Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is Wave Payroll. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the best payroll service for your business.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Wave Payroll, one of several financial solutions from Wave Financial Inc., promises “payroll that pays off” and “an effortless way to pay employees, contractors, and yourself”. Wave also promises no hidden fees, that you can run payroll in minutes, and a 100% payroll accuracy guarantee.

Wave Payroll services enable businesses to pay contractors and employees, generate W2 and 1099 forms, pay and file state and federal payroll taxes, and much more. With an easy to use website, sign-up is simple and straightforward, and you can get started right away for free.

Wave offers one signature payroll service with two different pricing options, depending on the state in which you run your business.

Wave Payroll is a comprehensive payroll service with two different pricing options, depending on whether you are in a tax service state or a self service state. Pricing for tax service states is $35 per month plus $6 per employee or contractor. Self service state plans are priced at $25 per month plus $6 per employee or contractor.

Wave offers one payroll solution with two pricing tiers, depending on which state your business is in. For what are considered “tax service states”, the base rate for payroll services is $35 per month plus $6 for each employee or contractor on your payroll.

In what are considered “self service states”, the base monthly rate for payroll services is $25 per month plus $6 for each of your employees or contractors.

The base rate is higher in tax service states (Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington and Wisconsin) because Wave provides automatic tax payment transfers in these states.

Wave will also file the necessary paperwork with your state tax office and the IRS in these states. The remaining 36 states are considered self service states, and Wave Payroll does not make tax payments or filings for businesses operating there.

Wave Payroll also offers a 30-day free trial.

The following benefits are included in both pricing tiers:

For an added charge, you can hire a Wave Advisor and get help completing the relevant forms and filing your business and personal income taxes.

Wave does not offer any human resources or benefits features in their payroll plan, but they do have a payroll education center on their website where anyone can download the latest payroll and tax forms free of charge. There is also a robust set of guidelines around how to create an employee handbook with a ton of free resources.

If you’re interested in additional support for you or your staff, Wave also offers payroll and accounting coaching services for a one-time fee of $329.

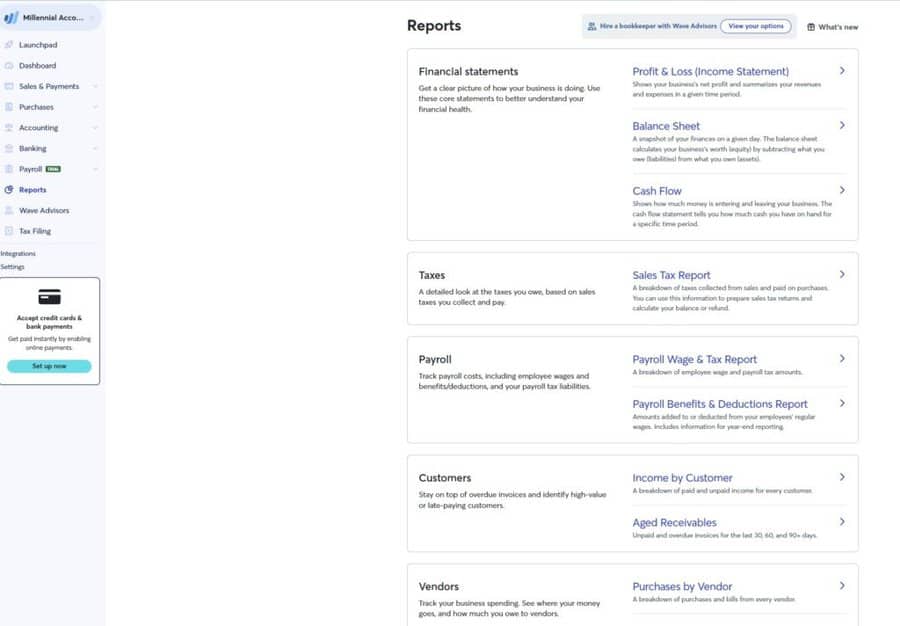

Wave is unique among payroll providers in that it aims to be a minimalist, yet full-service accounting program. For example, the reporting options cover multiple accounting categories at the top level, but lack detailed views that you would find in payroll-focused softwares. You can view traditional financial statements like a balance sheet, showing your sales, expenses, and payroll costs. Each menu only has a few options, but with a broad selection of categories.

