Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Carolyn Young

Carolyn Young is a writer with over 25 years of experience in business in various roles, including bank management, marketing management, and business education.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on July 14, 2023

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is QuickBooks Payroll. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you choose the payroll service that will put your business on the road to success.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

When most people think of QuickBooks, they probably think of accounting software and related applications, like Intuit Quickbooks and Quickbooks desktop.

Inuit is the parent of Quickbooks, which does also provide software solutions. But this review is only about QuickBooks’ payroll service, which can be purchased in packages that include accounting tools. Quickbooks’ payroll also offers health insurance benefits and administration, along with a variety of HR tools.

QuickBooks Payroll offers a number of different service levels. We explored all of the options, as detailed below.

| Core | Premium | Elite | |

|---|---|---|---|

| Price | $45 per month plus $5 per employee per month | $75 per month plus $8 per employee per month | $125 per month plus $10 per employee per month |

| Full service payroll | X | X | X |

| Auto payroll | X | X | X |

| 1099 e-file and pay | X | X | X |

| Expert product support | X | X | X |

| Direct deposit | Next day | Same day | Same day |

| Expert review | X | X | |

| Time tracking on the go | X | X | |

| 24/7 expert product support | X | ||

| Tax penalty protection | X | ||

| Personal HR advisor | X | ||

| 401 K plans | X | X | X |

| Health care benefits | X | X | X |

| HR support center | X | X | |

| Worker's compensation admin | X | X |

Note that all plans are offered with a 30-day free trial or 50% discount for three months.

The $45/month plus $5 per month per employee Core plan offers full payroll services, plus 401K plans and health care benefits.

The Core plan includes full-service payroll, including W-2s and 1099s and tax filings. Payroll and tax filings are done automatically. The plan also administers 401K and health insurance plans.

The Core plan provides a lot of bang for your buck, with many services offered for just $45 a month, plus the employee fee. This plan is a great value for small companies that just need their payroll handled and want to offer benefits to their employees.

The $75/month plus $8 per month per employee Premium plan has the additional benefits of same-day direct deposit, as well as on-the-go time tracking and an HR support center.

The Premium plan has the additional benefits of same-day direct deposit, as opposed to next day in the Core plan. It also includes time tracking on the go, enabling employers to track and approve employee hours from a mobile app.

With the plan, you’ll have access to an HR support center and workers’ compensation administration. For a minimal amount more, you’ll receive several extra benefits, making the Premium plan a good value.

At $125 per month plus $10 per month per employee, the Elite plan offers everything in the Premium plan plus 24/7 support, tax penalty protection, and a personal HR advisor.

The Elite plan has the unique benefit of tax penalty protection, so that if you receive a late penalty for tax filings, QuickBooks takes care of those penalties up to $25,000, subject to certain terms and conditions.

You’ll also receive a personal HR advisor. These are valuable add-on services that can offer you support and peace of mind.

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

You also have the option of paying employees by direct deposit or paper check, and they provide payroll reports. The payroll process is complex, so using QuickBooks can save you considerable time and ensure that you are in compliance with payroll laws at all levels.

All the QuickBooks plans offer health insurance administration with online enrollment. They also offer 401K administration.

These services are a great value, enabling you to provide quality benefits to your employees and stay in compliance with all laws.

The site is user-friendly. The plans are easy to find, with good detail on features and pricing. You can even get more information on each individual service. It’s laid out well and easy to understand.

When you view all the packages, you’re advised to select one to set up an account. After you select your plan, you’re offered bundled plans that include QuickBooks accounting features. You can select one of those plans, or select “just payroll”.

Then you go to checkout, where you’ll set up your account and password. The next step is to enter credit card information, which is unusual, as most competitors do not charge clients until the first payroll run.

This means that with Quickbooks you need to be absolutely certain of your choices when you’re setting up your account.

QuickBooks has a robust mobile app for employers. You can enter employee hours, submit payroll, view payroll taxes and forms, and even pay payroll taxes. They also have an app for employees to track their hours and clock in or clock out.

Th employers’ app is far superior to those of competitors. Many payroll services do not even have an app for employers to manage payroll.

The site is quite user-friendly and information is easy to find. The only issue was that new clients must pay immediately when they sign-up, which seems a bit aggressive. Otherwise, the site is not very “salesy” and just guides visitors to the optimal plan. Overall, a pleasant customer experience.

The QuickBooks cancellation process is as follows:

Note: Be sure to leave your bank account open until we debit and pay those tax liabilities. These liabilities (including annual liabilities) will be paid at the time we process your cancellation form.

You’ll receive an email confirmation within 3 business days once we have reviewed your cancelation request, and another when we have completed your cancelation.

We tested all three forms of QuickBooks customer support, as detailed below.

