Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Coralee Bechteler

Coralee is a business writer with experience in administrative services, education, and software testing.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers can handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is Paycom. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the right payroll service for your business.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Paycom is an industry-leading HR software service provider that supports nearly 34,000 companies daily, according to their website.

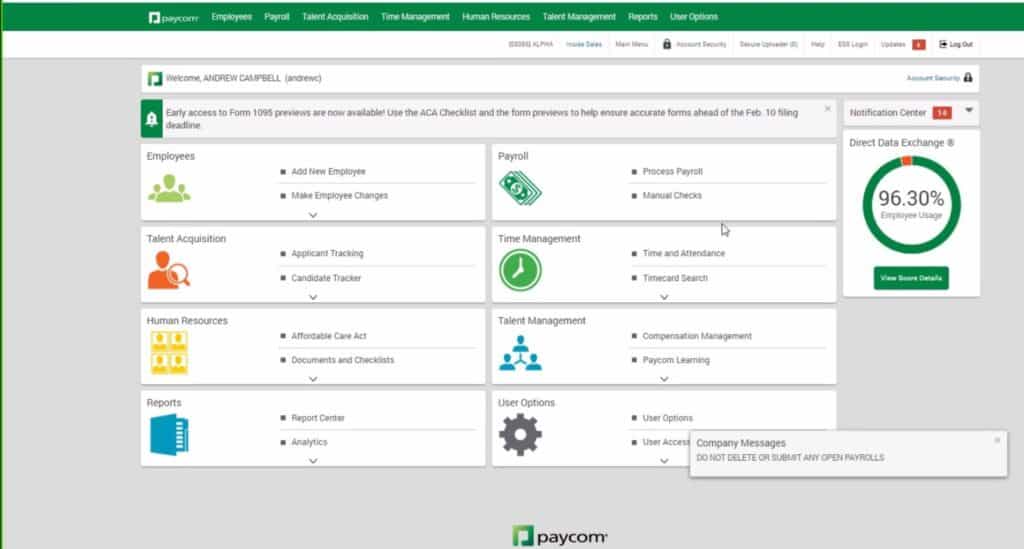

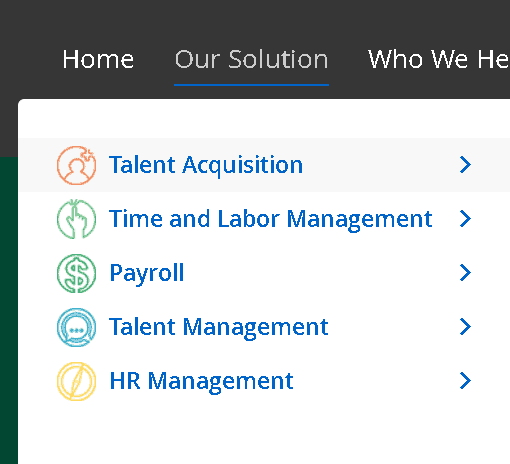

Paycom offers businesses a large spread of HR and payroll services that aim to satisfy a wide variety of business types and needs. Within one software application, businesses will find tools to assist with talent acquisition, time and labor management, talent management, HR management, and, of course, payroll duties.

Unlike other payroll service providers, Paycom doesn’t offer different service packages of HR solutions. Instead, Paycom offers one software solution that includes all of its HR and payroll tools.

Paycom breaks its HR software application down into five categories, with additional features and tools layered within. As detailed below, we explored Paycom’s software services and what’s included in these categories.

In the subsequent section, we’ll take a closer look at Paycom’s payroll software features.

| Software service category | Included features and tools |

|---|---|

| Talent Acquisition | Applicant tracking Automated recruiting and hiring Option to enable self-onboarding Onboarding alerts and reminders Obtain federal tax credit reductions Enhanced background checks E-Verify employee eligibility to work Staff management |

| Time and Labor Management | Time tracking and management Attendance tracking and management Shift scheduling Time tracking tool options Web-based time clock Physical terminal clock Hardware terminal clock Kiosks Mobile app Terminal options Standard: badge-swipe Biometric: fingerprint Proximity: distance-limited censored badge reading Track employee labor allocation Matches state labor and tax laws to individual employees Customizable reports |

