Pricing

Breadth of Services

Customer Satisfaction

Help and Support

Ease of Use

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Unlike payroll software, payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is Paycor. But is it the best service? And is it the right choice for you?

This Paycor review takes a closer look – putting ourselves in the shoes of an entrepreneur – to help you choose the service that will keep your small business on the road to success.

Pricing

Breadth of Services

Customer Satisfaction

Help and Support

Ease of Use

Paycor offers full service payroll, including your tax filings, as well as a variety of additional tools and benefits. Paycor is one of the more expensive providers, yet it also provides robust HR support and services, distinguishing itself from its competitors.

Paycor offers four different service plans. We explored all of the options, as detailed below.

| Basic | Essential | Core | Complete | |

|---|---|---|---|---|

| Price | $99 per month plus $5 per month per employee | $149 per month plus $5 per month per employee | $199 per month plus $8 per month per employee | $199 per month plus $14 per month per employee |

| Payroll and tax service | X | X | X | X |

| Garnishments | Basic | Pro | Pro | Pro |

| Payment options | X | X | X | X |

| Check stuffing | X | X | X | X |

| Online check stub | X | X | X | X |

| Online reporting | X | X | X | X |

| Additional tax local authorities | X | X | X | X |

| Additional tax state authorities | X | X | X | X |

| New hire filing EVS | X | X | X | X |

| Work number (optional) | X | X | X | X |

| On demand pay (optional) | X | X | X | X |

| Reporting options | X | X | X | |

| Report builder | X | X | X | |

| General ledger report | X | X | X | |

| Labor distribution | X | X | X | |

| HR support center | X | X | X | |

| Month end accounting pckg. | X | X | X | |

| Electronic custom data file | X | X | X | |

| Labor law poster | X | X | X | |

| Onboarding | X | X | X | |

| Time off manager | X | X | X | |

| Job costing | X | X | X | |

| 401K EDI and integration | X | X | X | |

| Expense management | X | X | ||

| HR support center on demand | X | X | ||

| Employee import | X | X | ||

| Paycor HR | X | X | ||

| Paycor career management | X | X | ||

| Paycor analytics pro | X | |||

| Paycor compensation management | X | |||

| Paycor talent management | X |

Note that all plans come with a three-month free trial.

The $99/month plus $5 per month per employee Basic Plan offers full payroll services and new hire verification and is a bit expensive compared to some competitors.

The Basic Plan includes full-service payroll, including W-2s and 1099s, and federal, state, and local tax filings. It also offers employee social security number verification and new hire reporting to the state.

Compared to the competition, this plan does not offer as much value. Other industry leaders offer similarly- or lower-priced plans that include health insurance administration, which requires additional payment in the case of this plan.

This plan offers little value considering the price.

The $149/month plus $7 per month per employee Essential Plan has the additional benefits of several onboarding and HR tools, making it a better value than the Basic Plan

The Essential Plan offers everything in the Basic Plan, with the addition of employee onboarding and HR support. It also offers a month-end accounting package, job costing, 401K processing and integration, and a few other services.

This plan offers much more than the Basic Plan, so it’s a better value. But it’s still more expensive than competing plans that offer healthcare administration for less.

The $199.month plus $8 per month per employee Core Plan has the additional benefits of expense management and HR by Paycor, which is a lot of support for the price.

The Core Plan offers everything in the Essential Plan plus Paycor expense management, Paycor HR, and Paycor Career Management, which is described by Paycor as follows:

“Paycor Career Management provides companies a way to create better career strategies, facilitate internal movement, and identify talent risks. Managers and employees can clearly define role responsibilities and set expectations together so that employees receive feedback that’s specific to them and their growth plan.”

This is a recently introduced service, and if it’s effective, a nice value-add.

Overall, with HR functions taken care of for you, this plan seems to be a good value, and offers more than competitors.

The $199 a month plus $14 per month per employee Complete Plan has the additional benefits of analytics, compensation planning, and talent management.

The Complete Plan offers everything in the Core Plan with the addition of Paycor Analytics, compensation planning and talent management.

The talent management feature monitors employee performance to collect data for reviews and automates the process of reviewing employees.

It’s an interesting service, and the entire plan seems to offer a robust suite of services that could provide a lot of HR support in addition to the payroll services.

The payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and your W-2s and 1099s.

Paycor also handles garnishment withholdings, saving additional time.

With their upper-tier plans, Paycor provides hiring documents for new employees that can be electronically signed and stored. Hiring employees comes with a lot of paperwork and having a service like Paycor can make it much easier for you.

