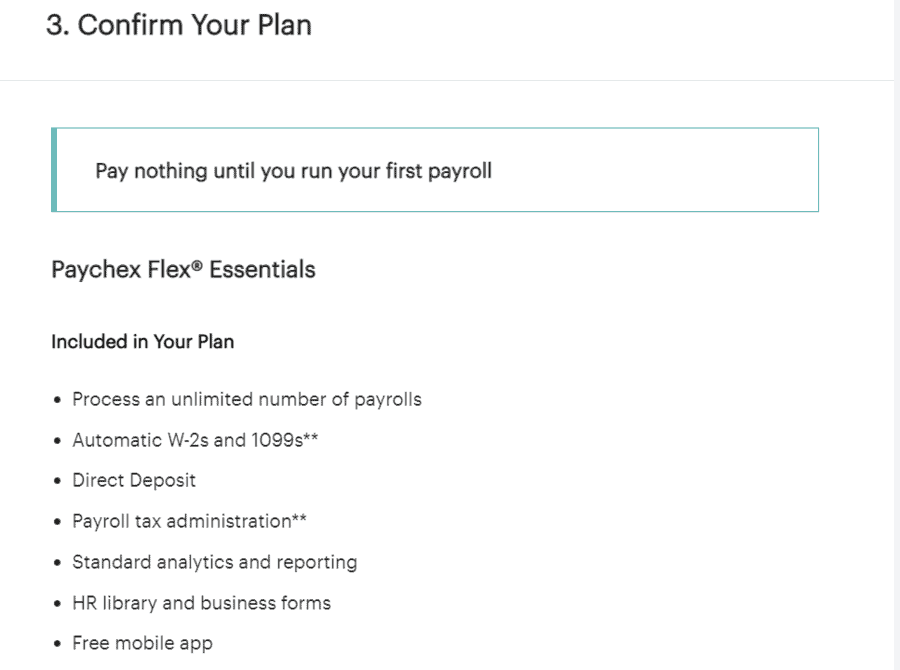

Next, confirm your plan selection, and you’ll be reminded that you won’t pay anything until your first payroll run.

You will also get to see a cost breakdown before finalizing your choice.

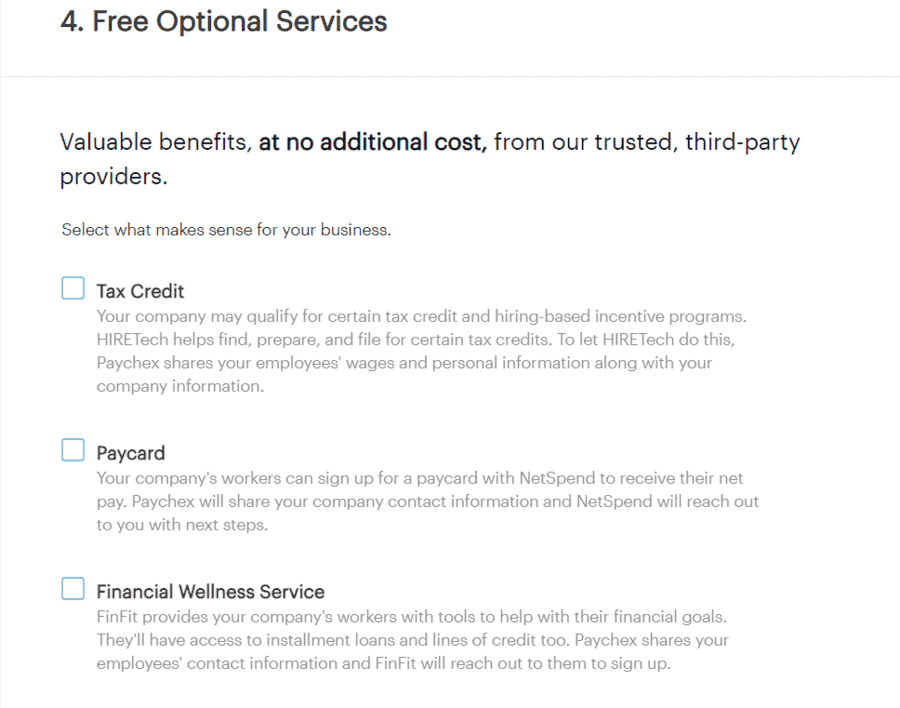

The last step asks if you’d like to sign up for free services from third-party providers.

Make your selections and then click Complete Sign Up at the bottom of the screen.

The Paychex Flex platform is extremely mobile-friendly, with several apps available for both employers and employees. When you sign up for a Paychex Flex account, you get access to the Paychex Flex App.

This app connects employers to vital payroll and benefits features with the security of Touch-ID and Face ID authentication. The Paychex Flex App also allows employers to enter, review, and submit payroll and access employee data and reports, while employees can access and update their own information.

