Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

If you’re starting a business and hiring employees, mastering payroll is likely to be one of your first major hurdles. Dealing with payroll is often quite complex and time-consuming, which is why many entrepreneurs turn to a professional payroll service.

Payroll providers handle the entire payroll process for you, making it nearly seamless and automated while offering additional services so that you can focus on building a successful business.

One of the top options is SurePayroll. But is it the best service? And is it the right choice for you? This review takes a closer look — putting ourselves in the shoes of an entrepreneur — to help you determine whether this is the right payroll service for your business.

Pricing

Breadth of Services

Help and Support

Customer Satisfaction

Ease of Use

SurePayroll, a subsidiary of leading payroll provider Paychex, is widely seen as Paychex’s more affordable option.

One thing that differentiates SurePayroll is their no tax penalty guarantee. The company will calculate, file, and pay your withholding and payroll taxes, and if there is any error, Sure will correct it and pay the penalties for you. For a business owner, it’s one less thing to worry about.

SurePayroll offers two service levels. We explored all of the options, as detailed below.

| No Tax Filing | Full-Service | |

|---|---|---|

| Price | $19.99 per month plus $4 per employee per month | $29.99 per month plus $5 per employee per month |

| Payroll service | X | X |

| 2 day direct deposit | X | X |

| Customer support | X | X |

| Payroll taxes calculated | X | X |

| Unlimited payroll runs | X | X |

| Auto payroll | X | X |

| Multiple pay rates and bonuses | X | X |

| New hire reporting | X | X |

| Online pay stubs | X | X |

| Federal, state, and local tax filings | X | |

| Year end tax filing | X | |

| HR advisor | X |

The $19.99/month plus $4 per employee per month plan will take care of all your basic payroll needs.

The No Tax Filing package includes full-service payroll, with unlimited payroll runs and two-day direct deposit. SurePayroll will also handle your new hire reporting with your state and you’ll have access to live support as well.

The No Tax Filing plan is a great value if you just want to outsource basic payroll.

The $29.99/month plus $5 per employee per month Full Service plan includes federal, state, and local tax filings.

The Full Service plan will save you the hassle of calculating, withholding and filing federal, state, and local taxes, as well as your year-end payroll tax filing.

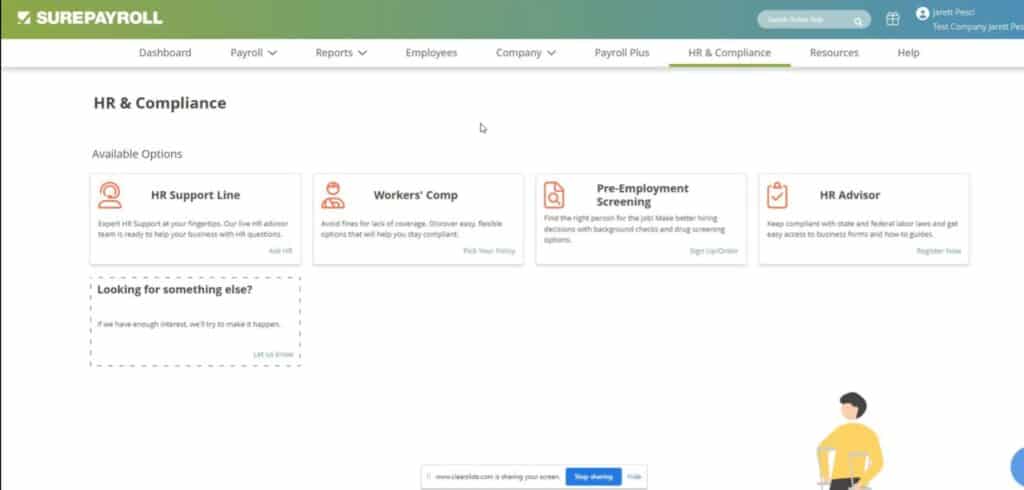

The plan provides access to Sure’s HR advisor service, which includes labor law posters, how-to guides, and business forms. The Full Service plan is priced well and takes many payroll and tax tasks off your plate.