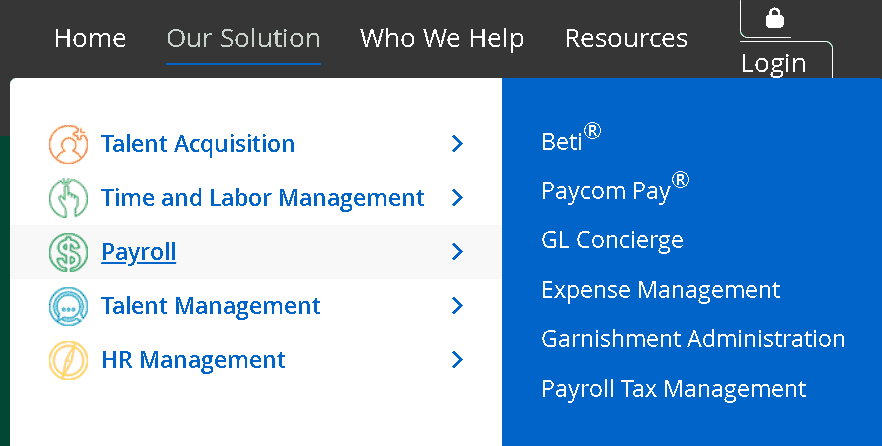

| Payroll | Beti: employee self-service payroll Paycom Pay: issue paper paychecks from Paycom’s bank account GL Concierge: generates general ledger reports Expense Management: employee expense tracking and reimbursement Garnishment Administration: automated employee wage calculations, payments, and recordkeeping Payroll Tax Management: automated payroll tax deductions and filings |

| Talent Management | Performance management Compensation budgeting Position management Company structure management Employee Self-Service Paycom Learning |

| HR Management | Compliance work Government and Compliance Personnel Action Forms Documents and Checklists Enhanced ACACOBRA Administration Employee engagement Paycom Surveys Process modification and enhancement Manager on-the-Go Benefits Administration Customizable reporting Direct Data Exchange Report Center Clue: track and monitor employee vaccinations and test results |

