What Is a Payroll Statement?

Written by: Coralee Bechteler

Coralee is a business writer with experience in administrative services, education, and software testing.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on October 2, 2023

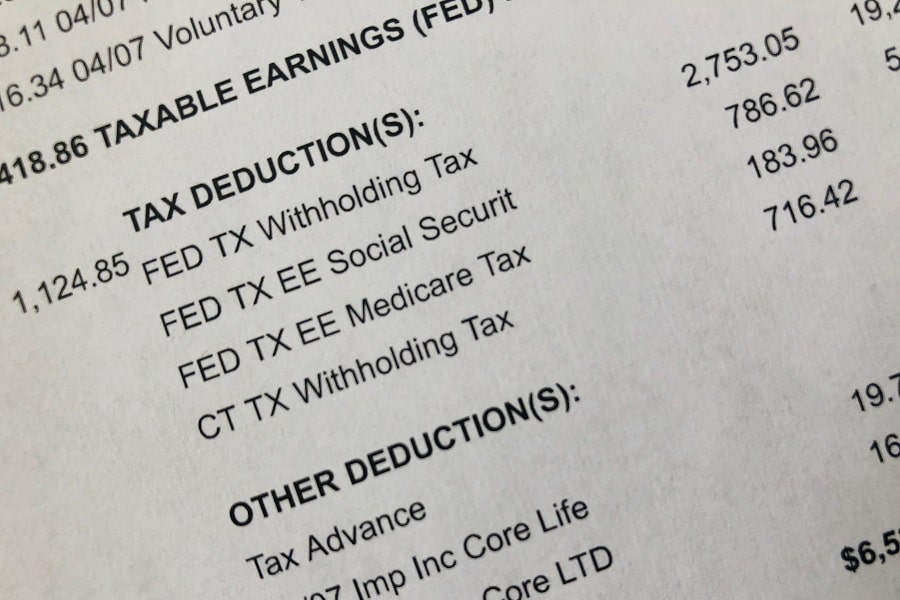

A payroll statement is a formal business document that details employees’ earnings and how they were calculated. You may have also heard of a payroll statement referred to as a pay statement, a paycheck, a pay stub, a payslip, a wage slip, or an earnings statement.

But what’s often found on a payroll statement? This guide walks you through the various deductions and tax details that appear on a pay statement, giving you a greater understanding of the relevent recordkeeping requirements.

Who Is a Payroll Statement For?

A payroll statement is essentially a copy of a compensation receipt issued by an employer to an employee. This record is beneficial for both parties: the employee better understands what’s been taken out or added to their earnings; while employers are able to comply with recordkeeping laws and regulations, detailed further below.

What Information Can Be Found On Payroll Statements?

A payroll statement details an employee’s earnings, deductions, and total take-home pay, which involves a variety of terms and details.

Pay Period and Dates

The payroll statement should identify the beginning and end dates of the pay period, as well as the payment issuance date, or pay date.

Hours Worked & Earnings

For hourly workers, the statement should detail the number of hours an employee worked during the pay period, as well as any overtime pay and the calculated gross wages.

Gross Wages

The term gross wages refers to the total income earned by an employee during a pay period. It’s the full amount made during that period before any taxes or deductions are taken out.

YTD

YTD, or year to date, represents everything an employee has been paid since the beginning of that year, along with categorized summaries of deductions taken out.

Deductions

A deduction is an amount taken out of an employee’s gross pay. The reason deductions are taken out is to reduce the amount subject to taxation. There are different types of deductions, which are detailed below.

Payroll Statement Deductions

Insurance

Some businesses provide their employees with insurance benefits, such as medical, dental, eye, life, disability, and so on. Depending on the business’s policies, insurance deductions may be made pre-tax or post-tax.

Retirement

Retirement plans, such as a 401(k), allow employees to set aside an untaxed portion of their income for retirement. Employers often contribute to an employee’s retirement funds, and sometimes will even match what the employee is putting in.

Wage garnishments

Wage garnishments refer to when an employee’s earnings are withheld by the employer in order to pay a debt, such as child support.

Net Pay

An employee’s net pay is the final amount of wages after all deductions have been taken out. Net pay is the amount that appears on your paycheck or direct deposit – it’s the same as take-home pay.

