Gusto’s base plan is $40 per month plus $6 per employee per month. It includes full single-state payroll services, health insurance administration, and financial benefits administration.

Gusto vs QuickBooks Comparison

Written by: Natalie Fell

Natalie is a writer with experience in operations, HR, and training & development within the software, healthcare, and financial services sectors.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 10, 2025

Payroll is an absolutely crucial business process, and because it’s often complex and tedious many entrepreneurs rely on a professional payroll service to do the job.

Two of the leading online services to consider are Gusto and QuickBooks. To help you determine which is better, and which might be best for you and your business, we have thoroughly reviewed their services by putting ourselves in the shoes of an entrepreneur.

Read on to make the choice that will put your business on the path to success.

- Easy to automate your payroll management operations

- Good value plans (Premium plan offers a robust suite of HR services)

- Good interface and software usability

- Easy to use software

- All plans include health insurance and 401K administration

- Part of the Intuit product suite (easy integration with Quickbooks accounting)

Overall, QuickBooks offers a better value for the payroll needs of small businesses.

Visit QuickbooksPros and Cons

Gusto

Pros

- User-friendly website

- Simple and Plus plans offer good value

- Premium plan offers robust suite of HR services

Cons

- Customer complain of poor problem resolution

- Email customer service is slow

- No mobile app to manage payroll

QuickBooks

Pros

- Good value for the price

- All plans include health insurance and 401K administration

- Easy to use website

- Great mobile app

Cons

- Customer service options are minimal

- A lot of unhappy customers

- Little HR support, particularly in the Core plan

Features and Services Overview

Gusto has three plans, all of which include full payroll services, although their base plan only includes single-state payroll. The Gusto plans also offer health insurance administration and financial benefits administration including 401K and healthcare savings accounts.

Their upper-tier plans also offer extensive HR tools and support.

QuickBooks also has three plans, all of which include multi-state payroll services. Their plans include healthcare and 401K administration, but not healthcare savings accounts.

QuickBooks has fewer HR tools and offers less customer support than Gusto.

Plans Pricing

Gusto’s base plan is $40 per month plus $6 per employee per month. It includes full single-state payroll services, health insurance administration, and financial benefits administration.

Gusto’s middle plan is $80 per month plus $12 per employee per month and has the additional benefit of some HR management tools. Gusto’s top-tier plan is custom-priced and offers a robust suite of HR tools, resources, and support.

The QuickBooks base plan is $45 per month plus $5 per employee per month. It offers full-service payroll including W-2s and 1099s and tax filings. It also includes health insurance and 401K administration.

The QuickBooks middle plan is $75 per month plus $8 per employee per month. It has the additional benefits of same-day direct deposit, as opposed to next-day in the base plan. It also includes time tracking on the go, which allows you to track and approve an employee’s hours from a mobile app. With the plan, you’ll also have access to an HR support center and receive workers’ compensation administration.

The QuickBooks top-tier plan is $125 per month plus $10 per employee per month. It has the unique benefit of tax penalty protection, so that if you receive a late penalty for tax filings, those penalties are taken care of up to $25,000, subject to terms and conditions. You’ll also have a personal HR advisor.

Simple Plan vs Core Plan

The two plans are similarly priced, but if you have more than five employees, the QuickBooks plan will be less expensive. The Gusto Simple Plan only offers payroll in a single state, so if you have employees in multiple states, QuickBooks is the better option.

The Gusto plan offers HSA account administration and hiring and onboarding tools, while QuickBooks has a mobile app for employers, which offers a convenient way to manage payroll.

| Gusto | QuickBooks | |

|---|---|---|

| Price | $40 per month plus $6 per employee per month | $45 per month plus $5 per employee per month |

| Payroll services | Single-state | Multi-state |

| Direct deposit | Two day | Next day |

| Health care insurance | Included | Included |

| 401K plans | Included | Included |

| HSA accounts | Included | Not included |

| Hiring and onboarding tools | Included | Not included |

| Mobile app for employers | Not available | Included |

| Customer Support | Basic | Full – business hours |

Plus Plan vs Premium Plan

Again, the Gusto plan is more expensive, but their plan offers more HR tools. However, the QuickBooks plan offers workers’ compensation administration.