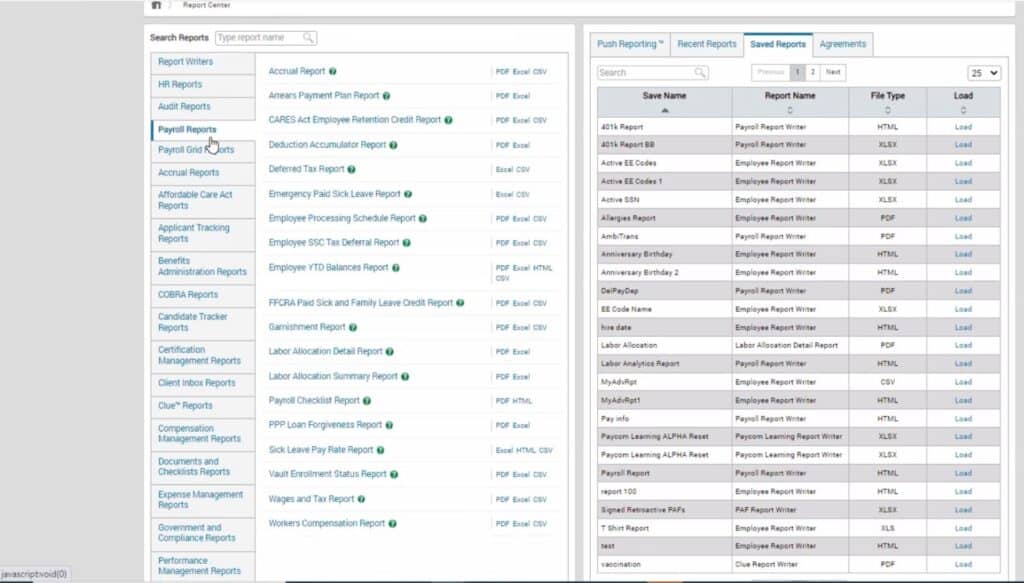

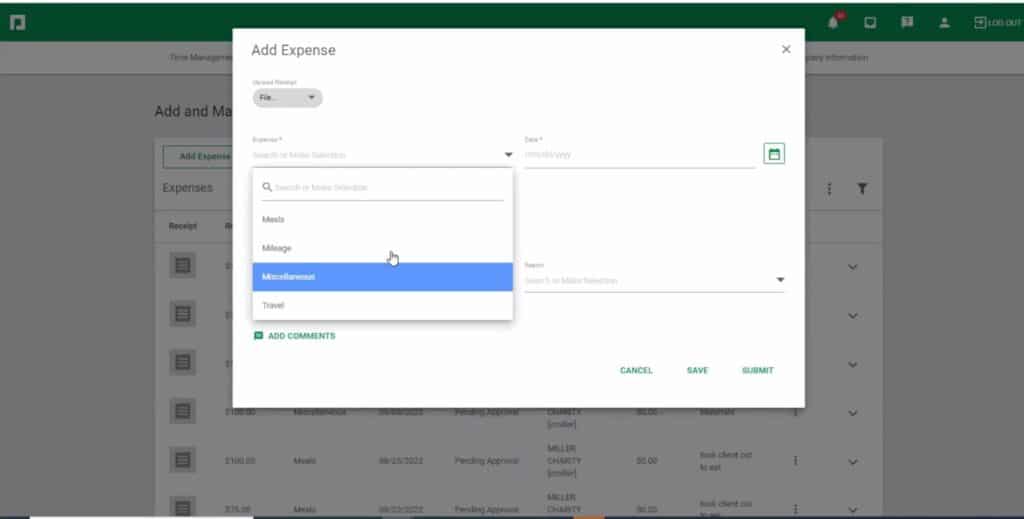

Paycom’s payroll service offers a suite of six tools that can take many tasks off your plate and allow you to focus on more pressing business matters. Paycom’s payroll tools include Beti, Paycom Pay, GL Concierge, Expense Management, Garnishment Administration, and Payroll Tax Management.

Beti, for instance, aims to help employees process payroll on their own, guiding them through an automated process that notes errors and provides troubleshooting assistance when needed. Employees are responsible for confirming the accuracy of their payouts, reducing the work of HR teams.

Paycom’s Payroll Tax Management tool provides automated payroll tax deductions and filings, handling federal, state, and local tax filings, including employee W-4 and I-9 forms, as well as W-2s and 1099s.

Paycom’s Talent Acquisition aspect of their HR software application provides businesses with advantageous features to assist with the hiring process, such as applicant tracking. Paycom’s e-verification tool is an extension of the US Department of Homeland Security’s Form I-9, and assists hiring managers in verifying candidates’ identities and job eligibility. Paycom’s software also offers background checks.