Taxes

Most people prefer more pre-tax deductions, which results in lower tax payments, rather than taking out few deductions and paying more at tax time. Below, we’ve listed taxes commonly taken out of a payroll statement.

- Federal Income Tax

United States federal income taxes are determined on a progressive scale based on an employee’s income threshold. Each employee falls into a certain tax bracket, which determines their federal income tax.

- State and Local Taxes

Not every state or municipality requires additional taxes to be taken out of payroll, so it’s important to look into your state and local requirements to ensure compliance.

- Social Security Tax

Social Security taxes are collected from employees and their employers and help fund the US government’s Social Security program.

Is It Required to Provide Payroll Statements to Employees?

There is no federal law requiring businesses to provide employees with a payroll statement. But states have instituted varying requirements, and companies must abide by them or face fines and legal penalties.

Federal Requirements

The Fair Labor Standards Act, or FLSA, lists recordkeeping requirements for all businesses and ensures that employees can approach their HR department with compensation questions. Proper recordkeeping enables the quick identification of an employee’s payment details.

State Laws

Again, no federal laws regulate business compliance on payroll statements, so it falls to the states to do so. State positions on payroll statements fall into one of four categories:

- State that do not require businesses to provide employees with payroll statements

- States that require businesses to provide employees with paper pay statements

- States that require businesses to provide employees with access to payroll statements

- States that support the provision of digital or written payroll statements.

Businesses often engage in collective bargaining agreements, which detail the commitments of an employer toward employees. Such agreements regularly include additional provisions on employee wages and payroll statements, so it’s vital that employers and HR teams familiarize themselves with these documents.

States Without Employee Pay Statement Requirements

The following states do not require businesses to provide employees with payroll statements:

- Alabama

- Arkansas

- Florida

- Georgia

- Louisiana

- Mississippi

- South Dakota

- Tennessee

States that Require Written Employee Pay Statements

- California

- NOTE: Pay statements must be provided every pay period or semi-monthly

- NOTE: Public and domestic workers are not required to be provided with a pay statement

- Massachusetts

- NOTE: Pay statements must be provided every pay period

States that Require Access to Employee Pay Statements

These states require businesses to supply employees with some form of payroll statement. Whether the statement is electronic or printed, it must be easily accessible.

- Alaska

- NOTE: Pay statements must be provided every pay period.

- Arizona

- NOTE: Only employees paid via direct deposit need to receive payroll statements.

- Colorado

- NOTE: Pay statements must be accessible every pay period or monthly.

- NOTE: Public workers and independent contractors are not required to be provided with a pay statement.

- Connecticut

- NOTE: Pay statements must be accessible every pay period.

- Delaware

- NOTE: Only businesses with at least four employees must provide payroll statements.

- NOTE: Local, county, and state workers are not required to be provided with pay statements.

- Hawaii

- NOTE: Pay statements must be accessible every pay period.

- NOTE: Local, state, and federal workers are not required to be provided with pay statements.

- Idaho

- NOTE: Pay statements must be accessible every pay period.

- Illinois

- NOTE: State and federal workers are not required to be provided with a statement, but local government employees are.

- Indiana

- NOTE: Pay statements must be accessible every pay period.

- Iowa

- NOTE: Pay statements must be accessible every pay period.

- Kansas

- NOTE: Pay statements must be accessible every pay period.

- Kentucky

- NOTE: Businesses with at least 10 employees must be provided pay statements every pay period.

- Maine

- NOTE: Pay statements must be accessible whenever an employee requests them.

- Maryland

- NOTE: Pay statements must be accessible every pay period.

- Michigan

- NOTE: Pay statements must be accessible every pay period.

- Minnesota

- NOTE: Pay statements must be accessible every pay period.

- Missouri

- NOTE: Pay statements must be accessible at least once a month.

- Montana

- NOTE: Pay statements must be accessible every pay period.

- Nevada

- NOTE: Pay statements must be accessible every pay period.

- New Hampshire

- NOTE: Pay statements must be accessible every pay period.

- New Jersey

- NOTE: Pay statements must be accessible every pay period.

- NOTE: Government workers are not required to be provided with a statement.

- New Mexico

- NOTE: Pay statements must be accessible every pay period.

- New York

- NOTE: Pay statements must be accessible every pay period.

