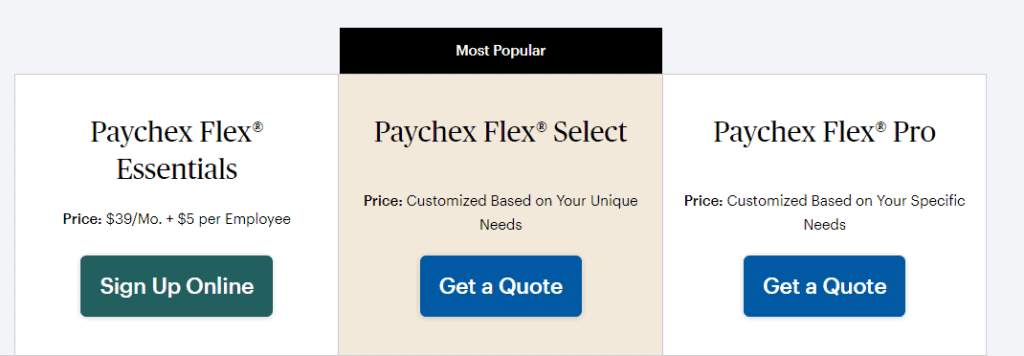

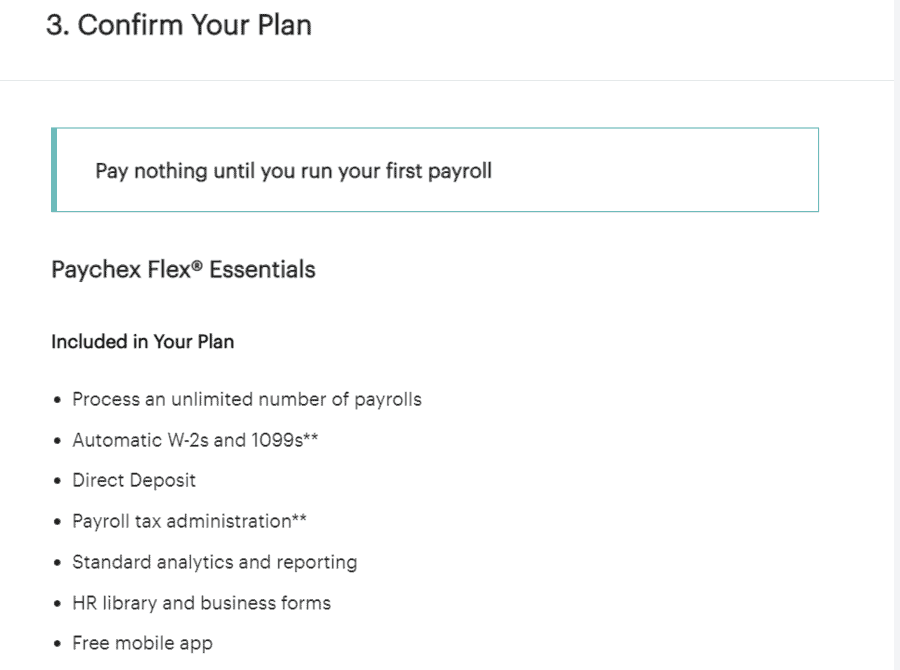

The Paychex base plan is $39 per month plus $5 per employee per month and includes full payroll services. Paychex’ middle plan has customized pricing and offers the additional benefit of the Paychex learning management system.

Paychex vs QuickBooks Comparison

Written by: Coralee Bechteler

Coralee is a business writer with experience in administrative services, education, and software testing.

Reviewed by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on March 4, 2025

Payroll is an absolutely crucial business process, and because it’s often complex and tedious many entrepreneurs rely on a professional payroll service to do the job.

Two of the leading online services to consider are Paychex and QuickBooks. To help you determine which is better, and which might be best for you and your business, we have thoroughly reviewed their services by putting ourselves in the shoes of an entrepreneur.

Read on to make the choice that will keep your business on the surest path to success.