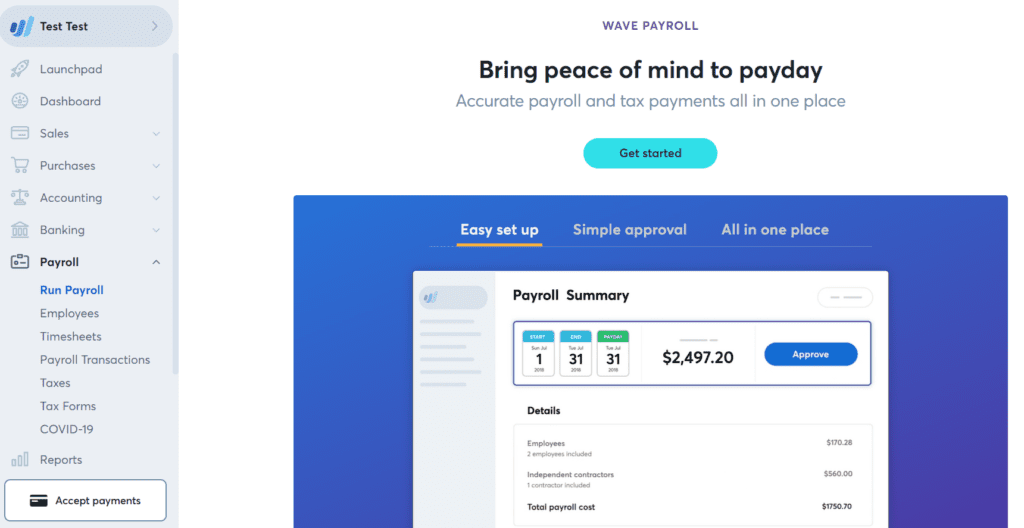

Wave’s interface is much like Quickbooks Desktop, but cleaner and more informative. The side-bar has logical categories for everything, in keeping with its all-in-one business software approach.

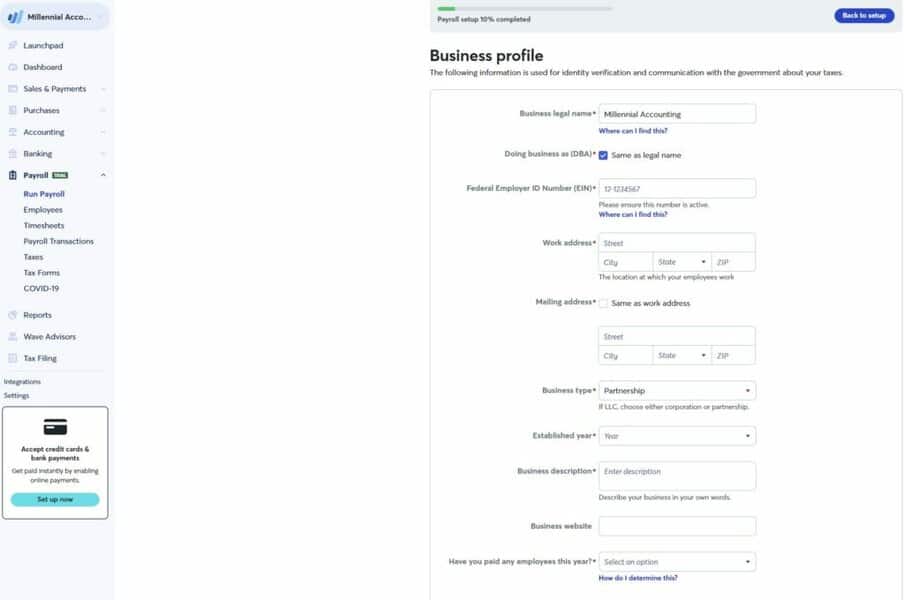

Submitting payroll through Wave was a bit of a hassle due to the amount of setup. But once all your information is in place, the steps of payroll processing were easy to follow.

What’s more, the integration with bookkeeping provided useful insights, and it was good to be able to jump straight to the journal entry after submitting.

Wave is fantastic for startups. New sole proprietorships and partnerships, for instance, will benefit from its compact, all-in-one accounting.

If your accountant is comfortable handling the entire financial and payroll process from start to finish in one place, Wave is a great option for your small business.

The website is user-friendly. The plans are easy to find, with good detail on features and pricing. There are several helpful FAQ sections that offer further clarification. Wave also provides a ton of free resources on business accounting.

Signing up for Wave Payroll was simple and straightforward. To begin, head to the Wave website and click on Payroll under the features menu. Next, click on the “Start your free 30-day trial” button.

Next, you’ll either enter your email and create a password, or use your Google credentials to create your Wave account.

You’ll then be brought to the first of four sign-up steps. In the first section, enter your name, business name, and business description. Once everything is entered, click Next.