Both the Full Service and No Tax Filing plans come with a two-month free trial.

This plan also comes with a nanny payroll option, if you’re looking for a service to manage your payroll for household employees. It costs $49.99 per month for one employee and includes everything in the Full-Service plan. Additional employees are $10 per month.

The payroll services within both plans offer a complete suite of services to take pretty much all relevant tasks off your plate and put your payroll on autopilot.

You’ll have the option of paying employees by direct deposit or paper check, and the service can handle multiple pay rates and bonuses to ensure your employees are paid correctly.

The payroll process is complex, so using SurePayroll can save you considerable time and ensure that you are in compliance with payroll laws at all levels.

With the full-service plan, they will also take care of your federal, state, and local tax filings.

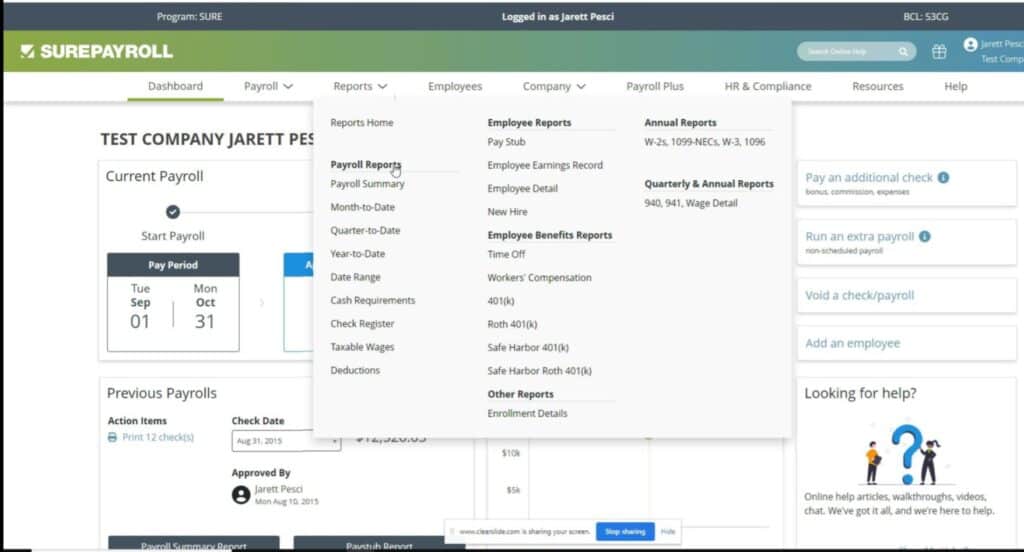

The reporting options for payroll are, in a word, standard. None of the big picture items are missing, but neither does it offer great detail. SurePayroll actually has more detailed information for HR and benefits than it does for payroll.

Specific types of investment accounts are all present, which is a bit unusual. If you really need to see the difference between 401k and Roth 401k, you can.