- Customizable plans

- Very easy and comprehensive payroll processing

- Good navigation and interface

- Easy to use software

- All plans include health insurance and 401K administration

- Part of the Intuit product suite (easy integration with Quickbooks accounting)

After a thorough assessment, we have determined that Paychex offers the better value and broader service offerings.

Explore Paychex FlexPros and Cons

Paychex

Pros

- User-friendly web experience

- Informative, detailed website

- Established industry reputation

- Flex Essentials offers great value

- Solid mobile capabilities

Cons

- Poor customer service

- Heavy upselling in sales process

QuickBooks

Pros

- Good value for the price

- All plans include health insurance and 401K administration

- Site is easy to use

- Great mobile app

Cons

- Customer service options are lacking

- Many unhappy customers

- Unlike competitors, poor HR support

Features and Services Overview

Paychex has three plans. Their base plan offers a full suite of payroll services including tax filings. Their middle plan offers everything in the base plan plus the Paychex learning management system.

Their top-tier plan includes a dedicated payroll specialist, accounting integrations, and employee screening and onboarding tools.

QuickBooks also has three plans, all of which include multi-state payroll services. Their plans include healthcare and 401K administration.

Plans Pricing

The Paychex top-tier plan also has custom pricing and offers a dedicated payroll specialist and accounting integrations.

The QuickBooks base plan is $45 per month plus $5 per employee per month. It offers full-service payroll including W-2s and 1099s and tax filings. It also includes health insurance and 401K administration.

QuickBooks’ middle plan is $75 per month plus $8 per employee per month. It offers same-day direct deposit, as opposed to next-day in the base plan. It also includes time tracking on the go, which allows you to track and approve an employee’s hours from a mobile app.

With the plan, you’ll also have access to an HR support center and receive workers’ compensation administration.

QuickBooks’ top-tier plan is $125 per month plus $10 per employee per month and provides the unique benefit of tax penalty protection. If your business is fined for late tax filings, Quickbooks will cover the fee up to $25,000, subject to terms and conditions. You’ll also have a personal HR advisor.

Paychex Flex Essentials vs Core Plan

The Paychex plan is less expensive and offers many extras but does not include employee benefits like the QuickBooks plan does.

| Paychex | QuickBooks | |

|---|---|---|

| Price | $39 per month plus $5 per employee per month | $45 plus $5 per employee per month |

| Payroll service | Included | Included |

| Direct Deposit and on site check printing | Included | Included |

| Mobile app for employers and employees | Included | Included |

| Analytics and reporting | Included | Reporting only |

| Garnishments | Included | Not included |

| W-2s and 1099s | Included at an additional cost | Included |

| New Hire reporting | Included | Not included |

| Customer Support | Included | Included |

| Labor compliance poster kit | Included | Not included |

| Worker’s compensation administration | Included at an additional cost | Not included |

| HR library and business forms | Included | Not included |

| 401K plans | Not included | Included |

| Health care benefits | Not included | Included |

Paychex Flex Select Plan vs Premium Plan

Again, Paychex does not include employee benefits, but does offer a learning management system. The QuickBooks plan also includes workers’ compensation administration at no additional cost.

| Paychex | QuickBooks | |

|---|---|---|

| Price | Custom pricing | $75 plus $8 per employee per month |

| Payroll service | Included | Included |

| Direct Deposit and on site check printing | Included | Included |

| Mobile app for employers and employees | Included | Included |

| Analytics and reporting | Included | Reporting only |

| Garnishments | Included | Not included |

| W-2s and 1099s | Included at an additional cost | Included |

| New Hire reporting | Included | Not included |

| Customer Support | Included | Included |

| Labor compliance poster kit | Included | Not included |

| Worker’s compensation administration | Included at an additional cost | Included |

| HR library and business forms | Included | Included |

| 401K plans | Not included | Included |

| Health care benefits | Not included | Included |

| Learning management system | Included | Not included |

Paychex Flex Pro Plan vs Elite Plan

The Paychex plan offers a richer suite of payroll and HR services, but QuickBooks still has the advantage of employee benefits.