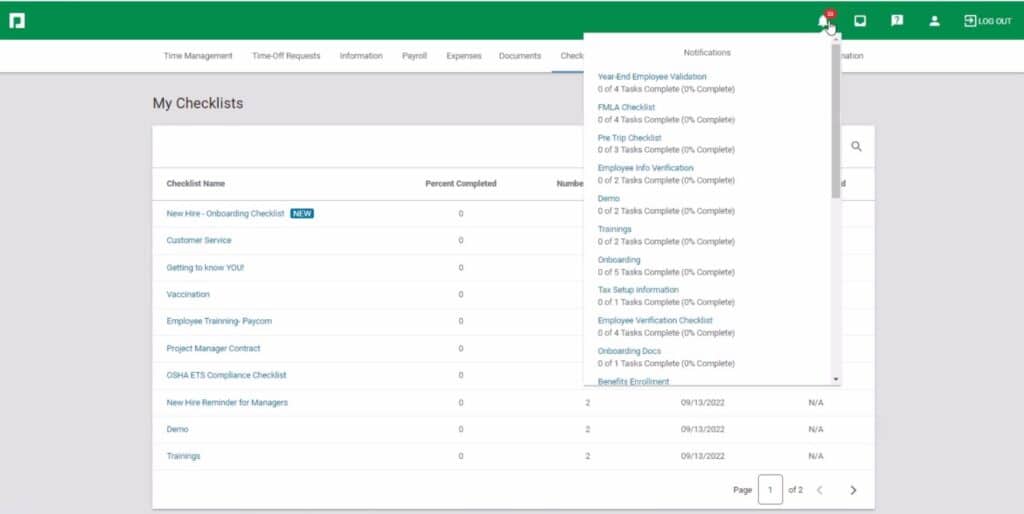

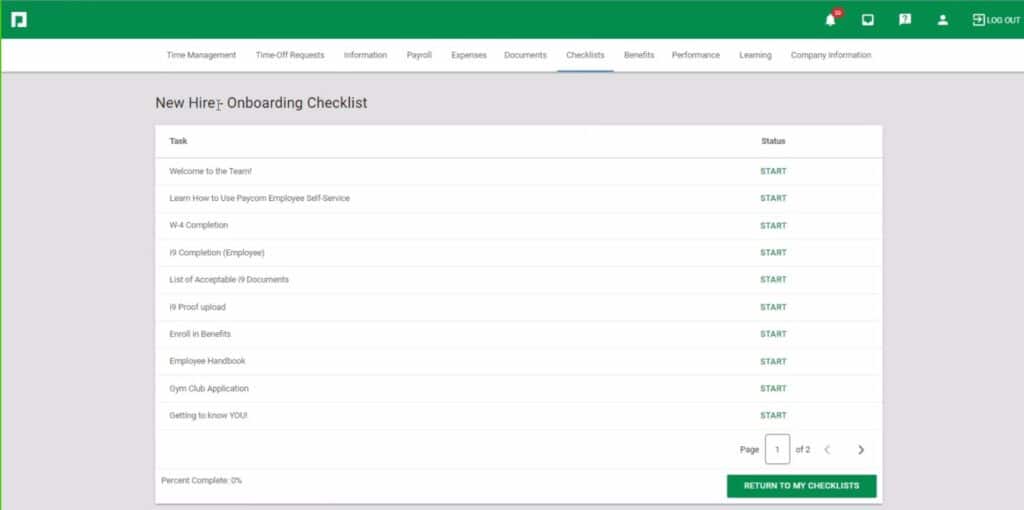

Paycom gives businesses the option to enable self-onboarding capabilities for new hires, integrating the new employee’s data and information across the entire software system. Paycom’s onboarding features also include checklists and reminders to ensure legal compliance.

Hiring employees comes with a lot of paperwork, and having a valuable service like Paycom can make it much easier for you.

Paycom’s Benefits Administration tool provides an automated and compliant benefit plan enrollment process. Employees have the ability to evaluate, choose, and access their own benefit plans, as well as review past benefits. Additionally, employees can view their wage deductions and how it impacts their take-home pay.