Other Paycor HR services can take a huge burden off the business owner, and are much less expensive than hiring in-house HR staff.

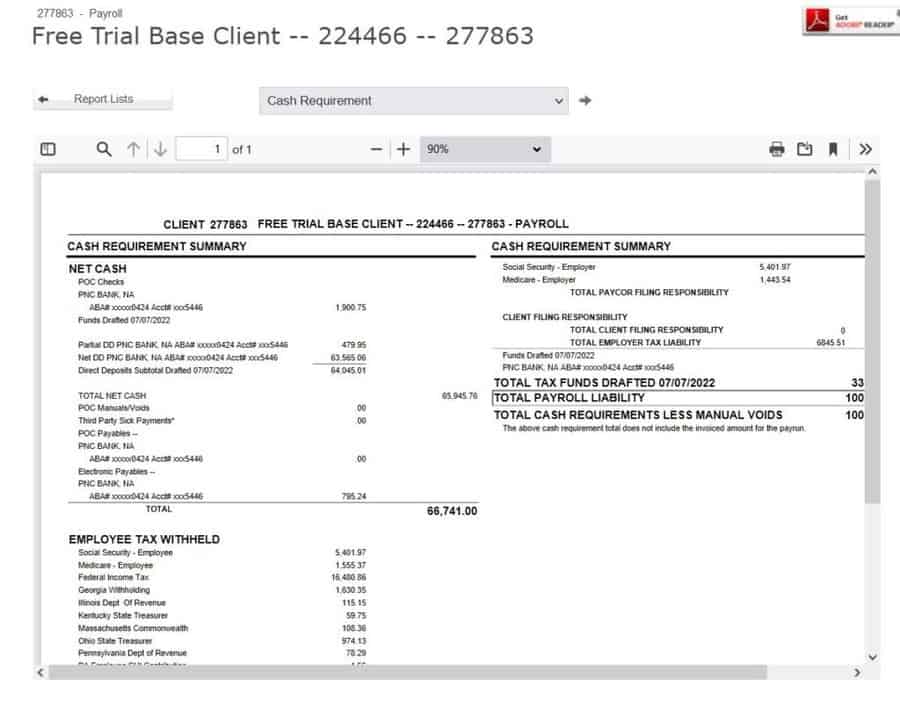

Paycor’s default reports are so comprehensive that there was no need to create custom reports for basic payroll. I was particularly impressed with the Cash Requirements report, which states estimated salary & tax costs based on current hours worked for the period.

The Payroll Journal is actually a register, rather than a journal entry in accounting terminology. Users are able to easily separate direct deposit and paper check and view only employee contributions.

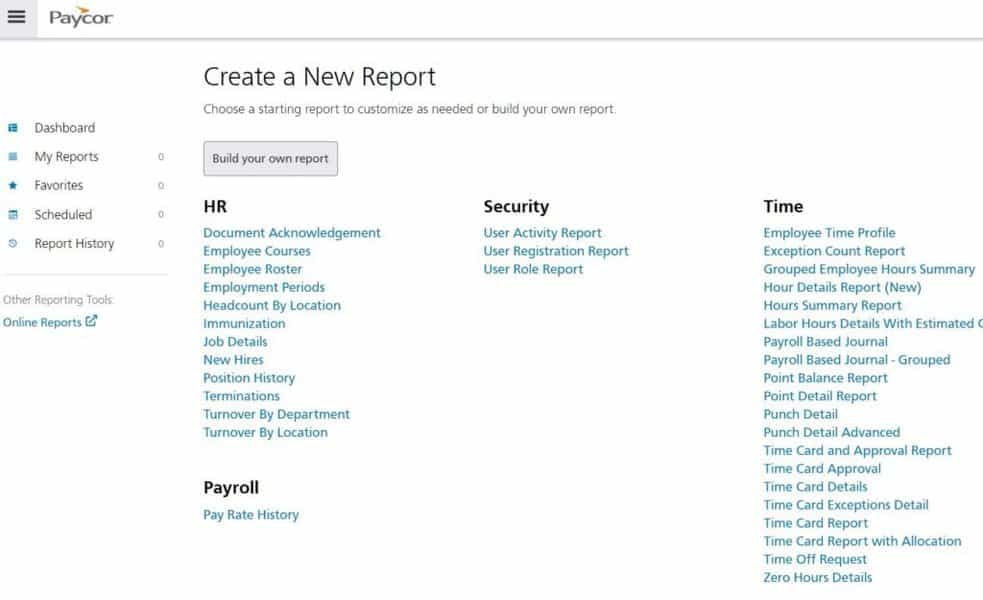

The Report Writer is an excellent power-user feature that can easily track and compare every possible statistic.