| Paychex | QuickBooks | |

|---|---|---|

| Price | Custom pricing | $125 plus $10 per employee per month |

| Payroll service | Included | Included |

| Direct Deposit and on site check printing | Included | Included |

| Mobile app for employers and employees | Included | Included |

| Analytics and reporting | Included | Reporting only |

| Garnishments | Included | Not included |

| W-2s and 1099s | Included at an additional cost | Included |

| New Hire reporting | Included | Not included |

| Customer Support | Included | 24/7 |

| Labor compliance poster kit | Included | Not included |

| Worker’s compensation administration | Included at an additional cost | Included |

| HR library and business forms | Included | Included |

| 401K plans | Not included | Included |

| Health care benefits | Not included | Included |

| Learning management system | Included | Not included |

| Guided setup | Included | Not included |

| Dedicated payroll specialist | Included | Not included |

| Personal HR advisor | Not included | Included |

| Accounting software integration | Included | Not included |

| State unemployment insurance services | Included | Not included |

| Onboarding | Included | Not included |

| Employee screening | Included | Not included |

| Tax penalty protection | Not included | Included |

Paychex Website Interface and Navigation

The site is user-friendly. The plans are easy to find, with good detail on included features. You can even get more information on each individual service. It’s laid out well and easy to understand.

Pricing is a bit trickier to navigate, as you must submit a quote to obtain the cost of both the Select and Pro plans. The site also has a robust help center where you can get information on a variety of topics.

How’s the signup process navigation?

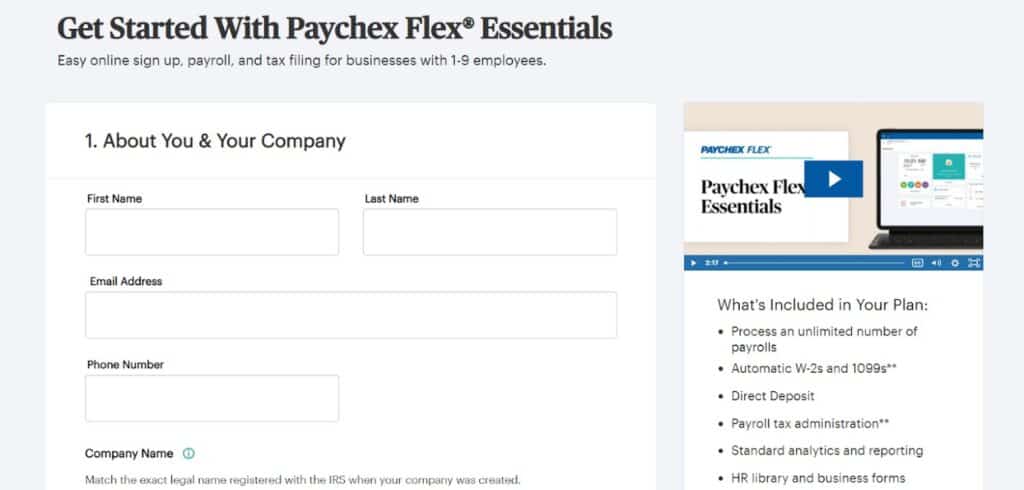

While you’re unable to sign up for the Select and Pro plans without contacting a representative and obtaining a quote, you can go ahead and register for the base Essentials plan.

To start the signup process for the Flex Essentials plan, click Sign Up Online. The next screen will prompt you to enter your contact information. There’s also an informative video about the plan on the right side of the page, along with a summary of the plan’s benefits.