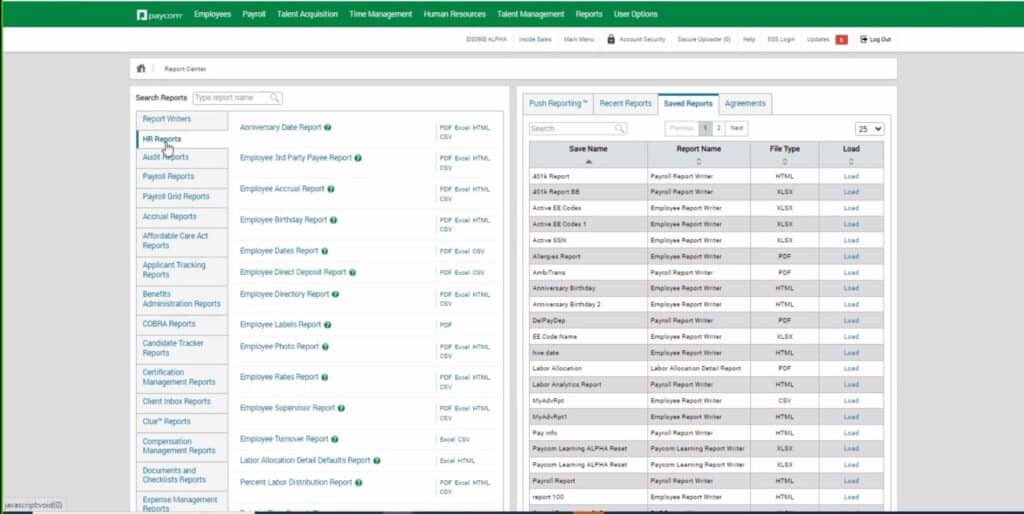

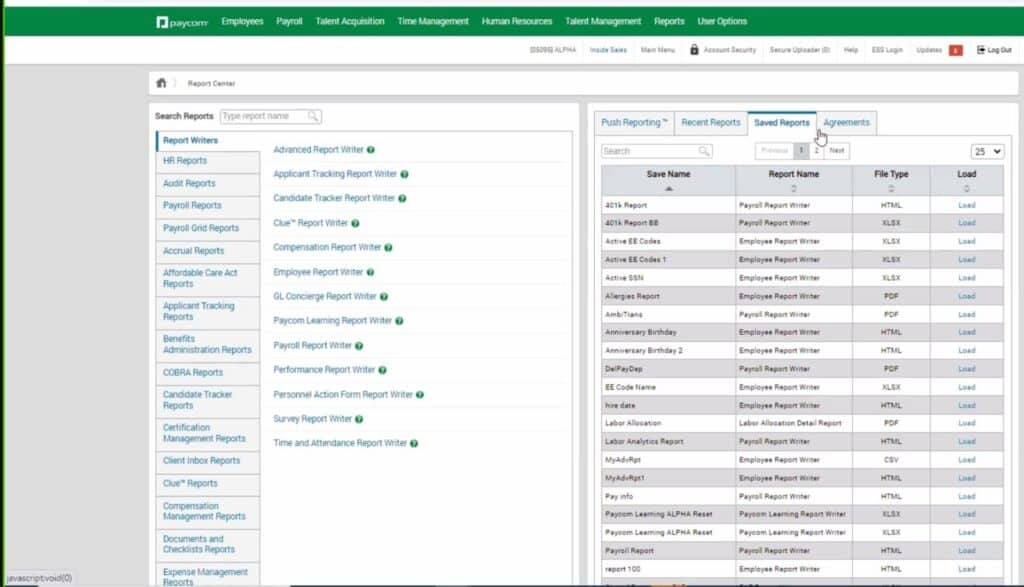

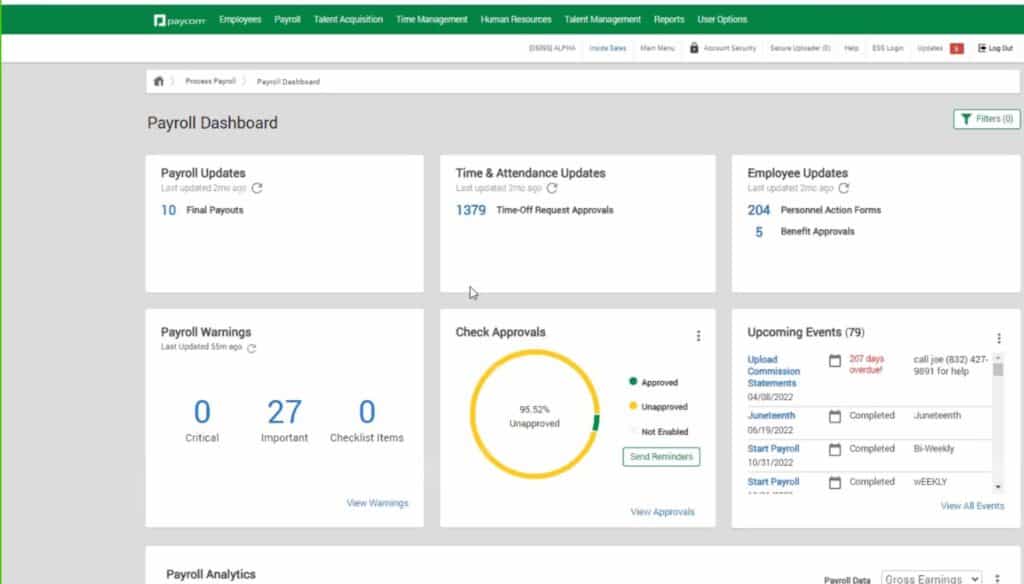

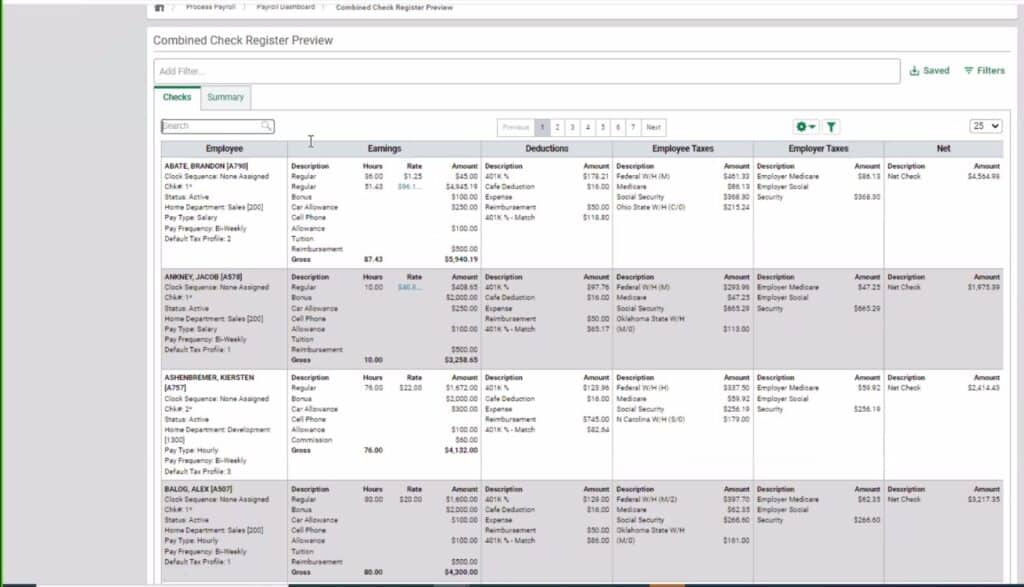

Paycom’s reporting is incredibly comprehensive, almost bordering on too much information, which is rare. The developers approached it from an engineering perspective, and it shows. Every reporting possibility I could imagine was either already provided or had a relevant field in the custom report writer.

The user interface offers a depth of detail that is by far the most extensive I’ve seen. I have worked with many payroll providers over the years, yet still felt overwhelmed by Paycom’s options.

Learning to navigate the ins and outs of this payroll system, as well as dedicated portals for employees and HR, would definitely take a good deal of time and effort. That’s not to say it’s confusing; everything made sense as I explored. It’s just that there is a lot to sort through.

The payroll submission process follows the theme, offering every conceivable detail as a preview. Like everything else, the dashboard also has a dedicated set of cards and links.

All fields can be changed from the preview screen and can provide a notification to the employee or HR portal as needed.

