Retroactive Pay Calculator

Written by: Daniel Eisner

Daniel Eisner is a payroll specialist with over a decade of practical experience in senior accounting positions.

Updated on November 27, 2025

💡Tip: To send an email, please fill in the advanced mode section fields.

Hourly Retro Pay Report

Employee: N/A

Company: N/A

Position: N/A

Prior Period Hourly Pay Rate Expected: $0.00

Prior Period Hourly Pay Rate Paid: $0.00

Number of Hours Paid Incorrectly: 0

Retro Pay: $0.00

Made by humanresource.com

The Retro Pay report has been sent.

Even payroll experts make mistakes, and sometimes employees are paid the wrong amount – whether because of a new overtime rate, a recent raise, or simple human error. In such cases, the staffers are of course entitled to retroactive pay to cover the difference.

But calculating retroactive pay is often complicated, requiring considerable time and solid math. Lucky for you, Human Resource has created a free and easy-to-use retroactive payroll calculator to save you time and provide peace of mind. Read on to learn how to use it.

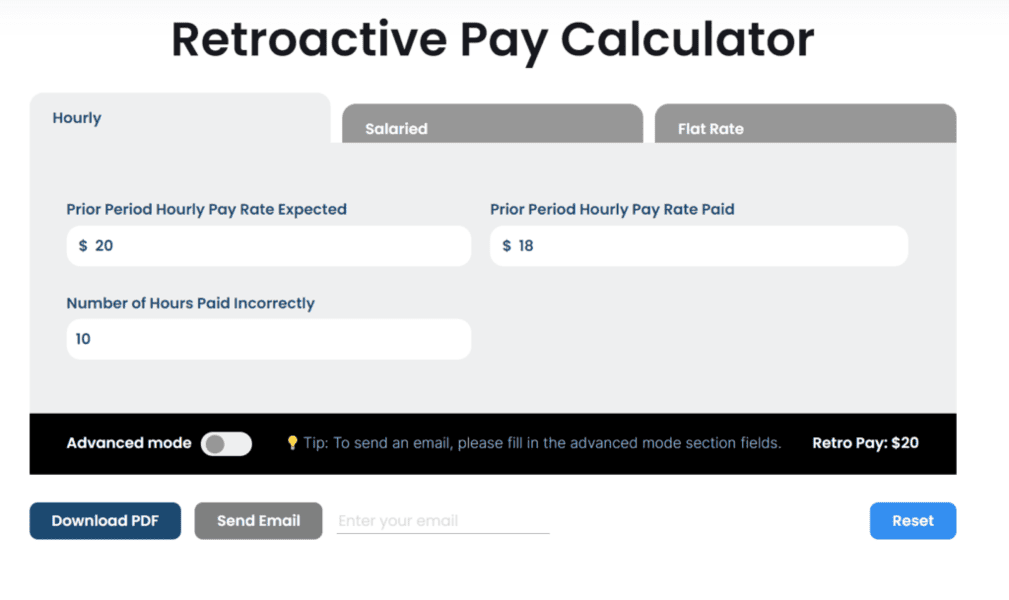

Hourly

If pay is calculated on an hourly rate, select the “Hourly” tab on the calculator. Enter the employee’s true hourly rate for the previous pay period, along with the hourly rate they were actually paid and the number of hours that were paid incorrectly.

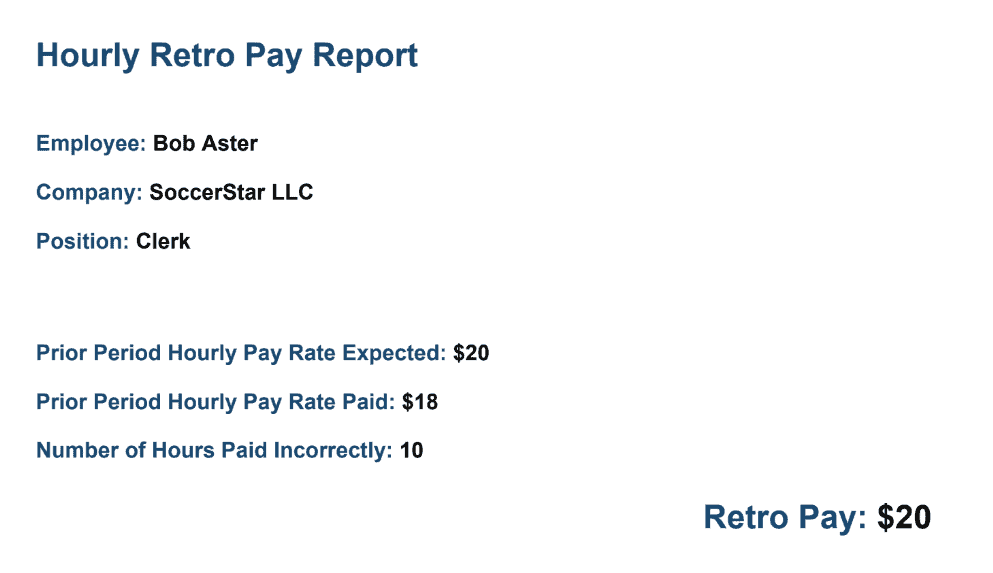

For instance, if Bob had been promised $20 per hour but was paid $18 for 10 hours, his supervisor would fill in the retroactive pay calculator like this:

At the bottom of the calculator, you’ll see that Bob is owed $20 in retroactive pay.