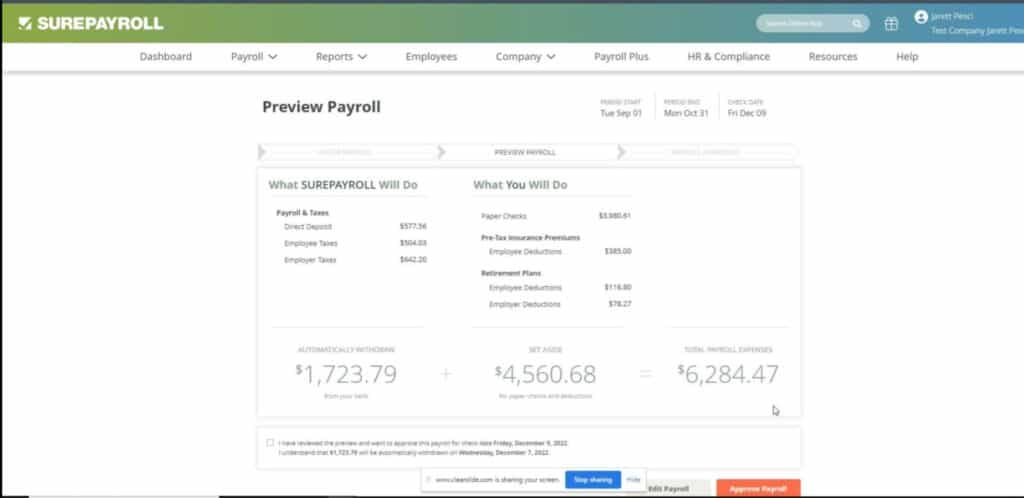

You can also preview the payroll register before submitting, which is helpful.

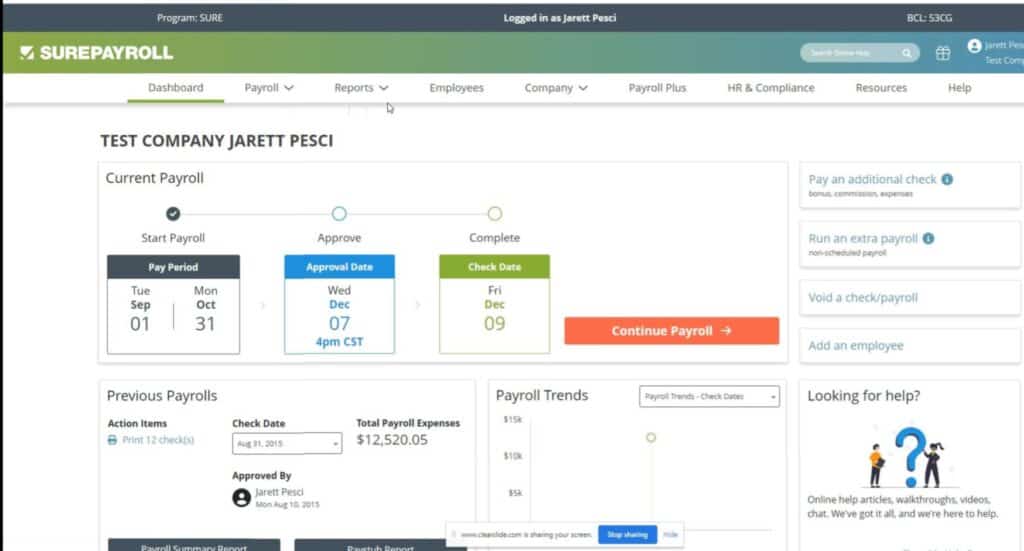

The interface is modern and user-friendly. The front page has all the useful links you would expect, while the top menu bar is well-organized. There is also a calendar and a graph of payroll statistics, which I appreciate for accounting purposes.

Being able to rearrange the cards would help, but the default setup was relatively intuitive.