The best way to sum up Paycom’s accounting features is that I wish my company was large enough to make use of all of it. Although you can use individual tools a la carte, going all-in on the full package is the most cost-efficient option.

This provider is well suited to businesses with multiple departments and over 100 employees.

**Alternatives: Paylocity, Rippling**

Website Interface and NavigationPaycom’s site is user-friendly and contains a bounty of information. Users can explore Paycom’s all-in-one software solution and have access to more in-depth information about the different services.

Paycom makes it easy for potential customers to investigate their five main categories.

Users can also analyze the tools available within each of Paycom’s software service categories.

Overall, we were impressed by the website’s design and organization. It’s laid out well and easy to understand. The site also includes a robust collection of resources and information.

Our only complaint is that Paycom does not make prices readily available on the website. However, this is common with payroll service providers as the total cost often varies from one company to another.

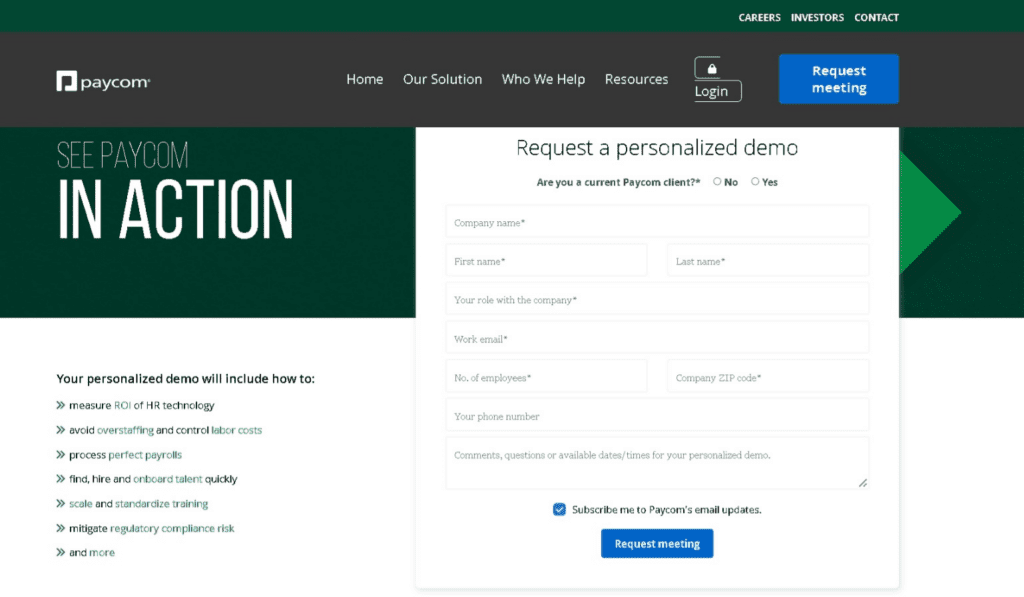

In order to get a price quote from Paycom, you must first request a meeting. This can be done on Paycom’s homepage, as detailed in the screenshot below.

