Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is Payroll Mate. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the right payroll service for your business.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Payroll Mate is a payroll software, not a service, enabling you to pay an annual subscription to do your payroll in-house. It also calculates your withholding tax and payroll tax filing amounts and provides the filing forms that you need.

Payroll Mate software has many features, as detailed below.

| Price | $149 per year |

|---|---|

| Run payroll for up to 10 companies with up to 75 employees per company | X |

| Automatic calculation of federal and state payroll taxes | X |

| Supports multiple pay frequencies | X |

| On step backup and restore | X |

| Supports multiple pay types | X |

| Generates forms 941, 940, 943, 944, W-2s, W-3s | X |

| Comprehensive payroll reports | X |

| Exports payroll to Excel, CSV, and PDF | X |

| Vacation and sick time calculation and accrual | X |

| Export to accounting software | X |

| Vendor and 1099 center | X |

| Prints signature ready checks and paystubs | X |

| General ledger export | X |

| Supports many state payroll forms | X |

| Customer support | X |

| Supports customizable income, tax, and deduction categories | X |

| Auto calculates SS and Medicare taxes | X |

| Auto calculates FUTA | X |

| Calculates SUTA | X |

| Calculates state disability insurance tax | X |

| Supports FSAs | X |

| W-2 and 1099 electronic filing | X |

| Supports wage garnishments | X |

| Handles exempt payroll deductions | X |

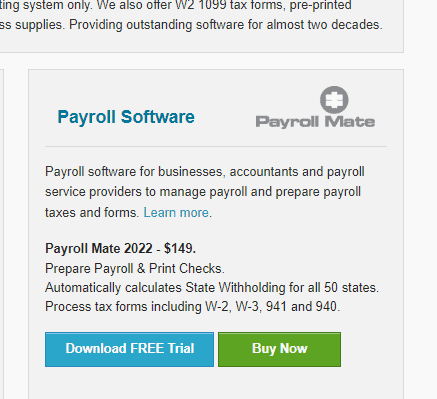

The $149 per year Payroll Mate Software allows you to easily handle your payroll process in-house with no additional monthly fees.

Payroll Mate’s software calculates employee withholdings, allowing you to manage your payroll process seamlessly. It will also calculate your payroll taxes, making your tax filings simple, and will generate W-2s and 1099s.

If you’re looking for an easy way to manage payroll in-house and avoid monthly fees to a payroll service provider, Payroll Mate software is a great option.

The site is user-friendly and clearly shows what Payroll Mate offers, explaining all its features and benefits. You have the option to purchase immediately or download a free trial.