- North Carolina

- NOTE: Pay statements must be accessible every pay period.

- North Dakota

- NOTE: Pay statements must be accessible every pay period.

- Ohio

- NOTE: only employees under 18 years of age are required to be provided with a payroll statement.

- Oklahoma

- NOTE: Pay statements must be accessible every pay period.

- Oregon

- NOTE: Pay statements must be accessible every pay period.

- Pennsylvania

- NOTE: Pay statements must be accessible every pay period.

- Rhode Island

- NOTE: Pay statements must be provided every pay period.

- South Carolina

- NOTE: Pay statements must be accessible every pay period.

- NOTE: Businesses with less than five employees are not required to provide them with pay statements.

- Texas

- NOTE: Pay statements must be accessible every pay period.

- Utah

- NOTE: Pay statements must be accessible every pay period.

- NOTE: Public, domestic, and farm workers are not required to be provided with a pay statement.

- Vermont

- NOTE: Pay statements must be provided every pay period.

- Virginia

- NOTE: Written statements must only be provided if specifically requested by an employee.

- Washington

- NOTE: Pay statements must be accessible every pay period.

- West Virginia

- NOTE: Pay statements must be accessible every pay period.

- Wisconsin

- NOTE: Pay statements must be accessible every pay period.

- Wyoming

- NOTE: Pay statements must be accessible every pay period.

States that Support Written or Digital Employee Pay Statements

- Alaska

- Arizona

- Delaware

- Hawaii

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Maryland

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New York

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How Long Does HR Need to Retain Payroll Statement Records?

Though no legal requirements dictate how businesses must practice recordkeeping, there are requirements that detail how long records must be kept. As a result, it’s extremely important for companies to establish and follow good recordkeeping practices. All records should be well maintained and safely stored in an accessible location, whether physical or virtual.

Fair Labor Standards Act

The Fair Labor Standards Act (FLSA) is governed by the Department of Labor and identifies recordkeeping requirements for all US businesses. The FLSA requires that all records for nonexempt employees be stored for a minimum three years.

The Department of Labor provides an index of the necessary employee records, which includes all payroll and payroll statement information. Here is the the list of FLSA Recordkeeping Requirements:

- Employee’s full name and social security number

- Employee’s complete address, including zip code

- If under 19 years old, employee’s date of birth

- Employee’s sex and occupation

- Day of the week employee’s work week begins

- Time of day employee’s work week begins

- Total hours employee works each day

- Total hours employee works each work week

- Rationale used to determine the employee’s wages, such as:

- “$15 an hour”

- “$1,000 a month”

- “Piecework”

NOTE: Piecework refers to a compensation arrangement wherein the employee is paid a certain amount for each project or task.

- Regular hourly rate

- Daily/weekly regular wage earnings

- Overtime earnings for the workweek

- Additions/deductions from employee’s wages

- Wages paid for current pay period

- Date of payment and pay period covered

In addition to the above list, the FLSA requires collective bargaining agreements to be retained for at least three years. Additionally, all information that details how an employee’s wages have been determined and calculated must be carefully recorded and retained for at least two years.

This includes schedules, timetables, wage tables, and any information regarding deductions and add-ons to an employee’s wages.

All this information is important for businesses to maintain for the sake of employees and necessary should the Department of Labor conduct an inspection or investigation.

Age Discrimination in Employment Act

Another act instituted by the Department of Labor, the Age Discrimination in Employment Act, or ADEA, requires payroll records to be retained for at least three years. Any documents detailing employee benefit plans must be kept for the duration of their employment, plus one year after termination.

Are There Payroll Services that Can Help with Payroll Statements?

Payroll and the associated payroll statements present an immense responsibility for human resources teams. It’s critical that businesses take their payroll responsibilities seriously, because one mistake can lead to confusion, delay, lost morale and decreased productivity.

In order to save HR a lot of time and headaches while attempting to resolve the issue later, businesses should look into outsourcing payroll processes from service providers such as Gusto or Justworks. Be sure to thoroughly review the options before making a commitment.

Conclusion

Payroll duties are an essential aspect of HR dues, so it’s great that you’re now better informed about payroll statements, deductions, taxes and how the relevant requirements vary depending on the state. Your business, and HR team, are now pointed straight toward payroll success.