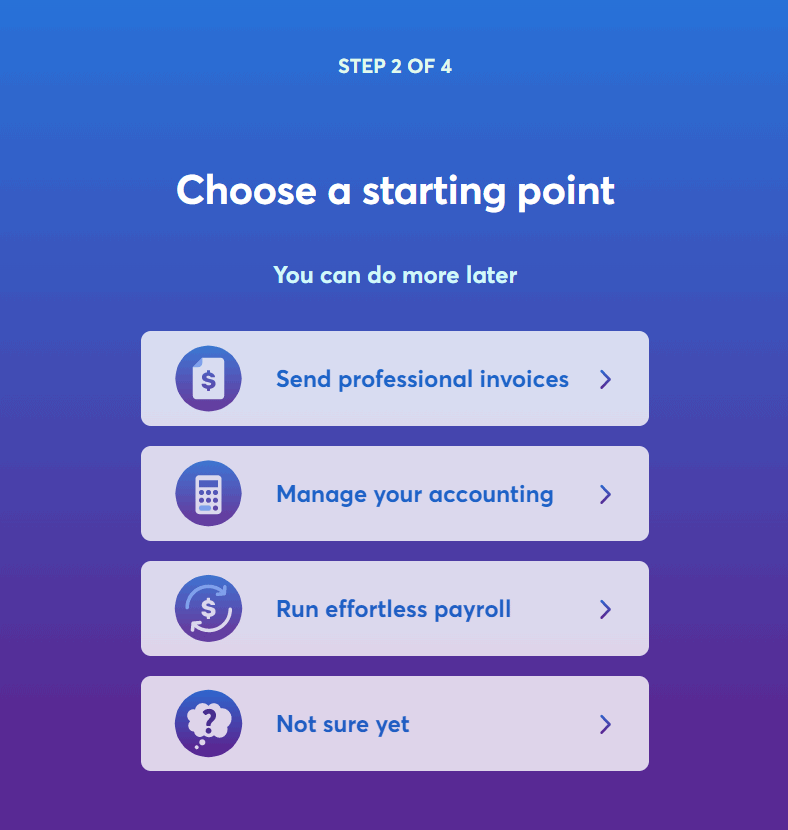

The next step asks you to choose a starting point based on Wave’s suite of offerings. For payroll services, you’ll click the Run effortless payroll button.

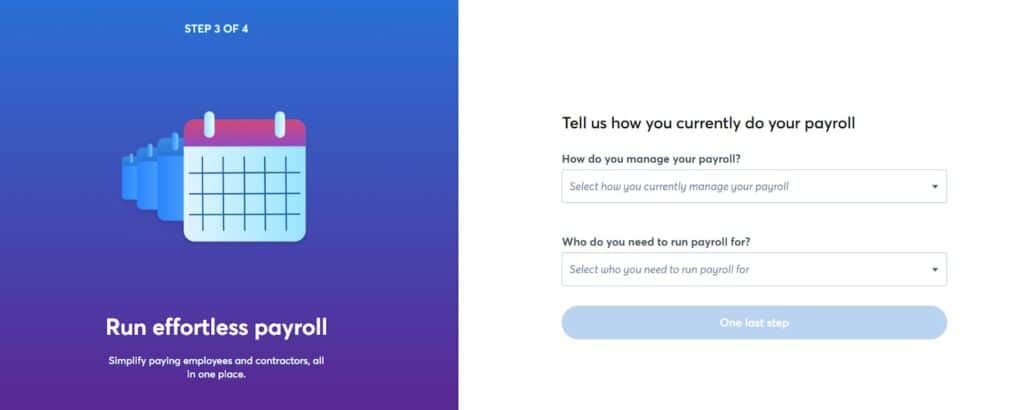

Next, you’ll be asked how you manage your payroll currently. Choices in the dropdown menu are: I use other payroll software, I’m not running payroll, or I do it all manually. The next question asks who you need to run payroll for. Choices in the dropdown menu are: just for myself, employees only, contractors only, or both employees and contractors.

Choose the right descriptors and then click the “One last step” button.

The last step in the process consists of several payroll bookkeeping questions. Complete each question, then click Continue to Payroll to complete the signup process.

Once sign-up is complete, you will be taken to the Wave Payroll dashboard.

Although Wave Payroll is 100% web-based, there is no mobile app for this feature. Employers and employees who wish to access Wave Payroll on their mobile devices can use their smartphone’s web browser.

Canceling a Wave Payroll subscription is easy, directly through your account. And when you cancel, you’ll have access to payroll until the end of that month.