Other available apps are tied to different Paychex solutions, such as timekeeping and employee benefits.

It was extremely difficult to find information related to the Paychex Flex cancellation policy on the website. We eventually found the terms of service, but it contained no information on cancellation policy. Several customer reviews at the Better Business Bureau and Trustpilot highlight the cancellation process as taxing and difficult.

Overall, the Paychex website is extremely user-friendly, with easy to follow navigation and a seamless sign-up process for the Essentials plan. Information about each plan is easy to find and explained in great detail. There are also information videos throughout the website to further explain plans and benefits. The only downside was that pricing for both the Select and Pro plans is custom, and thus not transparent. However, there are several opportunities to request a quote to find out more.

We tested all three forms of Paychex Flex customer support, as detailed below.

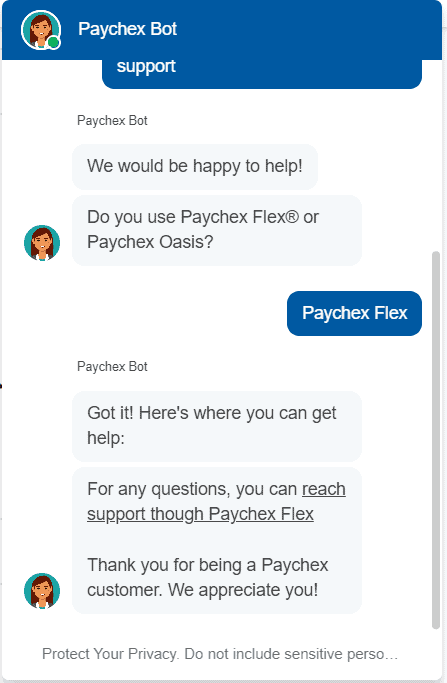

Our initial experience with the Paychex Flex chatbot redirected us back to the Paychex website.

We probed a bit further and were able to start chatting with a live agent. We asked about the cancellation policy and they said we could get that information from the sales team. We asked if there was a chat feature available to speak with the sales team, and the agent said “not that I know of” and asked for our first and last name to have someone reach out to us.

We closed the chat session without receiving an answer to our question.

Chat Support Rating:

Response time:

Reasonable

We hoped to email Paychex to ask about the cancellation policy, since we weren’t able to get very far with the chat feature. Because we had been directed to the sales team, we figured we would try emailing them directly. But when you click the “email us” button under sales support, you’re prompted to request a quote, which is not what we wanted to do.

We also tried another support email button, but it was for existing customers and we were prompted to enter a client ID number to proceed. Overall, the process to contact a representative for general questions was difficult, to say the least.

Email Support Rating:

Response time:

Reasonable

We called Paychex Flex customer service to ask if we could get an estimate on pricing for the Select and Pro plans. We had to go through a series of prompts before being placed on hold for several minutes.

After connecting, the representative was polite and told us we would have to request a quote with the sales team, as pricing depends on the size of our company. They offered to transfer us to a sales representative, but we thanked them and declined.

Phone Support Rating:

Response time:

Reasonable

Overall, Paychex Flex offers advantages and drawbacks, as detailed below.

Paychex is headquartered in Rochester, New York, and has more than 100 offices serving 670,000 payroll clients across the USand Europe. In 2019, Paychex ranked 700th on Fortune’s list of largest corporations by revenue.

The company was founded in 1971 by Tom Golisano. Today, the president and CEO of Paychex is Martin Mucci, and the senior vice president and CFO is Efrain Riviera.

ADP services are also priced by quote only and seem to be on par with Paychex Flex. ADP is also an established industry veteran with an A+ rating with the BBB and low customer review score.

Gusto has three plans, and its base plan is comparable to Paychex Flex Essentials. The pricier Gusto plans offer a bit more than Paychex Flex, but also cost more. Gusto has an F rating with the BBB.

The OnPay plan offers more than the Paychex base plan. However, Paychex has 24/7 customer service, while OnPay only has customer support during business hours. OnPay has solid ratings with Trustpilot and BBB, but mixed customer reviews.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of the Paychex Flex payroll services.

Overall, we have mixed feelings about Paychex Flex. On a positive note, their website is easy to use, with loads of information on plans and benefits, and signing up for the Essentials plan is quick and easy.

Yet Paychex’ customer service left much to be desired. For one thing, the initial customer service reps we dealt with were unable to answer our questions. Also, the high number of complaints about specialist turnover and cancellation issues is troubling.

Overall, Paychex has been around for years, gaining the trust of companies across the country. Its pricing and offerings are on par with competitors and each plan includes a robust suite of services, so if you choose to go with Paychex, you’ll probably make out just fine.

But if customer service is high on your list or priorities, you may be disappointed with Paychex as your payroll service provider.