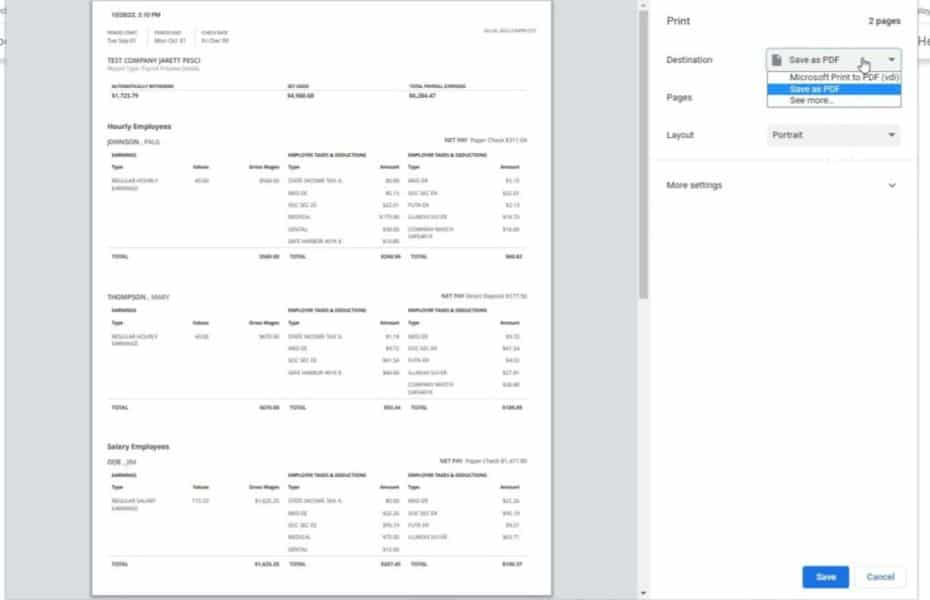

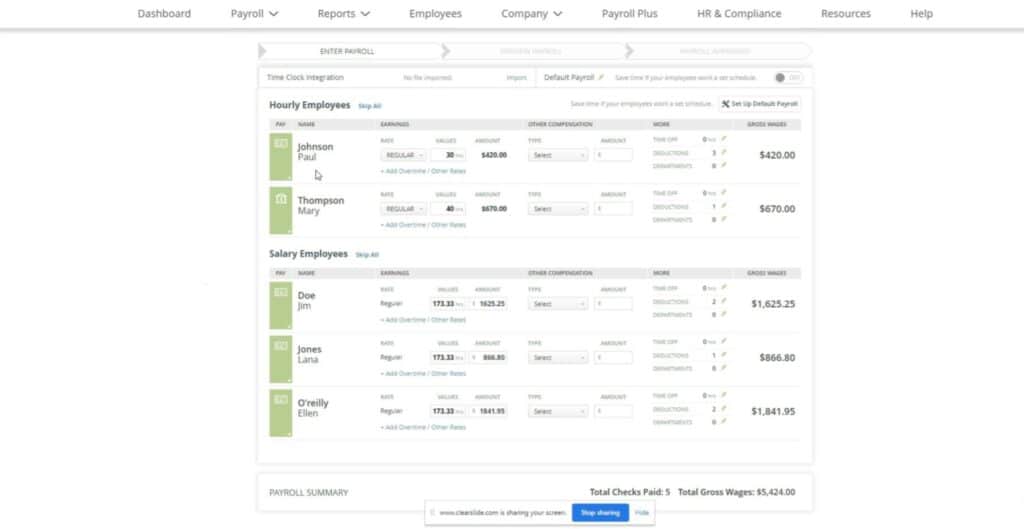

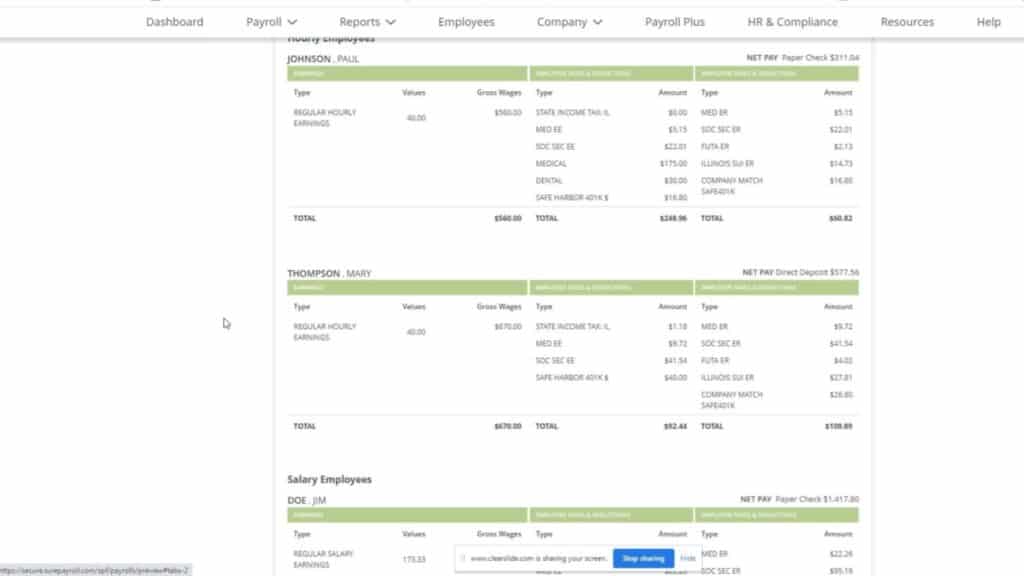

The information available on the payroll screens is exceptionally detailed. It includes statistics normally found in a report run later, like deductions and time off.

Additionally, the ability to see a full breakdown before changing hours or gross wages on-the-fly is very useful. Employees are grouped by type, and all applicable pay codes are visible, including bonuses and PTO.

SurePayroll is a solid option for mid-sized firms with a diverse payroll structure. Being able to see the full breakdown and change fields before submitting is very handy.

Though the reporting lacks customization, the standard options cover all the key bases. Also, the focus on employee information reports is excellent if you need to track metrics.

The site is user-friendly and information is readily available.

The plans are easy to find, with good detail on features and pricing. You can even get more information on each individual service. It’s laid out well and easy to understand.

You can also find information on additional products, such as health insurance for employees. When you view the plans, you have the option to select one to start your free trial.

Once you make your selection, you’re asked for your name, email, and phone number.

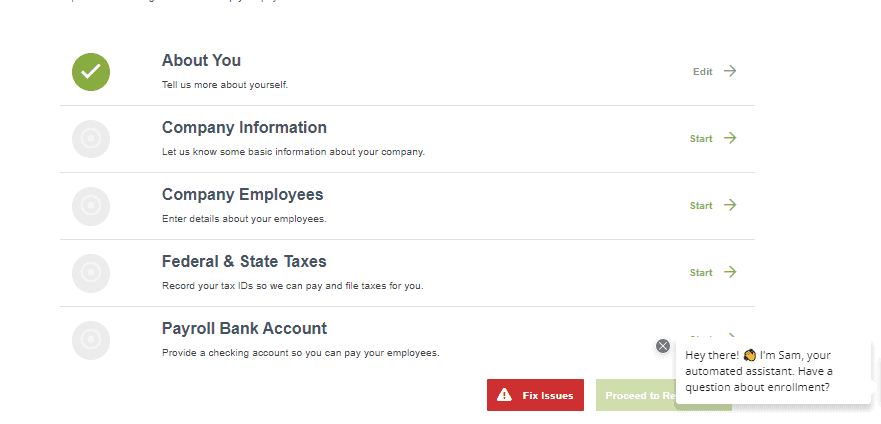

Next, you’ll get an email to verify your email address. Once you click the link you can create your username and password and be taken to a welcome screen.

You’ll need your EIN, employee information, business tax information, and details about your bank account.

The whole process seems quite simple and streamlined. If you have all your information handy, you can complete the process in less than 30 minutes.

SurePayroll has mobile apps for both employees and employers. With the employer app, you can manage payroll and even see payroll reports. With their app, employees can view pay stubs and manage their profile.

The SurePayroll cancellation process is as follows:

Step 1. Notify SurePayroll

To close your account, please contact our Customer Care team at 877-956-7873. One of our team members will walk you through the process and email you a Termination Request Form.

Step 2. Complete & Return the Termination Request Form

Please complete the Termination Request Form and fax it to SurePayroll at 224-260-4027. You may also log in to your payroll account, select “Contact Us” and attach the document to the contact form.

IMPORTANT: Your account will remain active until the termination process is complete. SurePayroll will continue to file tax returns and bill for services until the Termination Request Form has been submitted.

The reason why we keep your account open and continue to bill is because we’re required to fulfill our part of the service agreement and file with the tax agencies.