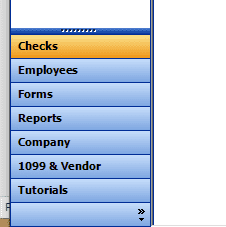

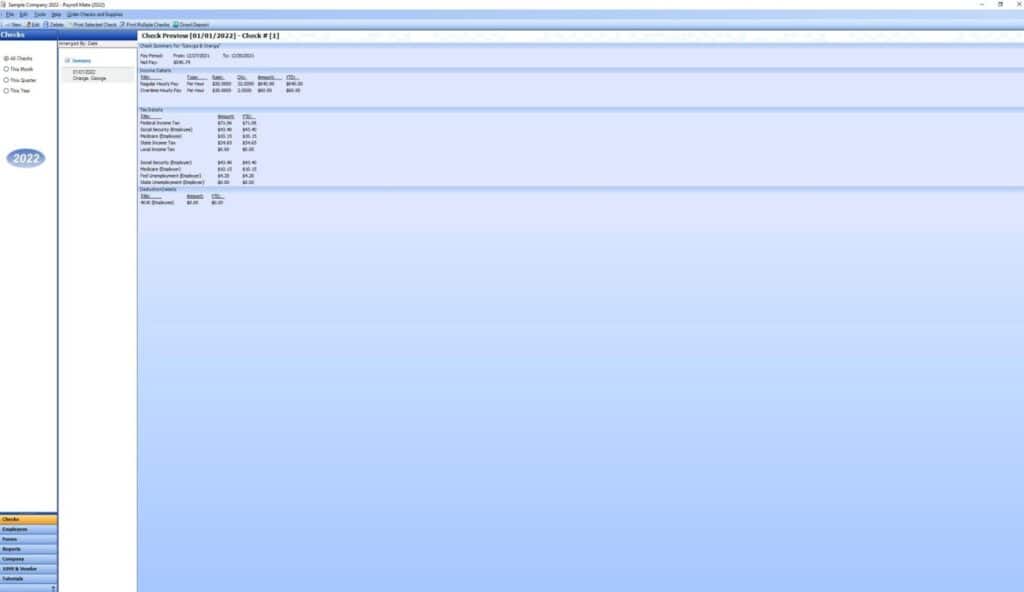

We downloaded the free trial in just a few minutes. When you open the software, you’ll see a sample dashboard to help you understand how the software will work.

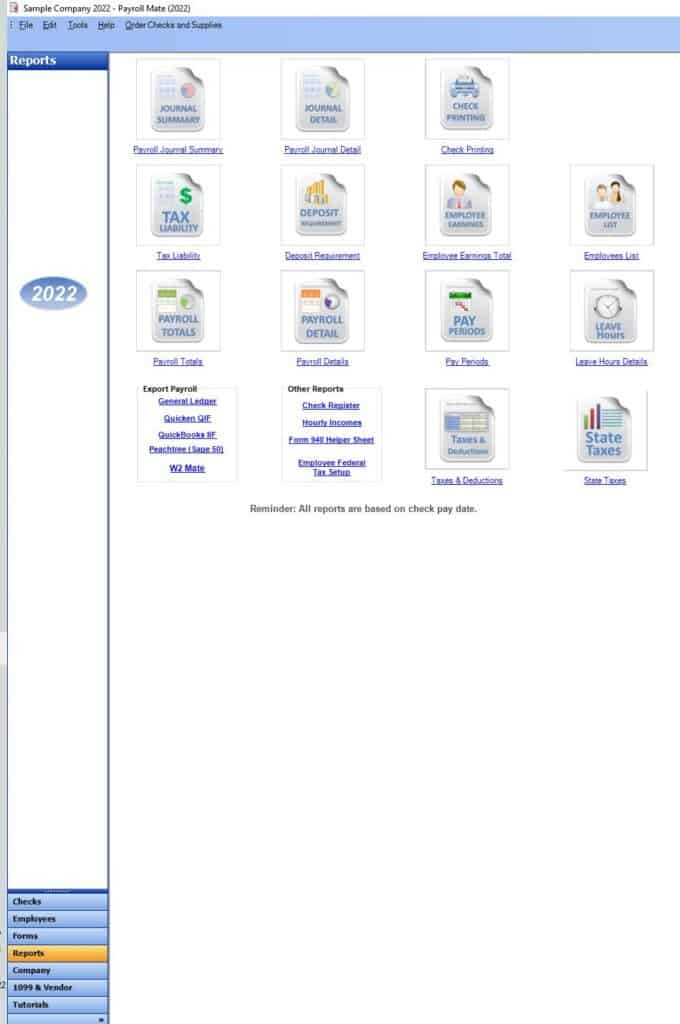

On the dashboard you can view and print payroll checks, see employee information, print forms, and generate reports.

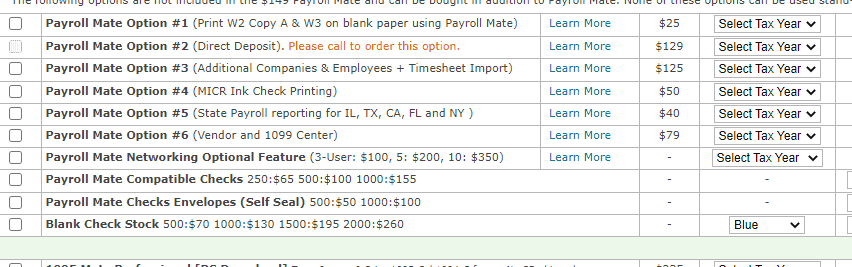

You can also purchase blank checks and other forms.

