Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 12, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

One of the top options is Gusto. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you choose the payroll service that will put your business on the road to success.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Overall, Gusto’s services offer advantages and drawbacks, as detailed below.

Gusto handles the entire payroll process for you, making it nearly seamless and automated, while offering additional services that can make life easier for a business owner. Gusto takes care of all the red tape so you can focus on building a successful business.

Gusto offers different service levels. We explored all of the options and have broken down the services and pricing here.

| Simple | Plus | Premium | |

|---|---|---|---|

| Price | $40/month plus $6/month per person | $80/month plus $12/month per person | Exclusive |

| Full-service payroll including W-2s and 1099s | Single-state | Multi-state | Multi-state |

| Employee profiles and self-service | X | X | X |

| Hiring and onboarding tools | Basic | Advanced | Advanced |

| Brokered health insurance administration | X | X | X |

| Employee financial benefits | X | X | X |

| Payroll and time-off reports | X | X | X |

| Custom admin permissions | X | X | X |

| Integrations for accounting, time tracking, expense management | X | X | X |

| Customer support | Basic | Full | Dedicated |

| Next-day direct deposit | X | X | |

| PTO management and policies | X | X | |

| Time tracking and project management | X | X | |

| Workforce costing and custom reports | X | X | |

| Team management tools | X | X | |

| HR resource center | X | ||

| Compliance alerts | X | ||

| Access to certified HR experts | X | ||

| Full-service payroll migration and account setup | X | ||

| Health insurance broker integration | X | ||

| R & D tax credit discount | X | ||

| Performance reviews | X | ||

| Employee surveys and insights | X |

The $40/month plus $6 per month per person Simple plan includes full-service single-state payroll and some benefits administration and other extras, making it a good value.

The Simple service level offers full-service single-state payroll including W-2s and 1099s, basic hiring and onboarding tools, Gusto-brokered health insurance administration, and an employee financial benefits service.

It also offers payroll and time-off reports and custom admin permissions that allow you to set access to various functions for different people. Integrations for accounting functions are also included, along with basic customer support.

The Simple plan provides a lot of bang for your buck, with many services offered for only $40 per month, plus the employee fee.

The $80/month plus $12 per person per month Plus plan has the additional benefits of multi-state payroll services, next-day direct deposit, and advanced hiring and onboarding tools.

The Plus plan has the additional benefits of multi-state payroll services, next-day direct deposit, and advanced hiring and onboarding tools. It also offers PTO management, time and project tracking, and workforce costs and custom reports. You also get team management tools and access to full customer support.

The plan offers many advantages and tools, but you’re paying double the price, so it seems as though the Simple plan is a better value. However, if you have employees in multiple states, the Plus plan is a must.

The exclusively priced Premium plan offers access to extensive human resources services.

The Premium plan offers a robust suite of services, along with everything mentioned above. It’s hard to judge the value, since it’s uniquely priced for each customer, but it’s a strong full-service plan that includes:

Several services can be purchased as add-ons to the plans or as a la carte services.

| Service | Price |

|---|---|

| International contractor payments | Varies based on exchange rates |

| State tax registration | Varies by state |

| R & D tax services | 20% of tax credits used plus fees |

| Health insurance | Premiums only |

| Health insurance broker integration | $6/month per eligible employee |

| Worker's compensation | Premiums only |

| Life and disability insurance | Premiums only |

| 401K retirement savings | Varies |

| 529 college savings | $6/month per participant |

| The following four services have one $200 annual fee for all | |

| Health savings account | $2.50/month per participant |

| Flexible spending accounts | $4/month per participant |

| Dependent care FSAs | $4/month per participant |

| Commuter benefits | $4/month per participant |

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

You also have the option of paying your employees by direct deposit or paper check, and they provide payroll reports.

The payroll process is complex, so using Gusto can save you considerable time and ensure your continued compliance with all payroll laws and regulations.

Gusto provides hiring documents for new employees that can be electronically signed and stored. They also provide offer letter templates and an onboarding checklist. Hiring employees involves a lot of paperwork and a service like Gusto can make it much easier.

The advanced hiring tools offered in the Plus and Premium plans include job posts and an applicant tracking system, which can simplify and streamline the hiring process. It also includes customized templates and hiring documents.