Step 3. Final Billing & Tax Reconciliation

SurePayroll bills for the previous month’s service, so you’ll receive a final service fee within 30-45 days after closing your account. Your accounts will be reconciled and if there’s any tax money we collected that hasn’t been paid to the tax agencies, you’ll be refunded with 4-6 weeks. If there are taxes due we’ll collect the necessary funds from you.

The site is quite user-friendly overall, and information is easy to find. The site is not very “salesy” and simply aims to guide you toward the right plan for your company. It offers an excellent customer experience.

We tested all three forms of SurePayroll customer support, as detailed below.

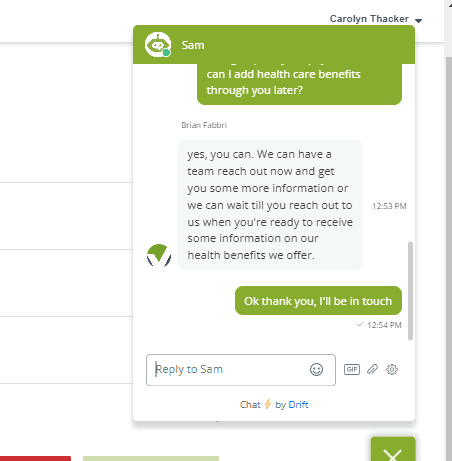

We asked chat support if we would be able to add health care benefits later if we signed up for the payroll service now. We received a response within a minute.

Support Rating:

Response time:

Very quick

We called customer support to ask if both direct deposit and paper checks are available. The answer was yes, and then they wanted to route our call to sales to answer additional questions, but we declined.

The support representative was very friendly. Our call was answered after about two minutes on hold.

Support Rating:

Response time:

Very quick

No email support is available.

Overall, SurePayroll’s services offer advantages and drawbacks, as detailed below.

SurePayroll was founded in 2000 as the first online payroll service company for small businesses with under 100 employees. In 2011, they were acquired by Paychex as a fully owned subsidiary.

Their mission is “to help U.S. small business owners succeed by providing payroll and related services through innovation and world-class support.”

Patriot’s full-service plan is slightly more expensive than SurePayroll’s. Both services focus on payroll, with few additional HR tools available.

Gusto has three plans to choose from, all of which are more expensive than SurePayroll’s. Gusto, however, offers quite a few HR services and resources in its upper-tier plans. Gusto also provides employee benefits.

Paycor is significantly more expensive than SurePayroll, but offers more robust HR services and tools. However, for payroll services, SurePayroll is a much better value.

We take our responsibilities seriously. We understand that countless entrepreneurs, and business owners, rely on our judgments and insights, particularly when it comes to creating their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful review of SurePayroll payroll services.

Overall, our SurePayroll experience was relatively pleasant. The site is easy to use, information is readily available, and sign up is fast. Customer service is a bit weak, with no email support, though chat and phone support are solid.

SurePayroll offers an outstanding value compared to the competition, which makes it hard to beat. The mostly negative customer reviews are concerning, but even so, we confidently recommend SurePayroll to business owners.

SurePayroll handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. SurePayroll takes care of all the red tape so you can focus on building a successful business.

Their No Tax Filing plan offers full-service payroll with unlimited payroll runs. It does not, however, provide payroll tax filings.

The Full Service plan includes full payroll services with unlimited payroll runs, tax filings, and an HR advisor.

The No Tax Filing plan costs $19.99 per month plus $4 per employee per month. If you’re just looking to have your basic payroll needs met, the plan is a great option.

The Full Service plan costs $29.99 per month, plus $5 per employee per month. It offers full service payroll plus all tax filings, as well as an HR advisor service.

The payroll service offers a complete suite of services to take many tasks off your plate, putting your payroll on autopilot. They offer unlimited payroll runs and can handle multiple pay rates and bonuses.

The SurePayroll Full Service plan includes an HR advisor, which includes labor law posters, how-to guides, and business forms.

The two plans that SurePayroll offers do not include any benefits. However, you can add health insurance and 401K plans for an additional cost.