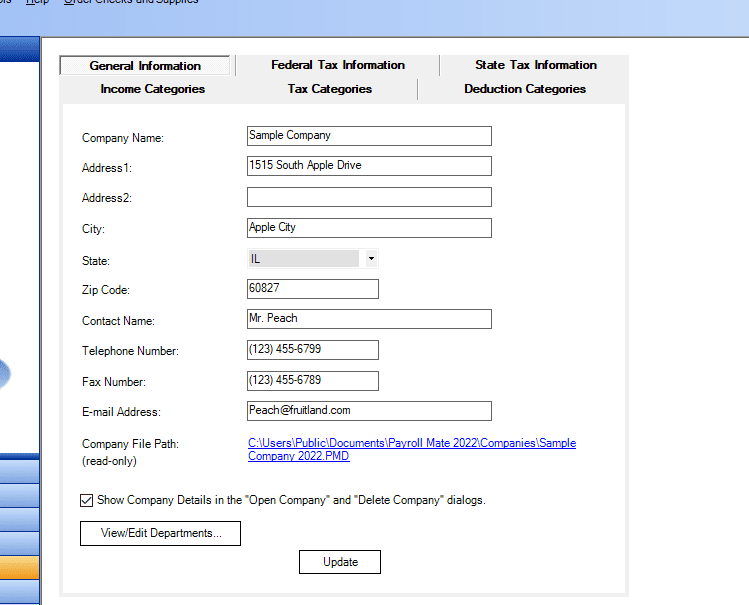

Before you start using the software, you’ll enter detailed company information.

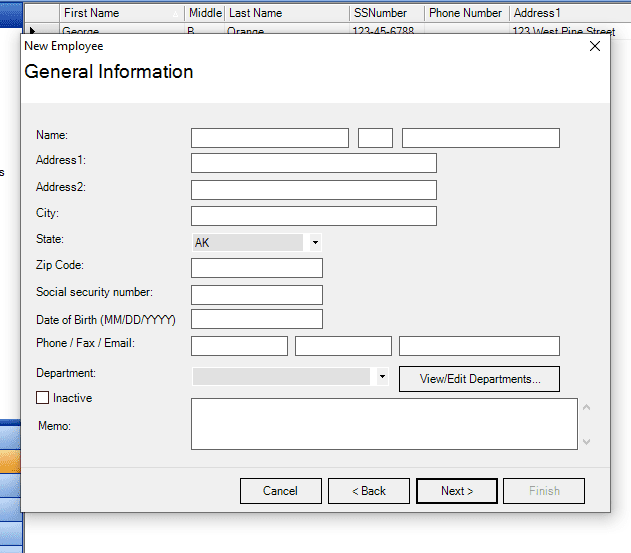

You’ll also enter information about your employees.

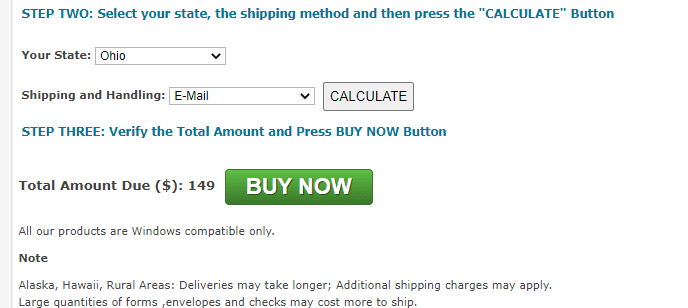

After you select the product, you’ll enter your state and be given your total.

Overall, it was a bit of a “clunky” process that took some time.

Payroll Mate is far from comprehensive, but neither is it inadequate. Reporting is focused on the big picture essentials, all with helpful preview options. Everything can be viewed as either a PDF or Excel.

The data is easy to read and logically organized. If you use Quickbooks or Sage, being able to export payroll information directly to a journal entry is a great help.

The interface is clear and minimalist, providing the basic essentials. There is no home menu, calendar, or extra features. This software focuses on payroll alone.