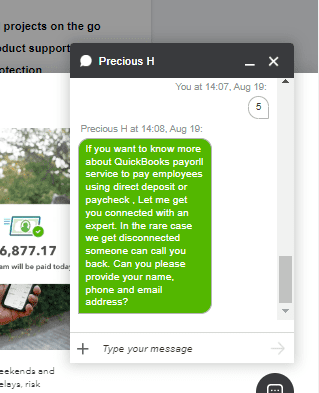

We asked chat support a simple question – do you offer the option of paying employees by direct deposit or paper check? She asked us several questions before saying she had to route us to a sales person, and asked for our email and phone number. Disappointing! We just wanted a quick answer, not a sales pitch. We never got our answer.

Phone customer support is only available if you have an account. Non-customers can only contact sales, so we did and asked the same question. The answer was yes, both are available, but we also got a bit of pressure to sign up.

Again, email support is only available if you have an account.

To understand how real QuickBooks customers feel about the service, we examined customer reviews at the Better Business Bureau and Trust Pilot.

QuickBooks’ parent company is Intuit, Inc, which offers accounting and tax software and services as well as payroll services. The BBB only monitors Intuit, not Quickbooks.

Intuit has an A – rating from the BBB with 1.09/5 stars in 450 customer reviews. They are not an accredited BBB business. They have received 2971 complaints in three years, all of which have a closed status.

We were unable to locate any positive reviews about the QuickBooks payroll services.

We did find a few negative reviews that mentioned errors and poor customer support.

“Used QuickBooks payroll. Disaster at the best. Calculated paychecks incorrectly. Customer service was of less than zero help. They assured me that they wouldn’t submit quarterly information to IRS but did. It was incorrect. Cancelled my account, they kept charging my credit card. What pathetic excuse for a company. NEVER EVER WILL USE ANYTHING INTUIT AGAIN”

You can read reviews on the BBB website.

**The Better Business Bureau is a private nonprofit that uses an A+ through F grading system to rate BBB’s degree of confidence that the business operates in good faith and will work to resolve customer issues and complaints filed with the BBB. BBB accreditation means that the business has undergone vetting and been approved and now pays dues to ensure its good standing with the BBB and gain use of the BBB logo in marketing materials. Over the years, several businesses have complained that the BBB gave them a poor letter grade, such as a D or F, largely because they refused to pay the fee to become an accredited member. Thus, these ratings should probably be taken with a grain of salt.

The TrustPilot score for QuickBooks is 1.1/5 stars from 343 reviews.

Reviews at Trustpilot break down as follows:

None of the positive reviews, again, were about QuickBooks payroll services.

We did find a few negative reviews that revolved around issues with payroll tax payments.

“I pay for their desktop payroll functionality and on their main tab it shows payroll taxes are being paid when I e-pay them. However, on a separate tab just for e-payments which I do not need to check because the first page shows the payments have a complete status after I make them through QuickBooks shows Agency Rejected. After multiple hours with QuickBooks its clearly there fault but they refuse to pay for the fines that they cause for the last 4 months of payments that were not sent properly.”

You can read reviews on the TrustPilot website.

Overall, QuickBooks’ services offer advantages and drawbacks, as detailed below.

QuickBooks payroll was developed by Intuit, which was founded in 1983 and, according to the BBB, has 8900 employees. Intuit is a public corporation with nearly $10 billion in annual revenue.

The company has had legal troubles over the years, mainly for misleading advertising about their tax products. They are currently the subject of multiple lawsuits and under investigation by the Federal Trade Commission.

The Paychex and QuickBooks base plans are similarly priced, though Paychex does have a more robust employee benefits service and more extensive HR services.

Paychex has an A+ rating with the BBB, although their customer review score is low.

ADP services are priced by quote only and are more expensive than QuickBooks. They do, however, include more health insurance options than QuickBooks. ADP has an A+ rating with the BBB, though its customer review score is low.

Gusto has three plans, and its base plan is similar in price to QuickBooks’. The higher-level Gusto plans offer a bit more than QuickBooks plans. Gusto, however, has an F rating with the BBB.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of QuickBooks payroll services.

Overall, the QuickBooks site is easy to use and detailed plan information is easy to find. Its plans are well priced and offer good value for small businesses, and Quickbooks offers an excellent mobile app for business owners.

We also liked that all the plans include health insurance and 401K administration. However, QuickBooks does not offer as many HR tools as some competitors. Also, its poor reviews and rankings are concerning, as are parent company Intuit’s legal issues.

QuickBooks has the advantage of its name – most people are familiar with it – and a lot of customers, so we can cautiously assume that many have had a good experience with its services and software.

Because of the outstanding value the QuickBooks plans offer, we recommend them to businesses willing to pay a bit more for quality payroll service.