This service, included as a basic version in the Simple plan, and as an advanced version in the Plus and Premium plans, is a great value.

All the Gusto plans include brokered health insurance administration, which includes medical, dental, and vision insurance. You’ll receive support from licensed benefits advisors, and employees can enroll online.

Employees also have self-service of their health insurance accounts. Most importantly, Gusto handles compliance matters related to health insurance, which can give you peace of mind. Gusto can also administer financial benefits, including 401Ks, health savings accounts, and 829 college savings plans.

Included in all three plans, this service is a valuable feature that will likely save your business a great deal of time.

We tested the Gusto customer service experience from every angle. Here’s what we found.

The site is laid out well and easy to understand. You can easily find the plans, detailing features and pricing, and get more information on each service.

The site also has a robust help center where you can get information on numerous topics.

When you view all the packages, you have the option to select one to setup an account. Once you make your selection, you’re asked a series of questions about your company including number of employees, industry, and business entity type.

Then you’re asked to set up your account and asked a series of questions:

Next you’re offered a few extra add-ons before you’re taken to a screen to select your plan.

You don’t have to pay for the service until your actual first payroll run. The whole process was quite simple and streamlined.

Gusto has a mobile app for employees of companies that use Gusto for their payroll. You can track your hours, manage your direct deposit information, and access up to $500 of your paycheck before payday through a payday-type loan, though no fees or interest are charged.

This seems to be one of the more useful apps.

The Gusto website offers detailed information about their cancellation policy.

“Admins can cancel their Gusto plan at any time. Before you cancel, it’s important to read the reminders below—once you’re done, click the Cancel your Gusto account dropdown to get started.

If you get your Gusto invoice/bill from someone other than Gusto, you’ll need to get in touch with them to cancel your account.

What to know before you cancel

Once your account is cancelled, you’ll still have unlimited access to your Gusto account to view company forms, reports, employee information, and past payrolls that were run through Gusto. Employees and contractors will also still be able to log into their own accounts to view their paystubs and forms.

Accounts canceled in the middle of a month will be charged for the full month. So long as you process all final payrolls before canceling, employees will still be paid even after you’ve completed the cancelation in your account.

Turn off Payroll on AutoPilot®

If one or more of your payrolls is on autopilot, you must first turn it off before you can cancel your account. To do so:

Taxes

We’ll ask you to let us know how you’d like us to handle future tax payments and tax filings. If you have questions about what selections are best for your company’s unique situation, we recommend working with an accountant or another third party (ex. new payroll provider).

Tax payment options

Tax filings options

Workers’ Comp

If you have an integrated Workers’ Comp policy, please contact our partner AP Intego at [email protected] and include your company name so the required cancelation form can be signed in a timely manner.”

The site is quite user-friendly overall, and information is easy to find. If you have all your information handy, you can probably complete the signup process in 25 minutes.

The site is not very “salesy” and simply seems to guide you toward the right plan for your company. It offers an excellent customer experience.

We tested all three forms of Gusto customer support. Here’s what we found.

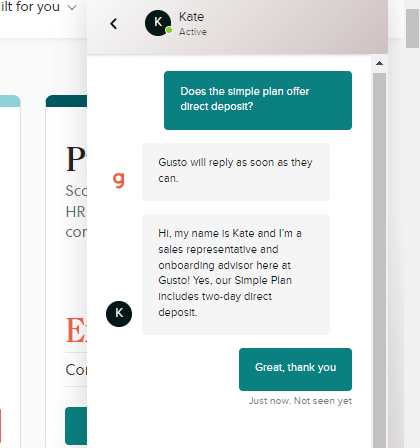

We used the chat feature to ask a question and received an immediate response.

The answer was quick and clear.

We called customer support to ask if there is a required minimum number of employees to sign up for the service. Our call was answered immediately, and the answer was no. The service representative was nice and asked if we needed further assistance.

We filled out an information request form on the site. The question we asked was, again, “Is there a minimum number of employees you need to have to sign up for the Simple plan?” We asked the question on a Friday and had not received a response by midday on Monday.

To understand how real Gusto customers feel about the service, we examined countless customer reviews at the Better Business Bureau and Trust Pilot.