As a result, there is a lot of wasted space. It would be nice if the sidebar menu was closer to the top with the rest of the links. In addition, this is a traditional desktop application, not a cloud-based service. This means the user is responsible for security and backing up data.

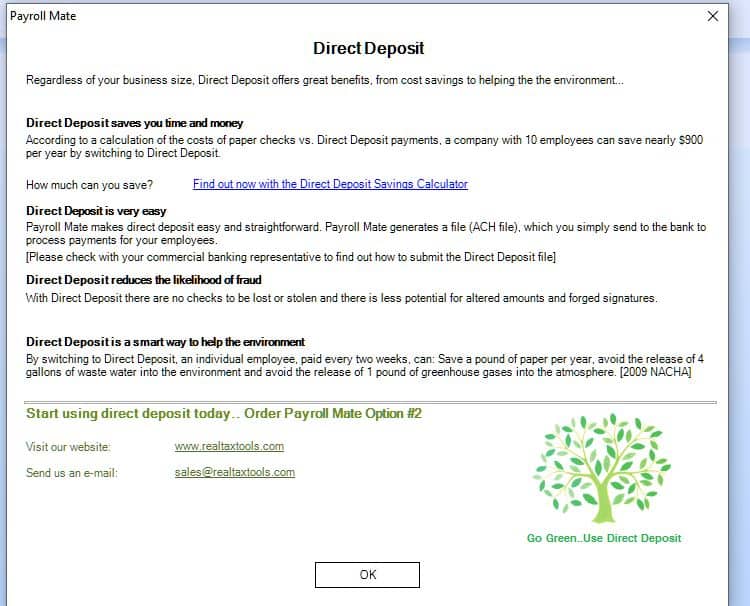

In keeping with Payroll Mate’s approach, setup is performed by the user, including tax withholding. You’ll also select direct deposit or printed checks for each employee.

Payroll Mate will handle calculations but will not actually remit the taxes owed. This was not readily apparent in my testing.

Payroll Mate does not have a mobile app.

You’ll have to renew your subscription every year, so if you want to stop your service at the end of the year, you simply need to choose not to renew.

Once you purchase the software, you cannot get a refund if you try it and don’t like it, as stated on the website:

“All return and refund requests must be pre-authorized by our company in writing. Please contact our refund department by sending an email to [email protected] . If your return is approved, we will initiate a refund to your credit card (or original method of payment). You will receive the credit within a certain amount of days, depending on your card issuer’s policies.

• Downloadable Software return policy: DOWNLOADABLE SOFTWARE IS NOT RETURNABLE OR REFUNDABLE. We offer free trial versions for our software this way you can download and try before you decide to make a purchase. Software Add-ons (including optional features you purchase on top of the basic product) are considered downloadable software.”

Payroll Mate is a good option for someone with an accounting background who’s comfortable handling the tax portion of payroll. If your business just needs a simple payroll calculator and reports, Payroll Mate does the job with no frills.

However, figuring out how the software works and getting to the actual purchase point is not very intuitive. Site usability could use a bit of work.

We tested all three forms of Payroll Mate customer support, as detailed below.

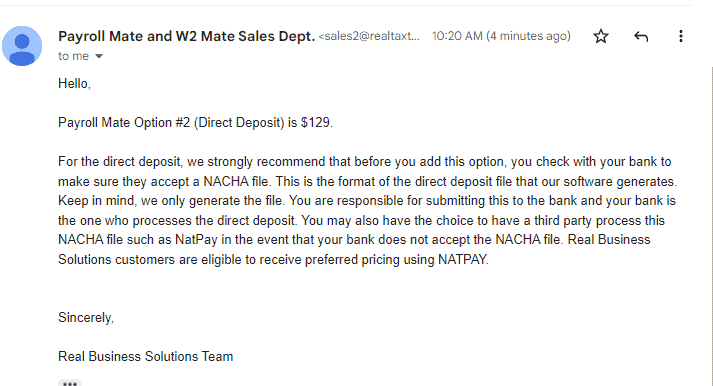

Live chat support was not available. The chat button took us to a form to fill out to receive an email response. We asked the cost to add direct deposit as an option with their software. We did not receive a response, although we did receive a response to our direct email to them, as detailed below.