When you click the button to request a meeting, you’ll be taken to a page asking you to fill out a form with details about you and your business. You will need to have the following information ready:

After you submit your request, you should receive an email outlining the next steps.

Paycom has a mobile app for employees of companies that use Paycom for their payroll. Employees have the ability to clock in and out of shifts, allocate their labor, review their accrued paid time off (PTO), and request time off, as well.

The mobile application also supports modifying personnel information, submitting time sheets, previewing take-home pay, reviewing past paychecks, and more.

To cancel Paycom’s service, contact your business’s Paycom specialist or customer support and request to cancel.

The site is quite user-friendly overall, and information is easy to find. If you have all your information handy, you can request a meeting with Paycom in less than five minutes.

Even though there aren’t any prices listed on the site and the meeting request button can be found on every page at least once, Paycom’s call to action is not intrusive. Rather, the website is more focused on providing users with information about their services and how Paycom can help them.

Paycom offers a strong user experience, though customer support is limited.

Paycom’s website does not offer chat support, and after a diligent search, we were unable to find any email addresses, either. We did, however, find multiple telephone numbers for Paycom, including a general inquiries number and numbers for Paycom offices in 28 states.

We tested Paycom’s phone support feature, as detailed below.

We called Paycom’s customer support and asked the service representative if employees are able to change their personal information on their own. The representative was very kind and assured us that Paycom’s software enables employees to update their information as needed.

Support Rating:

Response time:

Immediate

Overall, Paycom’s services offer advantages and drawbacks, as detailed below.

Paycom was founded in 1998 by Chad Richison in Oklahoma and now has offices in 28 states. It’s recognized as one of the first payroll services to be completely online, and, according to LinkedIn, the company employs more than 5,000 people.

Since its April 2014 initial public offering, Paycom has been a publicly traded company.

Patriot Payroll offers a free trial of their HR services and better customer support. Patriot Payroll, however, provides fewer services than Paycom.

ADP Run is typically better for smaller and growing businesses, while Paycom is great for larger businesses. However, Paycom’s software includes time and attendance services, while this service must be added on for an additional fee for ADP Run customers. Conversely, ADP Run offers more integration capabilities.

Paycor offers a similarly robust suite of HR services and tools. But Paycor has been an established company for a longer time, and provides more extensive customer support.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of Paycom payroll services.

Overall, we were pleased with our Paycom experience. The site is easy to use, information is readily available, and it doesn’t take long to request a meeting with a representative.

Their customer service is rather weak, as they have no live chat support and no email addresses listed on their website. When we called to speak with a customer service phone representative, however, our call was answered quickly and politely.

Paycom’s all-inclusive HR software services are more expensive than most competitors, but all of the included tools and features offer businesses an outstanding value– especially large businesses. Based on our thorough research, we feel confident recommending Paycom to business owners.

A payroll service handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner.

Paycom’s all-inclusive HR software application provides businesses with talent acquisition services, time and labor management services, payroll services, talent management services, and HR management services.

Paycom’s Payroll Service solution includes six different tools: Beti, Paycom Pay, GL Concierge, Expense Management, Garnishment Administration, and Payroll Tax Management.

Paycom handles all payroll deductions and filings to ensure businesses are legally compliant.

Paycom assists businesses with the hiring process by providing tools for applicant tracking, e-verification, background checks, and the verification of candidate eligibility. Companies can also enable self-onboarding capabilities for new hires, along with checklists and reminders for new employees.

Paycom’s Talent Acquisition solution provides businesses with several different valuable tools, including applicant tracking, automated recruiting and hiring, self-onboarding, and onboarding alerts and reminders. Additionally, Paycom provides assistance seeking out tax credit reductions, performs enhanced background checks, offers e-verification of employee eligibility, and supports staff management.

Paycom can issue payroll to employees that file as contractors using Form 1099.

Paycom’s HR software solution is customizable and can be tailored to fit most business needs.

Paycom supports both digital and paper W-2 forms.