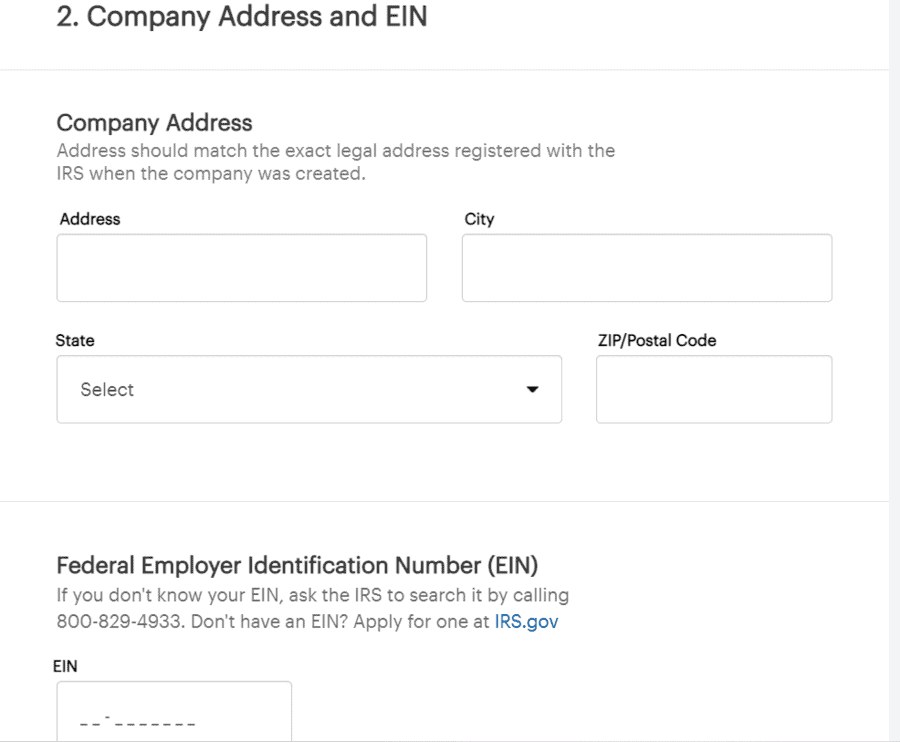

Next, enter your company information and EIN.

Next, confirm your plan selection, and you’ll be reminded that you won’t pay anything until your first payroll run.

You will also get to see a cost breakdown before finalizing your choice.

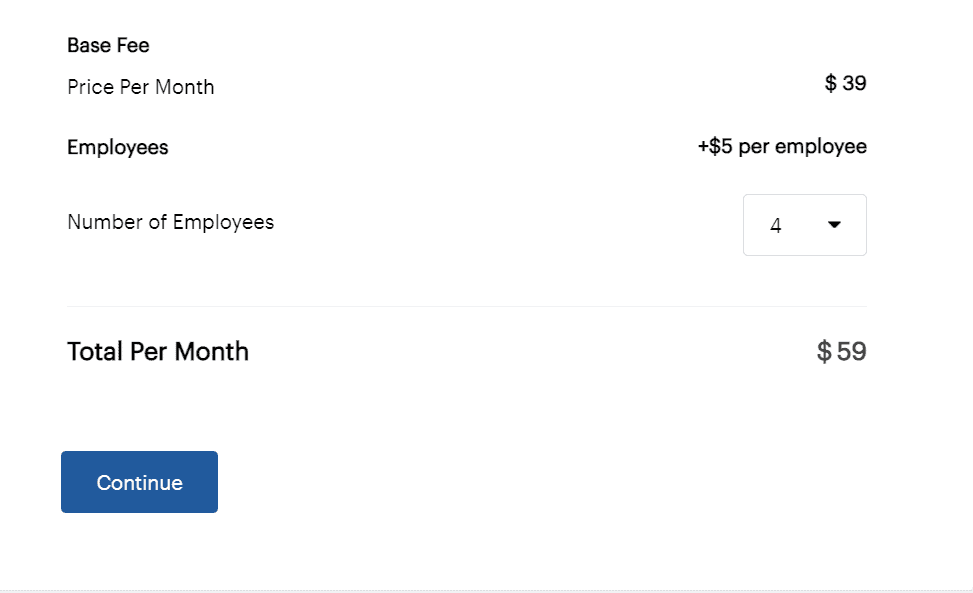

The last step asks if you’d like to sign up for free services from third-party providers.

Make your selections and then click Complete Sign Up at the bottom of the screen.

How’s the mobile experience?

The Paychex Flex platform is extremely mobile-friendly, with several apps available for both employers and employees. When you sign up for a Paychex Flex account, you get access to the Paychex Flex App.