Support Rating:

Response time:

Reasonable

Phone support is available M-F 9 a.m. to 5 p.m. CST. We called at 9 a.m. CST on a Monday and were on hold for nearly 30 minutes before we gave up. We tried again the next day in the afternoon and were on hold for 20 minutes before we gave up again.

Support Rating:

Response time:

Reasonable

We asked the same question about the cost of adding direct deposit through their direct email address instead of the form. We received a response within an hour.

Support Rating:

Response time:

Very quick

To understand how real Payroll Mate customers feel about the service, we examined customer reviews.

Payroll Mate is a product of Real Business Solutions. The company is not BBB accredited, and has no rating, customer reviews, or complaints.

There are no Payroll Mate reviews on TrustPilot.

We did find some reviews of Payroll Mate on Capterra, a software review site. The Payroll Mate rating is 4.7/5 stars in 122 reviews.

Positive reviews revolved around ease of use of the software.

“There has never been a time where processing payroll was a joy to do, and bad software can make that 1000% worse. This software though actually has made the whole process a lot less painful. Payroll is still not something I look forward to but it’s definitely more bearable. – ease of use is 10/10, intuitive design and easy installation – data transfers over from year to year seamlessly – Direct Deposit!”

“This software is the best so far in the handling payroll needs. one is able to export payroll details t o other accounting softwares like sage 300, calculate all employee deductions and benefits then use this data to prepare final financial statements with ease. This is a unique feature which lacks in many softwares . I also like its interface which is so simple and user friendly.”

Negative reviews were about poor customer service.

“The customer service was poor, and for this reason I will not buy this software again. It was very difficult to get a competent response when there was a problem. I’ve worked with many different payroll software companies (ADP, Paycom, QuickBooks, Patriot), and I would rate all of them better than Payroll Mate.”

“I asked to increase the font size on the MICR checks. Employee couldn’t with phone app. They told me they would refund my money and go elsewhere. I just asked them to increase the font. Would not recommend. They won’t even respond to my inquiries now. Not professional all.”

You can read reviews on the Capterra website.

Overall, Payroll Mate’s software offers advantages and drawbacks, as detailed below.

According to the BBB, Real Business Solutions, the developers of Payroll Mate, has been in business since 2007 and is managed by Ms. Nancy Walters, Manager. We could not find any more information about the company.

Patriot Payroll is a payroll service and has similar offerings to Payroll Mate, but charges a monthly fee rather than an annual fee. Patriot has an A+ rating with the BBB, though their customer review score is low.

SurePayroll is also a payroll service and has similar offerings to Payroll Mate, but with a monthly fee. SurePayroll has an A+ rating with the BBB, but a low customer review score.

Gusto is a more expensive option, but offers full payroll services, and their plans include HR services as well as employee benefits. Gusto, however, has an F rating with the BBB.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of Payroll Mate software.

Overall, we were pleased with our Payroll Mate experience, although the process to get to the point of purchasing the software could be streamlined.

Customer service was a bit lacking, as live chat was not available and we waited nearly 30 minutes to get through to their phone support.

Payroll Mate is a great option if you want to handle your payroll in-house rather than paying a monthly fee to a payroll service provider. Based on our thorough research, we recommend Payroll Mate to business owners.

Payroll software enables you to seamlessly handle payroll processing and tax filings. It does most calculations for you, so you don’t have to, saving you hours of time.

Payroll Mate’s software calculates employee withholdings, allowing you to manage your payroll process seamlessly. It will also calculate your payroll taxes, making your tax filings simple, and will generate W-2s and 1099s.

The software costs $149 annually. They do offer a free trial download of the software.

Payroll Mate is a payroll software, not a payroll service provider. The software allows you to easily handle your payroll processing.

Payroll Mate’s software does not include any hiring and onboarding tools.

Payroll Mate is a payroll software, not a service, and does not include any employee benefits services.

A payroll software will generally be less expensive than a payroll service. It will allow you to easily manage your payroll and tax filings in house.