Gusto has an F rating from the BBB with 1.07/5 stars from 70 customer reviews. They are not an accredited BBB business. They have received 141 complaints in three years, all of which have a closed status.

There is only one positive review on the BBB website, which is as follows:

“I have been using and recommending Gusto payroll services for 3+ years and the service has always been top notch. Yes, I have an accounting firm but all my clients have had similar experiences. **** ***** is my rep and she takes really good care of me anytime. She is prompt and responsive. The rep I had before her, was just as good. I have no complaints, and I would highly recommend this company for all your payroll needs. However, as a small business owner, it is not as easy as an ADP or Paychex, it does take a tiny bit of computer literacy but it is a lot cheaper.”

Negative reviews mainly concern processing errors, particularly in terms of tax payments and health insurance. People also complained of a lack of responsiveness.

Here’s one example:

“THIS IS THE WORST COMPANY EVER, THEY SHOULD BE HELD FOR CRIMINAL PENALITIES FOR THEIR LACK OF RESPONSE. They have NOT sent in my 941 and nothing but LATE FEES LATE FEES LATE FEES. I have emailed back and fourth and YET no response from either tax team. When you try to contact them, they keep saying the Tax team is handling this and will NOT let you contact anyone. STAY AWAY. They should be held accountable for their false advertisement . DO NOT purchase their product and what is so funny, everyone that has commented on them has the same exact issue about Tax filing. I wish I would of read this before I signed up with them.”

You can read reviews on the BBB website.

The Trustpilot score for Gusto is 3.5/5 stars from 1,565 reviews.

Gusto reviews at Trustpilot break down as follows:

Many positive Trustpilot reviews revolve around great customer service and ease of use. One person said they “truly care for their customers”. Other people said they liked only having to spend five minutes a week on payroll.

Some of the less favorable reviews revolve, again, around tax payment issues and poor responsiveness. One person said their quarterly taxes were not filed and they had to pay a penalty.

One review summed up what others were saying:

“Looks easy, intuitive. Paperless, modern. BUT BEWARE: Messed up filings, no responsibility taken, awful AWFUL customer support. It’s been a solid year trying to resolve issues. Meanwhile, they created new ones. Note to small business – stay away!”

You can read reviews on the TrustPilot website.

Gusto was founded in 2012 in California, and, according to the BBB, has 305 employees and is managed by Mr. Joshua Reeves, CEO & Co-Founder.

Gusto is a private company and raised significant venture capital to get started. They have grown significantly since they launched and have added many new products.

Justworks is a bit more expensive than Gusto, but allows vendor payments as well as payroll. Justworks also has 24/7 customer service while Gusto customer service has limited hours.

Paychex is slightly less expensive than Gusto, but with extended customer service hours. Paychex has a more robust employee benefits service, but the Gusto simple plan offers more than the Paychex base plan.

ADP services are priced by quote only. Again, they offer more extended customer service hours than Gusto. They also offer more health insurance options than Gusto.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of Gusto payroll services.

Our experience using the Gusto website was good, as it’s very user-friendly. Their pricing is very competitive and even their Simple plan offers an extensive package of services. In that respect, they are superior to most competitors.

But the customer reviews, particularly at the BBB, are deeply concerning. Many negative reviews involved inaccurate tax filings, which can lead to major issues for business owners.

If you’re looking for an affordable payroll option, Gusto is a great value, assuming the negative reviews refer to unusual circumstances. Based on our experience, we cautiously recommend Gusto.

Gusto handles the payroll process for you, making it nearly seamless and automated, while offering additional services that can make life easier for a business owner. Gusto takes care of all the red tape so you can focus on building a successful business.

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

Gusto provides hiring documents for all employees that can be electronically signed and stored. They also provide offer letter templates and an onboarding checklist.

The advanced hiring tools offered in the Plus and Premium plans include job posts and an applicant tracking system, which can simplify and streamline the hiring process. It also includes customized templates and hiring documents.

All Gusto plans include brokered health insurance administration, which includes medical, dental, and vision insurance. You’ll receive support from licensed benefits advisors and employees can enroll online. Gusto can also administer employee financial benefits, including 401Ks, health savings accounts, and 829 college savings plans.