This app connects employers to vital payroll and benefits features with the security of Touch-ID and Face ID authentication. The Paychex Flex App also allows employers to enter, review, and submit payroll and access employee data and reports, while employees can access and update their own information.

Other available apps are tied to different Paychex solutions, such as timekeeping and employee benefits.

In Summary

Overall, the Paychex website is extremely user-friendly, with easy to follow navigation and a seamless sign-up process for the Essentials plan. Information about each plan is easy to find and explained in great detail.

There are also informative videos throughout the website to further explain plans and benefits. The only downside was that pricing for both the Select and Pro plans is custom, and thus not readily available. But there are several opportunities to request a quote.

Paychex Customer Support

We tested all three forms of Paychex Flex customer support, as detailed below.

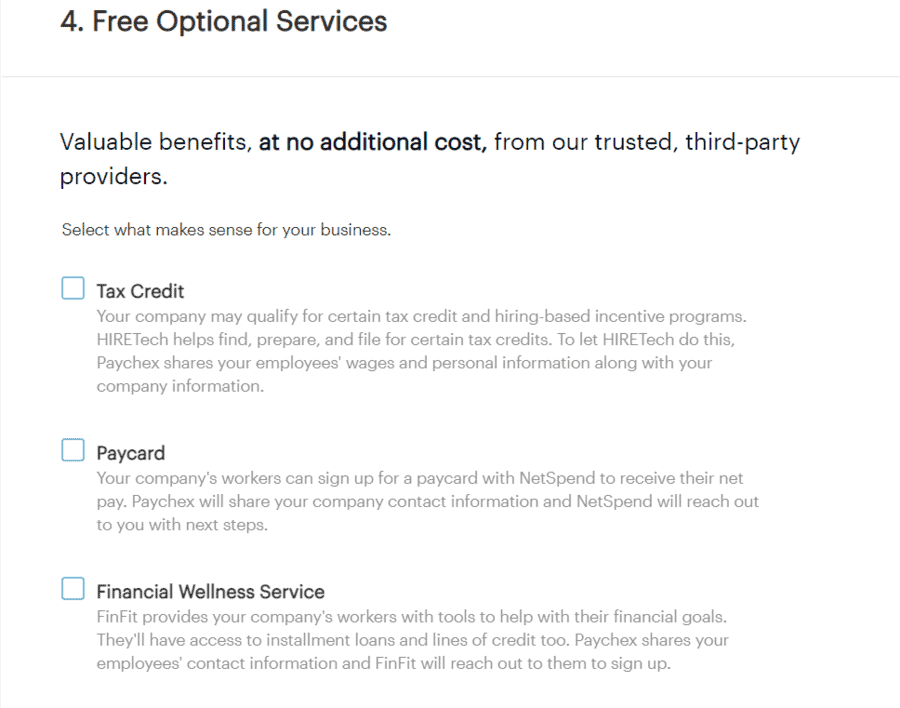

Chat support

Our initial experience with the Paychex Flex chatbot redirected us back to the Paychex website.

Support Rating:

Response time:

Reasonable

We probed a bit further and were able to start chatting with a live agent. We asked about the cancellation policy and they said we could get that information from the sales team. We asked if there was a chat feature available to speak with the sales team, and the agent said “not that I know of” and asked for our first and last name to have someone reach out to us.

We closed the chat session without receiving an answer to our question.

Email support

We hoped to email Paychex to ask about the cancellation policy, since we weren’t able to get very far with the chat feature. Because we had been directed to the sales team, we figured we would try emailing them directly. But when you click the “email us” button under sales support, you’re prompted to request a quote, which is not what we wanted to do.

We also tried another support email button, but it was for existing customers and we were prompted to enter a client ID number to proceed. Overall, the process to contact a representative for general questions was difficult, to say the least.

Support Rating:

Response time:

Reasonable

Phone support

We called Paychex Flex customer service to ask if we could get an estimate on pricing for the Select and Pro plans. We had to go through a series of prompts before being placed on hold for several minutes.