For growing businesses, Paycor is professional and reliable – and your accountant will thank you for investing in quality. That said, this provider has several power-user features that could overwhelm smaller businesses that may not need all that information.

Paycor does, however, offer a free two-week subscription, so you can take the service for a test drive and see how it works for you and your business.

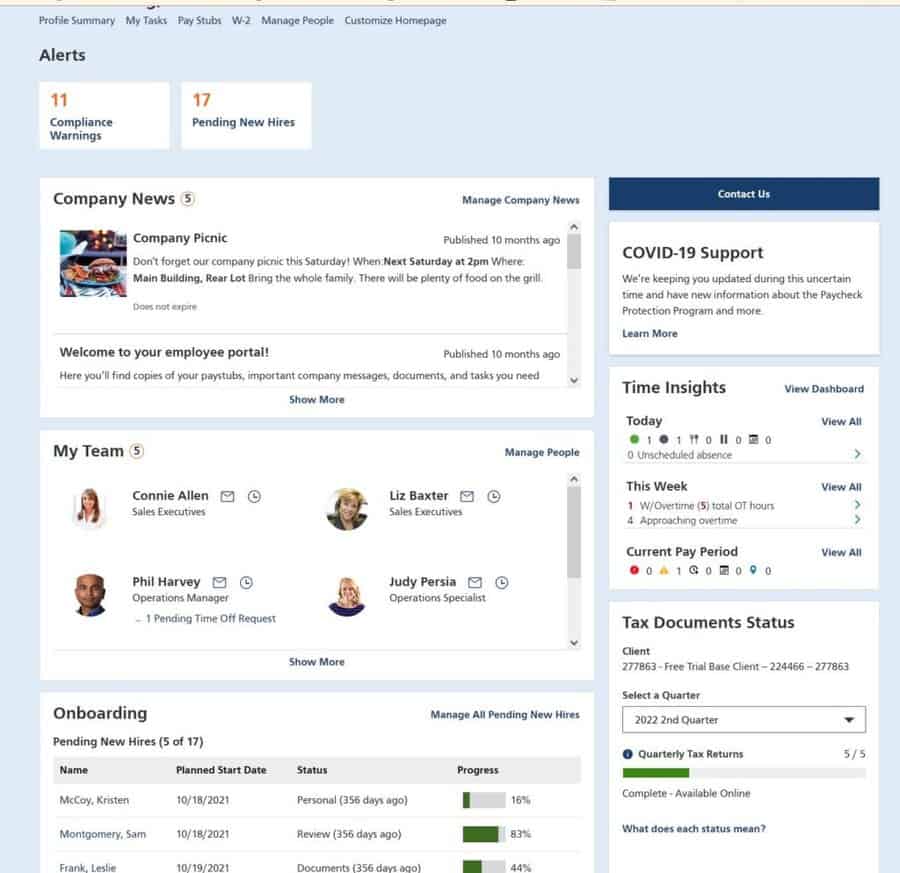

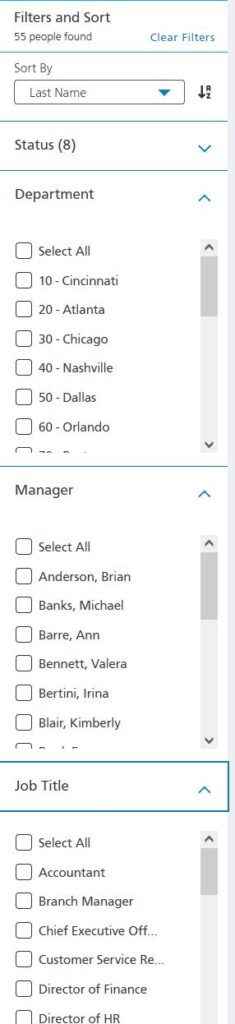

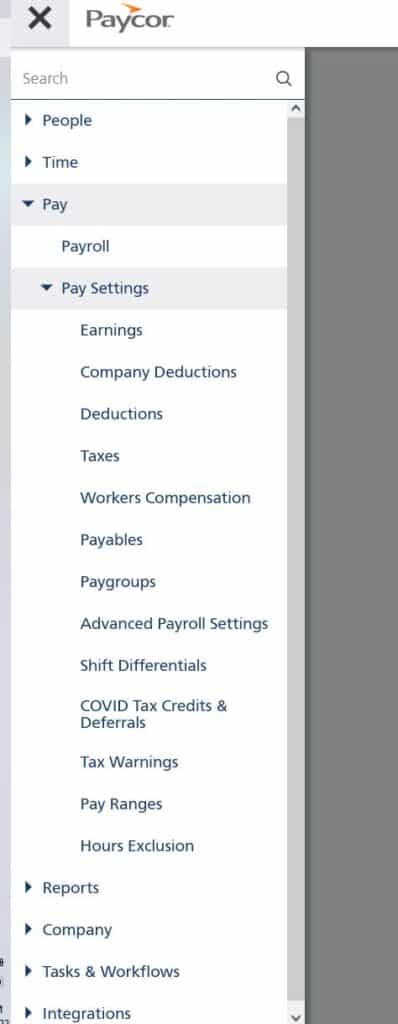

Everything a small business needs is readily available in logically categorised menus. Under “Company,” for instance, you’ll find “departments” and “user access.” Even the front page has customizable cards.

Your HR Manager would likely want to see “Onboarding” first, while the accounts team would prefer “Tax Notices & Time Reporting” at the top of the list, and you can set it up that way.

Arguably the most important part of a payroll provider is how well it handles the employer’s submission of payroll. Paycor’s interface is a clean grid format, with large buttons at the top for common adjustments like a paper check and memos.

The grid can also be customized, displaying everything your accountant wishes to see, from “department” to “overtime” and beyond.

Every report can be put in preview form and reviewed before submission. You can even summarize a given column, like the total cost for Department A.