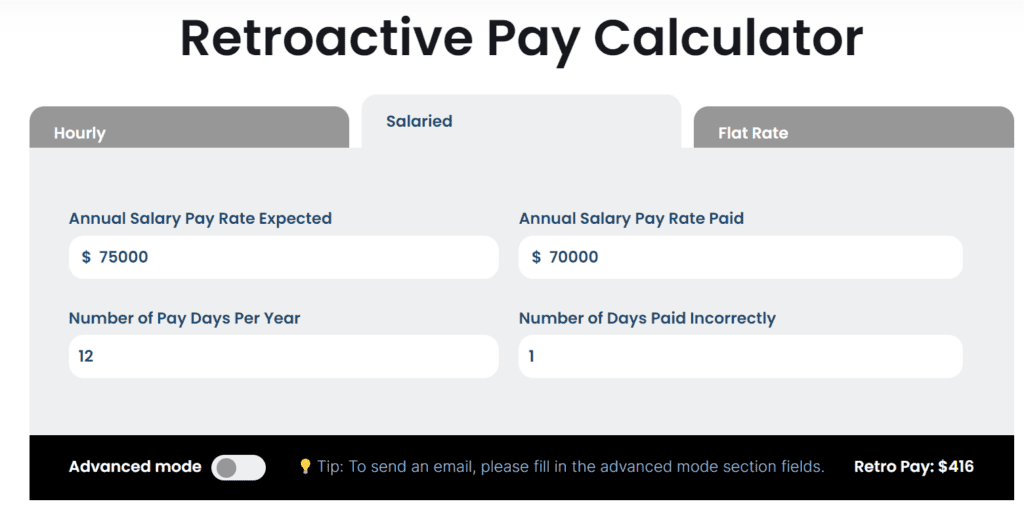

Salaried

If an employee is paid by salary, click the “Salaried” tab on the calculator. Enter the employee’s true annual salary, the annual salary they were actually paid, the number of annual pay periods, and the number of inaccurate payments.

So let’s say Hannah had a $70,000 annual salary and gets paid every month. If she received a raise to $75,000 that failed to appear in her latest payment, this is what she or her supervisor would enter into the calculator.

At the bottom we see that Hannah’s retro pay to be added to her next paycheck is $416.

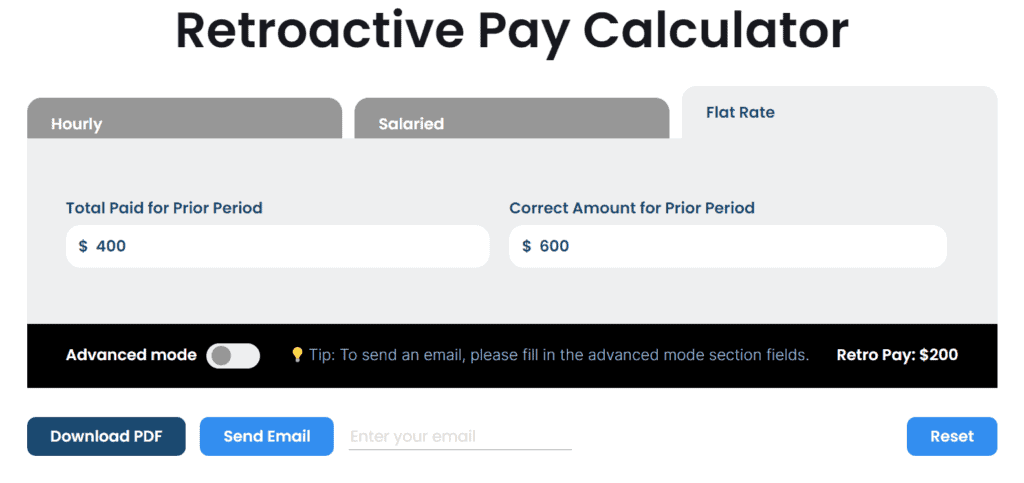

Flat Rate

Finally, for flat rate wages click the “Flat Rate” tab on the calculator. Enter the total paid for the most recent period and the amount that the employee should have been paid instead.

For example, if Henry, the contractor was supposed to be paid $600 for his services but received only $400, his retroactive payroll calculator would look like this:

We can see that Henry is owed $200.

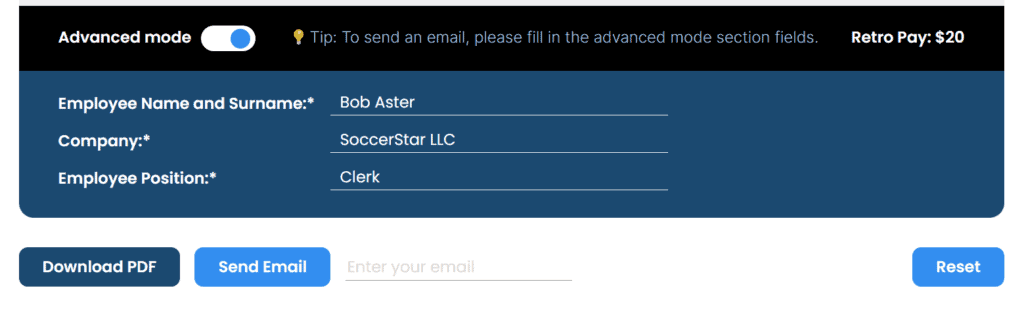

Generate Report

The calculator also allows users to generate PDF reports detailing employee information, retro pay owed, and more. These reports can prove crucial for accounting and HR purposes.

To generate a report, click over to advanced mode and enter the employee’s full name, company, and position. Click on the “Download PDF” button to open a new tab with your report, or input an email address in the field provided and click “Send Email” to have the PDF sent to your email.

The report will be created immediately. Here’s an example of Bob’s report from the example above.

Summary

Compensation discrepancies are annoying, but understandable. When they do happen, the most important thing is to correct the error and make the employee whole as soon as possible.

Human Resource’s retroactive payroll calculator streamlines and simplifies this process to put your payroll processing back on track and maintain staff morale.