| Gusto | QuickBooks | |

|---|---|---|

| Price | $80 per month plus $12 per employee per month | $75 per month plus $8 per employee per month |

| Payroll services | Multi-state | Multi-state |

| Direct deposit | Next day | Same day |

| Health care insurance | Included | Included |

| 401K plans | Included | Included |

| HSA accounts | Included | Not included |

| Hiring and onboarding tools | Included | Not included |

| Mobile app for employers | Not available | Included |

| Customer Support | Full | Full – business hours |

| Time tracking | Included | Included |

| HR support center | Not included | Included |

| PTO management | Included | Not included |

| Workforce costing and reports | Included | Not included |

| Team management tools | Included | Not included |

| Worker’s comp admin | Not included | Included |

Premium Plan vs Elite Plan

While it’s difficult to judge these plans on pricing, since the Gusto plan is priced for each potential client, both offer quite a few benefits to employers. Gusto, again, has more robust HR tools, while QuickBooks offers tax penalty protection.

| Gusto | QuickBooks | |

|---|---|---|

| Price | Exclusive pricing | $125 per month plus $10 per employee per month |

| Payroll services | Multi-state | Multi-state |

| Direct deposit | Next day | Same day |

| Health care insurance | Included | Included |

| 401K plans | Included | Included |

| HSA accounts | Included | Not included |

| Hiring and onboarding tools | Included | Not included |

| Mobile app for employers | Not available | Included |

| Customer Support | Full | Full –24/7 |

| Time tracking | Included | Included |

| HR support center | Included | Included |

| PTO management | Included | Not included |

| Workforce costing and reports | Included | Not included |

| Team management tools | Included | Not included |

| Worker’s comp admin | Not included | Included |

| Tax penalty protection | Not included | Included |

| Personal HR advisor | Access to experts | Included |

| Compliance alerts | Included | Not included |

| Full-service payroll migration | Included | Not included |

| R & D tax credit discount | Included | Not included |

| Performance reviews and employee surveys | Included | Not included |

Gusto Website Interface and Navigation

The site is laid out well and easy to understand. You can easily find the plans, detailing features and pricing, and get more information on each service.

The site also has a robust help center where you can get information on numerous topics.

How Is the signup process?

When you view all the packages, you have the option to select one and set up an account. Once you make your selection, you’re asked a series of questions about your company, including:

- Your company address

- Your accountant (optional)

- Company benefits

- Specific information about employees and contractors

- Federal tax information

- State tax information

- Bank account

- Payroll schedule

Next, you’re offered a few add-ons before you’re taken to a screen to select your plan.

You don’t have to pay for the service until your first payroll run. The whole process was quite simple and streamlined.

How Is the mobile experience?

Gusto has a mobile app for employees of companies that hire Gusto for payroll. Employees can track hours, manage direct deposit information, and access up to $500 of their paycheck before payday through a payday-type loan, without fees or interest.

This seems to be one of the more useful apps.

In Summary

The site is quite user-friendly overall, and information is easy to find. If you have all your information handy, you can probably complete the signup process in 25 minutes.

The site is not very “salesy” and simply seems to guide you toward the right plan for your company. It offers an excellent customer experience.

Gusto Customer Support

We tested all three forms of Gusto customer support. Here’s what we found.

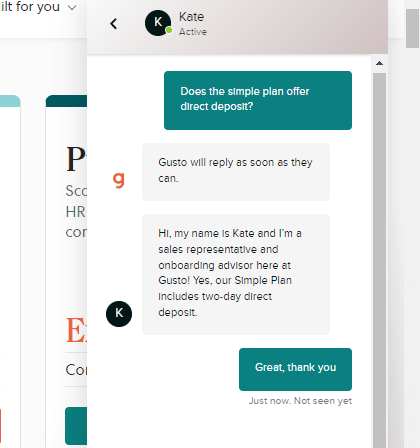

Chat support

We used the chat feature to ask a question and received an immediate response.

Support Rating:

Response time:

Immediate

The answer was quick and clear.

Phone support

We called customer support to ask if there is a required minimum number of employees to sign up for the service. Our call was answered immediately, and the answer was no. The service representative was nice and asked if we needed further assistance.

Support Rating:

Response time:

Very quick

Email support

We filled out an information request form on the site. The question we asked was, again, “Is there a minimum number of employees you need to have to sign up for the Simple plan?” We asked the question on a Friday and a week later had yet to receive any response.