From the Wave website:

When your final month ends, you will not be able to approve payrolls or access data stored within the “Payroll” tab. You will no longer be billed the subscription fee. If you reactivate your account, you will be charged the subscription fee for the month in which you reactivate, including the active employee fee.

If you are enrolled in Wave’s automated tax payment and filing service and would like to cancel your payroll subscription, click on the help icon at the bottom right of the screen in your Wave account, and type Cancel payroll and tax service. Our chatbot, Mave, will help you submit a request with the required information to our Payroll Team.

Wave’s website is extremely user-friendly and the sign-up process took just a few minutes to complete. The transparency through each step of the process inspires confidence and there was no upselling along the way.

We tested all three forms of Wave’s customer support, as detailed below.

Wave’s live chat support feature is available Monday-Friday from 9 a.m. to 5 p.m. Eastern Standard Time. Outside of those hours, you can ask a chatbot simple questions about the programs and features. We tried the chat support on a weekday afternoon and were connected with a live agent within about a minute.

We asked the representative to explain the cancellation policy and they pointed us to the relevant page on the website. The representative asked if we needed assistance signing up for services and made no sales pitches.

Support Rating:

Response time:

Very quick

We called the Wave customer support line and remained on hold for a few minutes before being connected to a representative, who was cordial and polite. We asked the representative to explain the difference between the two payroll plans, specifically the difference between tax service states and self service states.

The representative was able to explain the differences exactly how they were explained on the Wave website, as well as the prices for each. At the end of the conversation, we were asked if we had any questions. The call involved no extra sales pitches.

Support Rating:

Response time:

Very quick

Like the live chat feature, Wave’s email support is available during East Coast business hours. We sent an email requesting information about the cancellation policy and received a response within 12 hours.

The information matched what was provided to us from the representative, and we were directed to the relevant page on the Wave website. The message ended with an invitation to reach out if we had any further questions.

Support Rating:

Response time:

Reasonable

Overall, Wave Payroll’s services offer advantages and drawbacks, as detailed below.

Founded in 2009, Wave Financial Inc. provides financial services and software solutions for small businesses. Wave is headquartered in Toronto, Canada, and owned by H&R Block. The current CEO of Wave Financial is Zahir Khoja.

Wave’s first product was a free online accounting software tool for small businesses, followed by invoicing, personal finance and receipt-scanning software. In 2012, Wave moved into financial services, creating Wave Credit Cards and then Wave Payroll. Wave also offered lending services at one point, but discontinued it in 2017.

ADP offers four different payroll service plans based on different business needs. But their prices are tailored to each potential client, so it’s difficult to compare costs. ADP is also an established player in payroll, which offers more HR support than Wave. ADP has an A+ rating with the BBB, although its customer review score is low.

Gusto has three plans priced at a monthly rate plus per-employee fees. Its plans offer more variety than Wave, and Gusto is specifically known for payroll solutions, whereas Wave is more focused on financial solutions. Gusto, however, has an F rating with the BBB.

Like Wave Payroll, OnPay offers one basic payroll service plan. OnPay also has more HR support and software integrations than Wave. OnPay has solid ratings with Trustpilot and the Better Business Bureau, but has mixed customer reviews.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of the Wave Payroll services.

Overall, we were impressed with Wave’s online experience, as signing up was extremely easy and straightforward. The ability to sign up fast and use some of the services for free was an added perk, and the tax filing features are a plus for business owners who wish to outsource that portion of their payroll.

Still, the reviews highlighting poor customer service and payroll tax mistakes are troubling. Although Wave Payroll is one of the more affordable solutions, it seems to come at the expense of customer support.

If you’re an experienced small business owner with just a handful of employees and a limited budget, Wave might be a great fit. On the other hand, if you’re a new business owner or have many employees, it’s probably a good idea to explore other options.

Wave handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. Wave takes care of all the red tape so you can focus on building a successful business.

Wave Payroll includes features that allow you to run payroll and pay your employees, make payments, record accounting entries, and file tax documents for your independent contractors. Employees get online access to pay stubs and tax forms, and can update their banking and contact details, and employers get regular updates to features to incorporate government relief programs and changes. You can also generate W2 and 1099 forms.

Wave does not offer any human resources or benefits features in their Payroll plan, however they do have a payroll education center on their website where anyone can download the latest payroll and tax forms for your employees free of charge. There is also a robust set of guidelines around how to create an employee handbook with a ton of free resources.

In addition to Wave Payroll, Wave offers business payment, invoicing, and accounting solutions for small businesses. If you’re interested in additional support for you or your staff, Wave also offers payroll and accounting coaching services for a one-time fee of $329.