The site is user-friendly. The plans are easy to find, with good detail on features and pricing. It’s laid out well and easy to understand.

The site also has a robust help center where you can get information on a variety of topics.

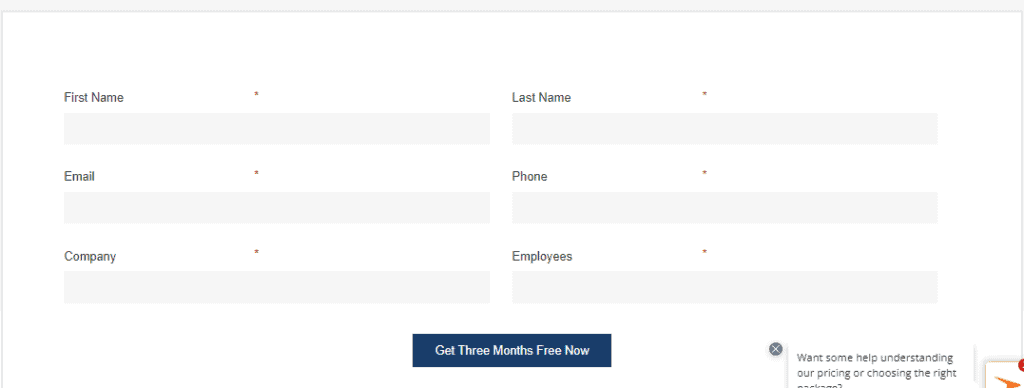

When you view all the packages, you have the option to select one to set up an account and unlock your three-month free trial.

Then you’ll be asked to enter your name, email, phone number, company name, and number of employees.

Once that’s done, you’re told that someone will reach out to you to continue the setup. Most other services allow you to immediately complete the setup yourself online.

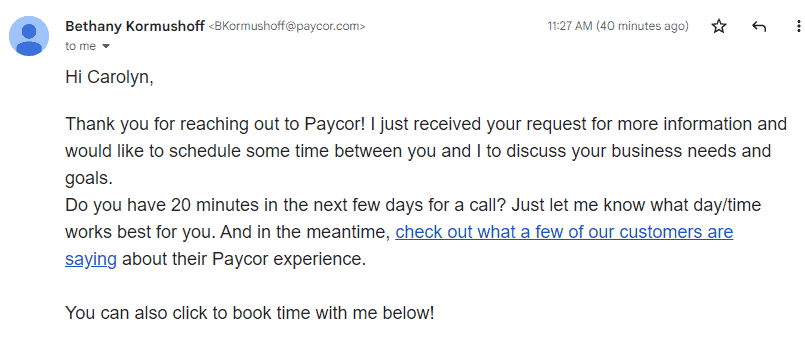

We received a phone call within a few minutes, and then an email about scheduling a call.

Paycor has a mobile app for employers and employees. Employees can review their timecards, schedules, PTO, and pay stubs. Employers can manage employees from the app, reviewing timecards and schedules.

The app is great compared to competitors, most of which only have an app for employees.

You can cancel services by calling 1-855-565-3285. Their cancellation policy is not made clear on the website.

The site is quite user-friendly, and information is easy to find. However, being unable to complete account setup online is less than ideal. Having to speak to someone to do so is an unnecessary hassle.