After connecting, the representative was polite and told us we would have to request a quote with the sales team, as pricing depends on the size of our company. They offered to transfer us to a sales representative, but we thanked them and declined.

Support Rating:

Response time:

Reasonable

QuickBooks Website Interface and Navigation

The site is user-friendly. The plans are easy to find, with good detail on features and pricing. You can even get more information on each individual service. It’s laid out well and easy to understand.

How’s the signup process navigation

When you view all the packages, you’re advised to select one to set up an account. After you select your plan, you’re offered bundled plans that include QuickBooks accounting features. You can select one of those plans, or select “just payroll”.

Then you go to check-out, where you’ll set up your account and password. The next step is to enter credit card information, which is unusual, as most competitors do not charge clients until the first payroll run.

This means that with Quickbooks you need to be absolutely certain of your choices when you’re setting up your account.

How’s the mobile experience?

QuickBooks has a robust mobile app for employers. You can enter employee hours, submit payroll, view payroll taxes and forms, and even pay payroll taxes. They also have an app for employees to track their hours and clock in or clock out.

Th employers’ app is far superior to those of competitors. Many payroll services do not even have an app for employers to manage payroll.

In Summary

The site is quite user-friendly and information is easy to find. The only issue was that new clients must pay immediately when they sign-up, which seems a bit aggressive. Otherwise, the site is not very “salesy” and just guides visitors to the optimal plan. Overall, a pleasant customer experience.

QuickBooks Customer Support

We tested all three forms of QuickBooks customer support, as detailed below.

Chat support

We asked chat support a simple question – do you offer the option of paying employees by direct deposit or paper check? She asked us several questions before saying she had to route us to a sales person, and asked for our email and phone number. This was disappointing, as we just wanted a simple answer – which we never got.

Support Rating:

Response time:

Reasonable

Phone support

Phone customer support is only available if you have an account. Non-customers can only contact sales, so we did and asked the same question. The answer was yes, both are available, but we also got a bit of pressure to sign up.

Support Rating:

Response time:

Reasonable

Email support

Again, email support is only available if you have an account.

Support Rating:

Response time:

Reasonable

Verdict

After a thorough assessment, we have determined that Paychex offers the better value and broader service offerings. With Paychex you’ill save money and get more robust HR support. The main advantage of QuickBooks is the employee benefits they offer, but we feel that Paychex counters that with a stronger overall experience.

Our approach

As a leading human resources advisory site, we take our responsibilities seriously. We understand that countless entrepreneurs, and potential entrepreneurs, rely on our judgments and insights, particularly when it comes to managing their business.

As a result, our writers do their utmost to gain a comprehensive understanding of the services offered and the actual customer experience. In this case, we:

- Examined every single page of both the Paychex and QuickBooks websites

- Reviewed all of their offerings

- Put ourselves in the customer’s shoes, creating accounts

- Communicated with customer service via chat, email and phone

- Gained a full understanding of the customer experience and service value

Thanks to this full immersion in the actual customer experience, our reviewer and team are able to provide the most complete and insightful comparison of Paychex and QuickBooks payroll services.

FAQs

Why should I use a payroll service?

A payroll service handles the payroll process for you, making it nearly seamless and automated while offering additional services that can make life easier for a business owner. The service takes care of all the red tape so you can focus on building a successful business.

What’s included in the Paychex Flex Select plan?

The Paychex Flex Select plan includes everything in the Essentials plan, plus features like a tax credit service, additional employee pay options, and online employee training and development.

What’s included in the Paychex Flex Pro plan?

The Paychex Flex Pro plan is the highest tier plan available. It includes everything from the Essentials and Select packages with additional benefits such as a dedicated payroll specialist, guided setup, and accounting software integration.

What’s included in the QuickBooks Core plan?

The Core plan offers full-service payroll including W-2s and 1099s and tax filings. It also includes health insurance and 401K administration.

What’s included in the QuickBooks Premium plan?

The Premium plan has the added benefit of same-day direct deposit, as opposed to next day in the Core plan. With the plan, you’ll also have access to an HR support center and receive workers’ compensation administration.