Support Rating:

Response time:

Reasonable

QuickBooks Website Interface and Navigation

The site is user-friendly. The plans are easy to find, with good detail on features and pricing. You can even get more information on each individual service. It’s laid out well and easy to understand.

How’s the signup process navigation?

When you view all the packages, you have the option to select one and set up an account. After you select your plan, you’re offered their bundled plans that include QuickBooks accounting features. You can choose one of those plans or select “just payroll”.

Next, you’ll go to check-out, where you’ll set up your account and password. However, the next step is to enter credit card information, which is unusual, as most competitors do not charge clients until the first payroll run.

This means that with Quickbooks you need to be absolutely certain of your choices when you’re setting up your account.

How’s the mobile experience?

QuickBooks has quite a robust mobile app for employers. You can enter employee hours, submit your payroll, view your payroll taxes and forms, and even pay your payroll taxes. This app is far superior to competitor apps that we’ve seen. Many payroll services do not even have an app for employers to manage payroll.

In Summary

The site is quite user-friendly, and information is easy to find. The only issue was that new clients must pay immediately when they sign-up, which seems a bit aggressive. Otherwise, the site is not very “salesy” and just guides visitors to the optimal plan. Overall, a pleasant customer experience.

Quickbooks Customer Support

We tested all three forms of QuickBooks customer support.

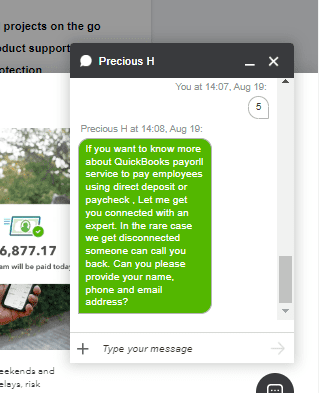

Chat support

We asked chat support a simple question – do you have the option of paying employees by direct deposit or paper check? She asked us several questions before saying she had to route us to a sales person, and asked for our email and phone number. Disappointing! We just wanted a quick answer, not a sales pitch. We never got any answer.

Support Rating:

Response time:

Reasonable

Phone support

Phone customer support is only available if you have an account. You can only contact sales, so we did and asked the same question about paper checks vs. direct deposit. The answer was yes, both are available, but the representative pressed us to sign up.

Support Rating:

Response time:

Reasonable

Email support

Again, email support is only available if you have an account.

Support Rating:

Response time:

Reasonable

Verdict

After a thorough assessment, we have determined that QuickBooks offers the better value for businesses that need payroll services. While it was a close race, you will save money with QuickBooks and have the same level of site usability.

The main advantage of Gusto is its more robust HR services, but QuickBooks still represents the better value for payroll.

Our approach

As a leading human resources advisory site, we take our responsibilities seriously. We understand that countless entrepreneurs, and potential entrepreneurs, rely on our judgments and insights, particularly when it comes to managing their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

- Examined every single page of both the Gusto and QuickBooks websites

- Reviewed all of their offerings

- Put ourselves in the customer’s shoes, creating accounts

- Communicated with customer service via chat, email and phone

- Gained a full understanding of the customer experience and service value

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful comparison of Gusto and QuickBooks payroll services.

FAQs

Why should I use a payroll service?

A payroll service handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. The service takes care of all the red tape so you can focus on building a successful business.

What’s included in the Gusto Simple plan?

The Simple service level offers full-service single-state payroll including W-2s and 1099s, basic hiring and onboarding tools, Gusto-brokered health insurance administration, and an employee financial benefits service.

What do payroll services with Gusto include?

Gusto’s payroll service offers a complete suite of services to take many tasks off your plate, such as federal, state, and local tax filings, including employee W-4 and I-9 forms and W-2s and 1099s.

What’s included in the QuickBooks Premium plan?

The Premium plan has the additional benefits of same-day direct deposit. With the plan, you’ll also have access to an HR support center and receive workers’ compensation administration.

What’s included in the QuickBooks Elite plan?

The Elite plan includes full payroll services and has the unique benefit of tax penalty protection, so that if you receive a late penalty for tax filings, those penalties are taken care of up to $25,000, subject to certain terms and conditions. You’ll also have a personal HR advisor.