We tested all three forms of Paycor customer support. Here’s what we found.

We asked chat support if any of the plans offer healthcare administration. It took about one minute to get a reply, and the answer was that it can be added to any of the plans. We asked the price and were told to speak to a sales representative.

Chat Support Rating:

Response time:

Very quick

We attempted to call customer support. A menu is offered when the call is answered, and you’re asked to enter a customer ID to speak to a representative or select that you’re a prospective customer and be routed to a salesperson.

Acting as a prospective customer, we asked the salesperson the same question about health care pricing. In response, she wanted to do a full interview to determine our needs, which we declined.

Phone Support Rating:

Response time:

Very quick

Email support is not available.

Note that after giving our information during the signup process, we have received numerous sales emails and phone calls.

To understand how real Paycor customers feel about the service, we examined customer reviews at the Better Business Bureau and Trust Pilot.

Paycor has an A+ rating from the BBB.

Paycor has an A+ rating from the BBB with 1.14/5 stars in 36 customer reviews. They have been an accredited BBB business since 2011. They have received 127 complaints in three years, all of which have a closed status.

The one positive review was from an employee.

“I love it when I get hired and the place i am working for has PAYCOR it’s SOOO easy to track and clock in and out.”

Negative reviews revolved around processing errors, poor customer service, and issues getting problems resolved.

“After a year of frustrations we made the move from Paycor. Their customer service is a joke; no dedicated individuals and massive wait times only to leave issues unresolved. At year end W2’s were issued incorrectly (aren’t they supposed to be the experts?), and we have yet to see adjusted W2’s 45 days later. I would never, never recommend this service to any company.”

You can read reviews on the BBB website.

**The Better Business Bureau is a private nonprofit that uses an A+ through F grading system to rate BBB’s degree of confidence that the business operates in good faith and will work to resolve customer issues and complaints filed with the BBB. BBB accreditation means that the business has undergone vetting and been approved and now pays dues to ensure its good standing with the BBB and gain use of the BBB logo in marketing materials. Over the years, several businesses have complained that the BBB gave them a poor letter grade, such as a D or F, largely because they refused to pay the fee to become an accredited member. Thus, these ratings should probably be taken with a grain of salt.

Paycor has a poor trust score rating on Trustpilot.

The Trustpilot score for Paycor is 2.6/5 stars, out of 4 reviews.

Paycor reviews at Trustpilot break down as follows:

The reviews on TrustPilot are all negative and all mention an inability to reach customer service to get issues resolved.

“Typically, weeks of emails and calls go ignored. There is no way to get their team to answer a call at any time, despite any length of wait — well into hours. Trouble tickets are incoherently non-addressed. A call back might come, many days after an inquiry — and you’d better not miss that (I did).”

You can read reviews on the TrustPilot website.

Overall, Paycor’s services offer advantages and drawbacks, as detailed below.

Paycor was founded in 1990 in California, and, according to the BBB, is managed by:

According to Paycor’s website, the firm serves over 40,000 businesses and has almost 2 million users. In hiring practices, the company says it is committed to diversity, equity, and inclusion, and encourages giving back to the community.

OnPay is much less expensive than Paycor, and the one plan the former offers includes health care insurance administration, which is not included in any Paycor plan.

OnPay has an A rating with the BBB and very few negative reviews.

Paychex’s pricing and features are similar to those of Paycor, but Paychex has 24/7 customer service, while Paycor only has customer support during business hours.

Paychex has an A+ rating with the BBB, though its customer review score is low.

Gusto has three plans, all less expensive than similar plans offered by Paycor. However, Paycor has more robust HR services. Gusto also has an F rating with the BBB.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of Paycor payroll services.

Paycor offers four plans, which give customers more options to choose from than other payroll services. Information is easy to find on the site, and the site is user-friendly. However, you cannot complete the signup process online, which extends the time involved.

Paycor offers robust HR services in its higher-tier plans compared to the competition, which helps set the company apart. However, if you just need payroll services, Paycor’s Basic plan is expensive.

Overall, Paycor’s higher-tier plans offer good value, though they include no health insurance administration. If you’re looking for robust HR support, we highly recommend Paycor. But if you only need good payroll processing, we suggest shopping around.

Paycor handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. Paycor takes care of all the red tape so you can focus on building a successful business.

With its upper-tier plans, Paycor provides hiring documents for new employees that can be electronically signed and stored. Hiring employees comes with a lot of paperwork and having a service like Paycor can make it much easier for you.

The three upper-tier plans include 401K administration. None of the plans offer health care insurance administration but it can be added for an additional cost.